Hello everyone. We continue our series of posts about the forex market. We're sharing events that we've witnessed or participated in. Today, we will focus on trading gaps. Gaps in the Forex market usually occur over the weekend or after major economic or political events. Trading around such events presents unique opportunities and challenges. Our analysis and experiences reveal that gap trading, while potentially profitable, demands a thorough understanding of market dynamics. Our article will explore various scenarios to illustrate gap trading's complexities, including leverage effects, broker policies, and market responses. From capitalizing on high-impact news to mastering order execution, we aim to guide traders through these turbulent times. Join us for insights and strategies from the front lines of forex trading as we share valuable lessons on navigating market gaps.

The Art of Gap Trading in Forex: Strategies Amid Economic Shifts

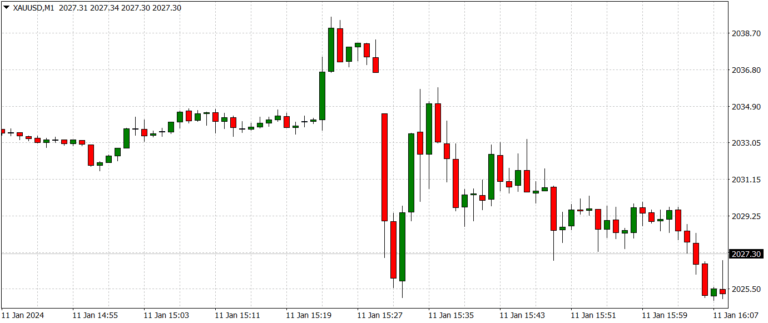

Whenever big economic news comes out or an important political event occurs, whether on the home front or the international stage, the financial markets take a roller coaster ride, and forex markets, in particular. You’ll spot the chaos if you look at candlestick charts around such events. There are “price gaps” in the charts. There are candles with ridiculously long bodies and/or shadows or ones that stretch out way longer than usual. On the chart, it looks something like this:

We’ve encountered discussions on various forums and have even come across forex trading textbooks stating that it’s possible to profit from price jumps using pending or market orders set “both ways.” Retail traders usually call this strategy “gap trading.” In theory, it’s an intriguing idea. We must admit that it may have been feasible twenty years ago or so, but now, it seems unlikely. At first glance, the idea seems workable, but the devil is in the details. Let’s examine a few scenarios:

Scenario 1. Trading Gaps with Market Orders

Let us say that a hypothetical trader opens two accounts and deposits an equal amount of money into both. Both accounts have leverage of 1:200. Before potentially volatile news events (referenced in our previous post), our trader places orders on each account. Both orders are of the maximum volume their account leverage allows. If prices jump by more than half a percent, one account plunges into the red while the other soars into significant profit.

The total loss across both accounts equals the spread, the difference between the buy and sell prices. However, there’s a catch: Typically, a trading account cannot go negative according to a broker’s terms and conditions. In simple terms, losses cannot exceed the deposited amount. Under these conditions, the market maker would absorb any loss beyond the deposited amount, zeroing out the negative balance in the trading account. So, our trader ends up with a big plus in one account and a loss of the deposit in the other. The idea for this gap trading strategy is to generate such a profit on one of the accounts that it is higher than the loss on the second account.

But as we said before, the devil is in the detail:

It’s important to note a few key points. First, the accounts should belong to two different individuals. Alternatively, one trader could open these two accounts but should do so with two different forex brokers. Here’s what happens if both accounts are under one trader’s name with one forex broker. The broker will use the funds from all other accounts that belong to our trader to offset the losses.

Another factor reducing the likelihood of profit when trading gaps is that brokers may lower the leverage. As a result, our hypothetical trader may incur a substantial loss, roughly equal to the profit of the second order. Therefore, our hypothetical trader’s “straddle” strategy stops working. Why? Should the broker reduce the leverage, one of the accounts will incur a loss, but the account balance will not drop below zero. Instead, the account will experience a margin call first, and then that trader will be stopped out of your trades before account reaches zero.

The broker would close losing orders either way, even without leverage reduction. However, high leverage allows a trader to open trades of huge volume. So, when the market gaps up or down, this volume quickly results in the margin call and eventual stop out. The account goes into negative territory pretty quickly. However, it doesn’t happen with lower leverage because the trading platform server has time to process the margin call correctly. The broker closes the order, but the account doesn’t enter the negative territory. In this case, they may not lose all funds in their account. Therefore, it’s advantageous for our hypothetical trader to enter the red zone with high leverage. Additionally, the loss is limited because the broker would absorb the loss by zeroing out our trader’s account balance.

