Hey everyone! We're back with more tales from the Forex frontlines. Today, we will review several forms of intraday forex trading, focusing primarily on intraday scalping, intraday pipsing, and high-frequency trading (HFT). Our discussion will cover their distinct characteristics, as well as their advantages and drawbacks, specifically within the realm of retail trading.

Intraday Scalping

Scalping is a day trading strategy focusing on minor price movements, with traders opening and closing positions within the same day to profit from small market fluctuations. This approach demands quick decision-making and strict discipline, as it involves conducting numerous trades throughout the day, capitalizing on the market’s liquidity and volume without keeping positions overnight. For this reason, many traders implement scalping strategies using Expert Advisors (EAs) on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These automated trading systems execute trades based on specific criteria, eliminating the need for manual intervention and streamlining the scalping process.

It’s crucial not to confuse this intraday scalping with HFT (High-Frequency Trading). Both involve quick trades; scalping trades typically last between 1 and 3 seconds, unlike the shorter duration of HFT trades (e.g., milliseconds or microseconds).

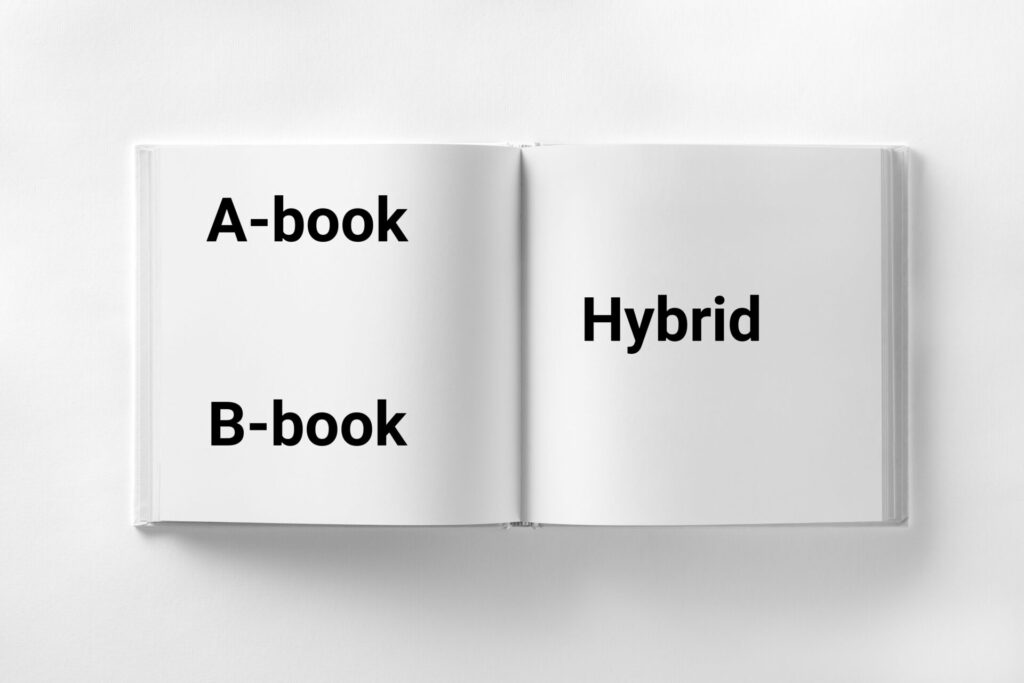

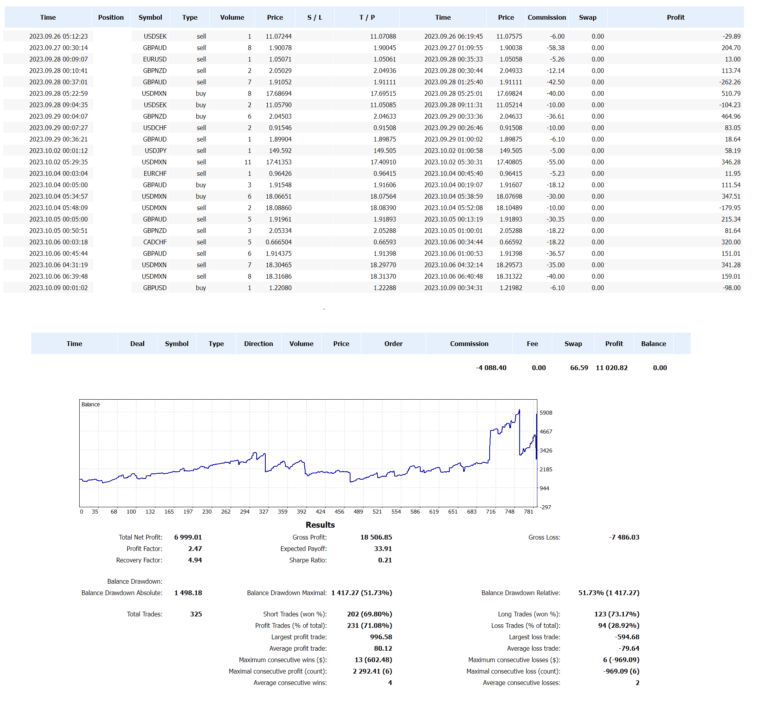

Below, you’ll find a screenshot showcasing a portion of a scalper’s trading report. The individual traded for about eight months, starting with an initial deposit of around $4,000, and ended up with a total profit of $1,382 (which translates to an annual return of about +52%) across ten accounts. This trader was neither greedy nor took excessive risks on any account. Instead, they capitalized on opportunities that only came around sometimes. Since a robot did the trading, it likely didn’t require the trader to spend much time constantly glued to the terminal for “market analysis” or catching these moments.

Scalping involves transactions that last just 1 to 3 seconds.

At the end of the balance chart, in the image above, you’ll notice the blue line takes a sharp dive – this isn’t a loss but rather a withdrawal of all funds. The last row confirms this in the table of transactions above.

By the way, the complete withdrawal of funds after a period of successful trading is a typical move for many profitable retail traders. They fear their accounts might be blocked under some pretext and their trading results nullified. However, it’s not that traders are pulling their money out of trading altogether, as if to say, “I’m tired, I’m out, I’ll spend what I’ve earned.” Not at all.

