According to recent estimates, the daily turnover of the global foreign exchange market hit a mark of $7.5 trillion (April 2022). The spot foreign exchange market is unregulated mainly due to its nature. This lack of regulation made this enormous market a breeding ground for forex scams of different sizes and shapes. In this article, we will review different types of forex trading scams and why people fall for them. This article aims to teach you to identify common types of forex scams, take apart their “modus operandi,” and hopefully help you learn how to avoid them.

What Do We Mean When We Say Forex Scam?

The purpose of any scam is to deceive someone to gain something of value, typically money. Scammers exploit trust, ignorance, vulnerabilities, naivety, or a combination of these factors to achieve their goals. Throughout our professional careers at different brokers, we’ve seen a large variety of different scams.

The Office of Fair Trading (OFT) estimated in 2006 that 3.2 million adults in the UK fall victim to mass-marketed scams yearly, costing the UK a total of £3.5 billion.

They all have one thing in common: they all start similarly—a promise to deliver superior performance with minimal risk. As someone who uses common sense (we hope you do), you may have expected something high-tech and sophisticated. Well, sorry to disappoint you, but most scams start simple. Why do people fall for scams if we are all so clever (or are we)? Well, we have some ideas.

Why Do People Fall for Forex Scams?

It’s easy to wonder how people fall for forex scams when you hear the stories of others, especially when they seem obvious in hindsight. However, scams are designed to exploit human psychology, emotions, and cognitive biases, often making them surprisingly effective.

Lack of Knowledge

Many people don’t fully understand forex (crypto, stocks, etc) trading or how markets work. Scammers use technical jargon, fake success stories, or complex charts to create the illusion of expertise. Promises of guaranteed profits or “proven” strategies appeal to those who don’t realize that no legitimate trading method can eliminate all risk.

“People are doubling their money in days! Don’t miss this once-in-a-lifetime opportunity!”

Scammers exploit our greed, the universal desire to make quick, easy money. They amplify this by showcasing others’ supposed success, creating urgency and a fear of missing out.

Demographics

Scammers try to target specific demographics. The less educated people are, the better.

“Pay off your debts or quit your job in just a few months of trading!”

They seek out vulnerable people, people in financial distress, or those looking for alternative income sources to support their families, who are especially vulnerable to promises of financial freedom.

Social Proof

Scammers often use social proof (Monkey See, Monkey Do) to make their schemes appear “legit.” Testimonials, fabricated success stories, or even paid actors posing as satisfied clients tap into our natural tendency to trust what others seem to endorse. Go ahead and type “forex” or “crypto trading” on Instagram, and you’ll see many of them.

It works like a charm every time because humans are inherently social creatures, and we tend to mimic behavior when we see others doing it. Scammers exploit this, especially if it appears successful or beneficial, by creating the illusion of widespread approval or success.

Cognitive Biases

Scammers prey on common cognitive biases to manipulate their victims and make their schemes more convincing. People tend to believe they’re less likely to be scammed than others. Because of this false sense of security, we let our guard down, making us more vulnerable to fraud.

“That could never happen to me—I’m too smart to fall for a scam!”

We’re wired to trust individuals who appear to have authority or expertise. Scammers exploit this by pretending to be financial experts, brokers, or representatives of reputable institutions. We may ignore red flags and seek information that supports our desire to believe the scam’s promises. A person desperate for financial freedom will focus only on success stories and disregard warnings or negative reviews about a “get-rich-quick” investment scheme.

Whenever you scroll through thematic trading-related groups on different social media platforms, people love to talk about psychology (e.g., one person giving advice to another: “All you gotta do is focus on your mindset” or “The road to success in trading is 95% in psychology”). Ironic, isn’t it?

Common Types of Forex Scams

We have just discussed why humans fall for scams. In short, our decision-making ability is inherently compromised. Now that we have established that, we will look at several of the most popular forex scams that have been around for a while now.

Trading Robots: The Reality Behind the Hype

Trading robots, or Expert Advisors (EAs), are automated systems that execute trades without human intervention. They promise an effortless trading experience where you “set it and forget it.” In theory, this sounds like an incredible innovation because an EA doesn’t get tired or cranky, never gets emotional, and never takes a break. As the philosopher Sarah Connor once said:

“The Expert Advisor would never stop. It would never leave a trader, and it would never screw up a trade because it got emotional or drunk or needed to step away from the monitor.”