For illustrational purposes, consider an example: Suppose our hypothetical trader has two trading accounts with $300 each. These accounts have a leverage of 1:500. Then, this trader opens two orders for 150,000 units of the base currency, i.e., 1.5 lots on each account. One account would have a long order, and the other one would have a short order. You may have heard traders refer to this type of trade as a “straddle” or a “lock.”

Every tiny price move, say just 0.0001, can swing your account’s value by about 15 bucks. If we’re talking a 20-pip move, we could end up with one of the accounts in the red, hitting a margin call and eventual stop-out level. Meanwhile, your other account? It’s party time there because its value just doubled.

But let’s say things get wilder, and the price jumps by 30 pips. Now, one of your accounts ends up with a loss of $450, while the other generates a $450 gain. Your broker’s terms and conditions usually have a clause that says you can’t lose more than you put in. As a result, you’re looking at a $300 loss on one side but a $450 win on the other. So, you’re up by 150 bucks. Not too shabby, right? That’s the beauty of playing both sides with a straddle.

No one can predict in advance whether there will be a gap or how large it will be.

Scenario 2. Gap Trading Using Market Orders Wit SL and TP

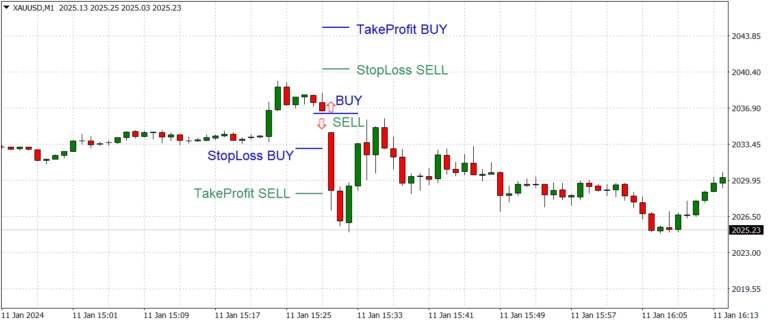

Right before the news comes out, a hypothetical trader simultaneously opens two market orders, BUY and SELL. Each order has a stop-loss (SL). Again, the idea is to trade gaps up or down. But in this case, traders hope the losing order is closed because the price triggers the Stop Loss, while the second order results in profit.

Again, about twenty years ago, such a strategy could have been profitable. Forex brokers attracted traders, claiming, “We would execute orders at the stated price.” As you can imagine, with this type of execution, a trader could easily profit. However, soon this strategy stopped working. Why? Forex brokers introduced a very interesting clause into their execution policies. They still executed limit orders at the stated price. However, regarding Stop Loss and Take Profit orders, the broker would only execute these orders at the first market price after a gap. In practice, the first market prices following a gap would trigger both Stop Loss and Take Profit orders at the first market price after the gap.

“The first market prices after a price gap” is an interesting expression. Let’s say the price was 100, then it gaps up to 110. At the same time, ticks go up as high as 109. So, the first market price after the gap is not 110 but effectively 109. The forex broker would only execute at 110 for one specific trader, who happens to have that price price in their order book. All other orders will be executed at the level of 109, where the “first market price after the gap” happens to be.

Complaining that there was a better tick price but a big bad broker didn’t execute your order is futile. Brokers execute orders in accordance with their execution policy. If the price is in the order book, they would use this price to execute an order. However, no one can guarantee that it will be your order. On that basis, your broker and their regulators will reject your complaint.

Scenario 3. Trading Gaps With Pending Stop Orders

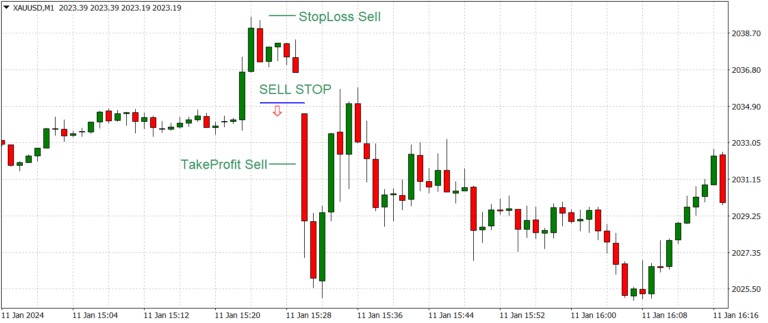

Just before the publication of high-impact economic news, a trader places one of the pending stop orders (e.g., Sell Stop or Buy Stop) with pre-set StopLoss and TakeProfit levels.