Eventually, they deposit again with the same broker but under a different identity, like a relative’s passport. But such tricks are futile. It is naive to think brokers don’t see what is going on. Trading activities are logged by the IP address of the devices used for trading. This isn’t some broker’s crafty invention; it’s a built-in feature of the trading terminals. If a broker wanted to find a reason for freezing accounts, this behavior alone could be a reason to accuse a trader of fraudulent activities, nullify profits, and terminate the contract.

The idea behind making profits through scalping is to exploit micro-delays in the price stream provided by a forex broker, which they receive from their liquidity provider. These delays can occur due to various technical issues or other reasons. Traders capitalize on this by setting up multiple expert advisors (EAs) on trading terminals of multiple brokers. These EAs are interconnected. They compare tick price feeds to identify which broker’s price feed is lagging. Then, the robot takes advantage of these moments to open and close orders with the lagging broker, nearly guaranteeing a profit since it can infer the trade’s direction from the price changes of the broker with the normal stream. This forms a unique form of arbitrage based on tick price delays. Brokers might not notice the delays in their price stream from the liquidity provider for some time, which can technically be problematic.

Surprisingly, it’s easier for traders to exploit these issues because they are more numerous and can monitor for discrepancies more swiftly, forming the basis of scalpers’ earnings. In a dispute over such trades, regulators might (but not guaranteed) side with the trader, as they traded using technical means and based on prices provided by the broker, meaning they didn’t violate any rules. However, we consider such practices unethical and condone them.

Feel free to experiment on your own. For intraday scalping, you’ll need to analyze the tick prices from several brokers to identify any that are experiencing delays. This can be achieved with tools designed to record and analyze tick history. Additionally, you’ll require trade copiers, which are also readily available online for free download. The third tool in your arsenal should be a trading robot installed on your terminals to do the actual trading. We won’t provide specific examples of such robots, but you can find them by searching for “trading with tick delays.” These robots are usually not advertised, but they are out there. If you can’t find one but still wish to scalp, consider commissioning a custom robot. You can have a robot programmed to your specifications on platforms like MQL. The cost can range from $10 to $300, depending on the complexity of your devised algorithm.

The combination of these tools enables the implementation of an intraday scalping strategy. Choosing currency pairs with narrow spreads for scalping is advisable, as this will minimize losses on the spread across numerous transactions.