While this paints an enticing picture, the reality is far more complex.

Are All EAs Scams?

The concept of an EA itself is not a scam. However, the way they are marketed often raises red flags. Sellers frequently use aggressive marketing strategies, making grandiose claims about their robots’ ability to exploit “loopholes” or inefficiencies in the forex market or any other market, for that matter. These claims are often backed by outlandish promises. Phrases like “96% winning trades” or “guaranteed profits” are common in their marketing materials.

To make their claims more “legitimate” in the eyes of their buyers, they may provide trading statements, and “verified” results which are often fabricated to lure buyers. Their websites and social media pages feature glowing testimonials that are impossible to verify. Back in the day, they used to hire actors and shoot promo videos, but that’s not as common anymore.

Nowadays, a simple screenshot or screen recording of a trading statement seems to suffice—no creativity, no nothing. LOL. This is designed to attract inexperienced traders who may see the EA as a shortcut to success.

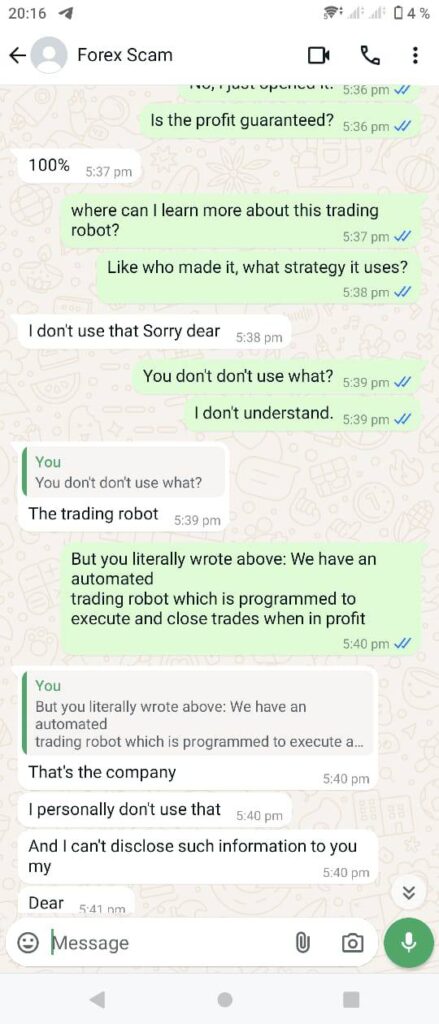

How Do EA Forex Scams Operate?

Here’s the typical lifecycle of an EA scam:

A company pops up overnight, aggressively advertises its “unique” trading robot, and makes promises of effortless profits. The robot is sold for a seemingly affordable price, often between $50 and $200. After generating quick sales, the company vanishes without a trace or, in some cases, continues scamming unsuspecting traders for years. The marketing often emphasizes simplicity:

“No setup required! XXXTurbo™ 3 comes pre-installed on your broker platform. Just plug, play, and profit!”

This type of scam primarily targets beginners who are easily impressed by technical jargon, high-profit claims, and the allure of a hands-off solution. While trading robots can execute trades without human input, they are far from a guaranteed success. Claims of “no-brainer” systems with extraordinary win rates are a hallmark of scams.

The truth is, markets are complex, and no EA can outperform them consistently. If something sounds too good to be true, it probably is. For more insights into trading robots and why they fail, check out our detailed article on losing EAs. We’ve seen our fair share of different EAs. In fact, we had a front-row seat.

If you want to read more about losing EAs, we have written a detailed article about it.

How Managed Account Forex Scam Operates?

Next up are forex scams that offer account management services. Let’s break them down. But before we get to the point, let’s examine how real or rather professional money or portfolio managers (sometimes people use these terms interchangeably) work. This way, you will have a reference point, and you will be able to compare them with scammers.

How Do Professional (real) Money Managers Work?