After a price drop like the one shown in the picture above, the following is most likely to happen for a Sell Stop order:

The Sell Stop order will not be executed at the stated price but “at the first market price,” which usually turns out to be worse than the price specified in the order. After placing the order, the trading platform checks the condition for triggering SL.

If the TP level is below the opening price after the price jump, all is good, and the platform will set the TP for the order. Whether it triggers or not will depend on further price movement. If the pre-set TP level in the pending order is higher than the closing price, the order can be closed at the TP price stated. This leads to the order closing at a loss as soon as it is opened, and the order will have the following comment: “closed at TP.”

In the specific scenario of a price drop, a Buy Stop order will not be executed since there is no price for it to be triggered.

Scenario 4. Trading Gaps Using Pending Stop Orders With SL and TP

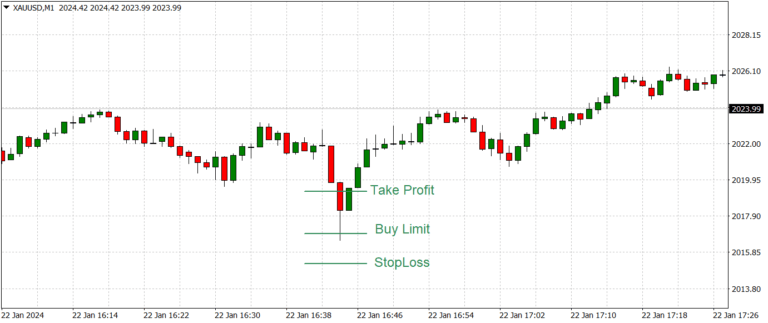

This gap trading strategy uses pending stop orders. Just before the publication of high-impact news, a trader places “pending stop orders” (e.g., Sell Limit and Buy Limit) at a predefined distance from the current price and naturally with pre-set StopLoss and TakeProfit levels.

The release of high-impact news often causes the market price to move sharply in one of the directions. Then, immediately after the initial move happens, the price bounces back in the opposite direction. Moreover, this initial movement may completely ignore the type of news (e.g., positive or negative). For instance, positive news may cause prices to drop, while negative news may increase prices. The type of macroeconomic indicator itself is not important in this situation; that’s how robots usually trade. We are sure you’ve encountered such price action.

The idea behind trading gaps with limit orders is to catch such counterintuitive market movements. At first glance, the logic is sound, and this strategy of trading gaps may appear feasible. However, the execution of limit orders in such situations may have certain characteristics that can render this strategy ineffective. Therefore, it’s crucial to read your broker’s execution policy very carefully. For example, orders may be executed at the “best price,” which essentially means that an order will be executed at the first market price, or they may be executed at the stated prices. Another peculiarity of trading gaps with limit orders is that no one can predict in advance whether there will be a gap and, if there is one, how large it will be. This also applies to stop orders.

From our experience, we can say that we only managed to trade gaps and sharp price jumps successfully during important geopolitical events and on days of unexpected interest rate changes. The 15th of January 2015 was a spectacular day for profit (or loss) when he Swiss National Bank abandoned its cap, and the prices of USDCHF and EURCHF pairs jumped by more than 30%. Then, on April 21, 2020, when WTI oil traded below zero. Those were the days of easy profits on trading gaps! However, we generally believe that gap trading strategies rarely lead to consistent profits.

Conclusion

In wrapping up, it’s clear that trading forex gaps can be an intriguing yet complex endeavor, especially during big economic or political changes. While it might have been a solid strategy back in the day, the game has changed due to shifts in market behavior and broker rules. Diving into various scenarios showed us just how crucial it is to get the lay of the land and have a sharp strategy in place. Despite the tempting prospect of quick gains, traders should tread carefully and be equipped with a deep understanding and readiness for the risks. Bottom line: success in forex gap trading is all about smart planning and staying informed.

In our previous article we reviewed a practical example of how to trade support and resistance levels. Next time, we will examine the worst of the worst of Expert Advisors. Stay tuned.

Happy trading, everyone!

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.