Be warned, though, that market makers* do not favor scalping. Here’s why: first, it can overload trading servers with a massive flow of requests.

*We use this term in its original meaning. A market maker is a forex broker acting as the counterparty to your trades.

The second reason is quite intriguing: it’s ethical. In the early 2000s, market makers attracted clients with the promise of “instant order execution.” However, “instant execution” created an imbalance among financial market participants. Those with better internet connections executed trades faster, securing the best prices and order book volumes, thus having a higher chance of profit. For instance, a trader living closer to a broker’s server would have faster data exchange rates than those in remote or technologically lagging areas, giving them an advantage. Poor internet connection can play a significant role in order execution. Regulatory authorities of different countries began to address this “inequality.”

The third reason, which seems to be the main one, is that market makers often find themselves on the opposite side of the trade, and therefore, they lose money on scalpers, which necessitates a response. As a result, around the mid-2000s, instant execution vanished. Instead, order execution began to include micro-delays of a few ticks or even a second. Unfair? Only demo accounts can guarantee execution at the order’s stated prices. Incidentally, this is one of the reasons why trading robots perform significantly differently on demo accounts compared to real accounts.

Intraday Pipsing

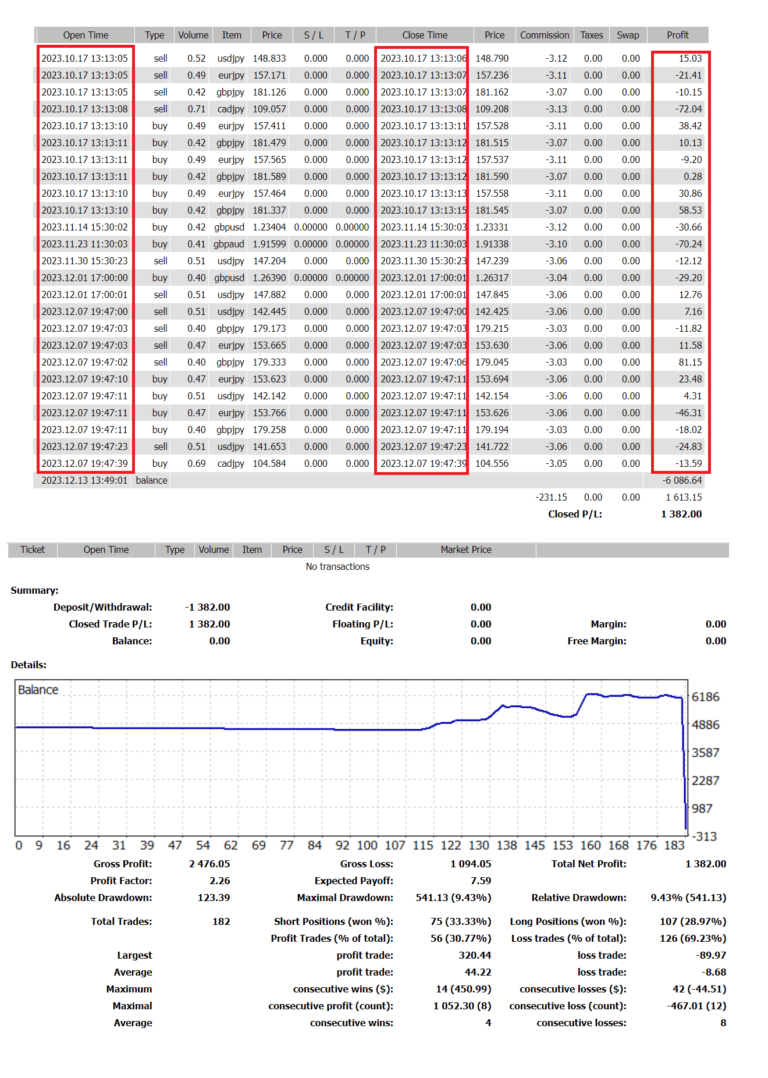

While many lump scalping and pipsing together as the same intraday trading strategy, we beg to differ. In our opinion, they are distinct strategies. With pipsing, an order can be held for several hours if luck isn’t on your side. Like scalping, intraday pipsing aims for a few pips of profit. Sometimes, profit barely surpasses the spread size, even if the order sits through a loss of a hundred pips. Below is a portion of a trading report from a trader practicing “pipsing.” From the commentary his Expert Advisor added to the trades, you can see the name of the pipsing robot – AF Global SCALPER. A quick Google search of this term will yield the following results:

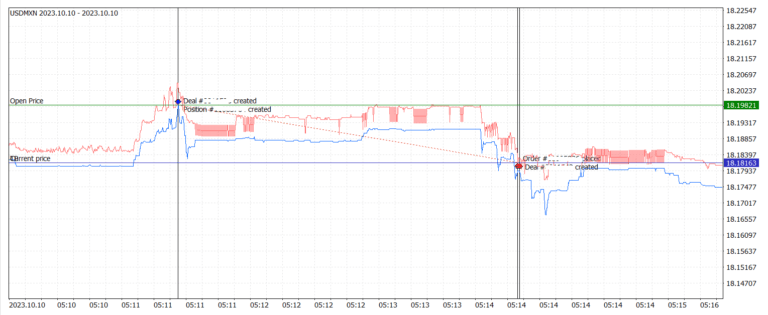

In the screenshot above, you can see an example of “pipsing.” Trades last more than 10 seconds, with the Take Profit (TP) set up at a minimum distance from the opening price. In this specific example, with a trading volume of 1 lot, the profit from each transaction would be $20.

This intraday trading strategy, much like scalping, is typically done by robots. Below is an example of the results from such a “pipser” robot:

This is what the balance of a trading account looks like when traded by a “pipser” EA.

Traders that follow this strategy usually operate until about 5 AM (Central European Time). This is because currencies are less volatile during that period, and prices often fluctuate within a relatively narrow range.

During this period, the following approach is possible. You select one of the cross-currencies or exotics with a relatively large spread. The second condition for this strategy is that the overnight volatility should exceed the spread but not by much. Then, place a pending order inside the spread as it widens. As the spread narrows, the order is executed at better prices than in standard market trading, increasing the chance of making a profit.

Here’s an example of such a trade:

For intraday pipsing, any trading robot using pending orders to trade would suffice. You set it up to place pending orders inside the spread. Then, the closing levels should be configured closer to the opening price by half to a full spread and the trading period should be specified from 11 PM to 5 AM (Central European Time). The only thing left is to pick the signals for opening a trade. One possibility is using trend indicators like the Moving Average or Alligator to generate entry signals. However, in low volatility conditions, their signals traditionally lag, which, in principle, could make them suitable for scalping. But you should remember that this isn’t a sure thing; here, you’ll need to use your imagination to come up with a signal for your entry.

You’ll also need an archive of tick prices for backtesting pipsing strategies. MetaTrader’s built-in editors and testers won’t do the trick since they generate ticks using a rather “strange” algorithm. We’ll try to cover this topic in our upcoming publications.

The loss through spreads and commissions is a downside to all these intraday trading strategies (HFT, scalping, and pipsing). A dealer we know boasted once about their trading volumes. Their company’s trading robot racks up commissions from HFT, totaling over a million dollars a month. Just imagine their turnover and the number of orders!

High-Frequency Trading (HFT)

This intraday trading strategy involves using powerful computers and algorithms to execute many orders at extremely high speeds. These algorithms analyze market conditions and execute orders based on market conditions within fractions of a second. The primary goal is to capture small price gaps and discrepancies across different trading venues, benefiting from small price movements.

One of the HFT strategies is placing numerous pending orders. These trades can create the appearance of increased market activity or liquidity. This perceived increase in volume (demand or supply) can influence the decisions of other market participants. When these market conditions unfold as intended, high-frequency traders may capitalize on the resultant price movements to take profits.

You will unlikely be able to access High-Frequency Trading (HFT) capabilities through retail forex brokers. However, you’ll be able to engage in scalping through forex brokers. Retail trading platforms like MetaTrader 4 (MT4) are designed for retail investors and not specifically for HFT. While MT4 allows for automated trading through Expert Advisors (EAs), the capabilities and infrastructure of MT4 do not match those typically required for high-frequency trading.

Our next post will explore news-based trading (News Trading). Stay tuned for Story 4, which continues right here.

Happy trading, everyone!

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.