A money manager is either a person or a company that takes care of your investment portfolio for a fee. In both cases, these are financial professionals with a serious pedigree. Now, in places like the EU, the US, or the UK, these guys need a special license to do their job. And getting this license is no walk in the park. They have to pass a bunch of exams to prove they’re qualified to do the job.

If we’re talking about a company playing the role of a money manager, it has to be set up in a specific legal way and, of course, have that crucial license. These licenses come from government regulators and cost a pretty penny to keep active. Basically, money managers have a lot on the line if they mess up. Their job is to make the best moves with your money, charging a fee for the trouble.

“In professional lingo, this is called “fiduciary duty.”

They’re supposed to keep you in the loop about what they’re doing with your hard earned money, minus the trade secrets. And when they make a move, like picking one stock over another, they need document why they made that call, offering a peek into their decision-making process. Let’s just say money managers are the adults in the room.

Do you want to learn to select a money manager like a pro? We wrote a detailed article on this topic.

How Do the Scam Versions of the Real Money Managers Operate?

In the forex world, “money manager” can have a bit of a shady vibe. Nowadays, just about anyone can claim they are a “money manager.” And that creates a problem, because chances are an average trader wouldn’t know how to vet these guys, what to ask, and where to look for red flags. This is the reason this type of forex scam is so popular.

These guys promise to handle your investments with the same grown-up responsibility, charging a fee, very often a standard “2/20” cut or something close. But then they dangle the carrot of unrealistic returns from forex trading, usually targeting people who are either too busy or too green to trade on their own.

INTERESTING FACT: The “2/20” structure became popular with the rise of hedge funds in the mid-20th century, particularly through pioneers like Alfred Winslow Jones, who is often credited with launching the first hedge fund. It has since become a standard fee model in the investment management industry, though variations exist, especially as investors demand more competitive pricing or greater alignment of interests. It refers to the management fee (the 2%) and performance fee (the 20%).

Insatiable Appetite

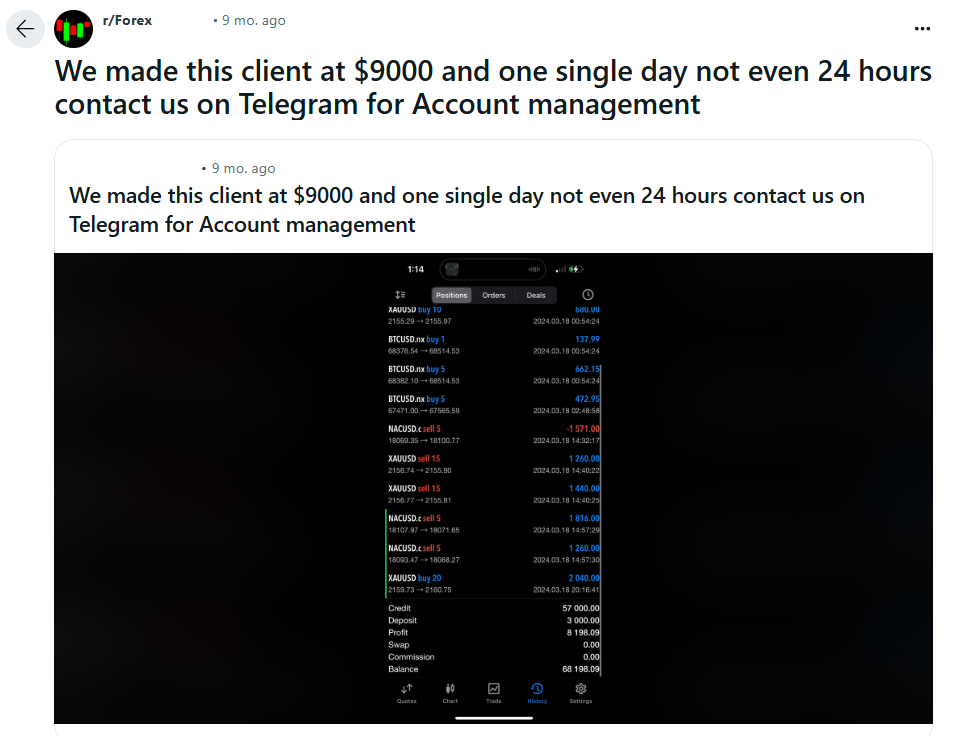

Alright, now we get to the juicy part of this forex scam. When it comes to what they’re charging, our forex money managers can play it cool, sometimes asking for a hefty 30%, 40%, or even 50% as their cut. Yep, you read that right, and we’ve seen it firsthand. Just so that you understand, professional money managers (licensed counterparts) would probably choke on their sandwich if they saw such marketing materials. That’s a total rip-off! But hold on to your hats because the real kicker isn’t just the fee; it’s the kind of returns they claim they can make for you.

Unrealistic Profitability

They throw around numbers that are, frankly, pie-in-the-sky—like saying you could rake in a 10% return daily. Yeah, that’s right. That kind of consistency isn’t attainable. Do you know how many times we facepalmed ourselves while scanning through forex subreddits? And sometimes, they even dare to guarantee profits. If that doesn’t scream “scam alert,” we don’t know what does. No licensed professional would ever do that. It is a big No-No.

Additional Red Flags

Of course, they’ve got all the usual trappings to sell you on this fantasy. A slick website plastered with their “money management” spiel, not to mention their blasts across social media and various messaging apps, drumming up business. So far, we have established that this type of forex scam promises huge profits to lure naïve, unsuspecting traders in. But that’s not the end of it. How so? As a money manager, you need a place (a broker) and the appropriate infrastructure (MAM, PAMM functionality) to “manage” the funds of their victims.

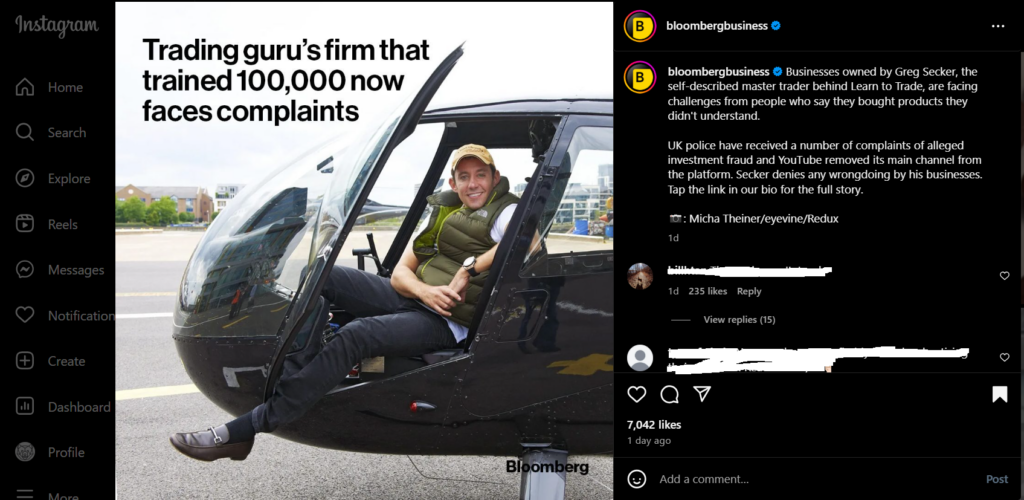

Fake “Gurus”: A Popular Forex Scam

One of the most common forex scam types revolves around fake “gurus.” These individuals present themselves as trading prodigies, often sharing dramatic “rags-to-riches” stories. The narrative is always the same: someone from humble beginnings transforms into a millionaire through forex or crypto trading.

The Illusion of Success

Sometimes, these so-called gurus don’t hold back on flaunting their supposed wealth. Think luxury cars, mansions, yachts, and private jets—all designed to make you believe their success came from trading. The message? “If trading worked for me, it can work for you too!” Sometimes they don’t and simply claim to have found the “holy grail”.

But the reality is different. These individuals rarely make their money from trading. Instead, they profit by selling overpriced and generic trading courses that promise “secret strategies” or “exclusive edges” to succeed in the market. In most cases, these courses are nothing but junk, offering no real value.

The Hidden Agenda

Some gurus take this scam to the next level, creating a near-cult following. Their devoted retail trader audience clings to their every word and fiercely defends them against criticism. Outside the retail trading community, these “gurus” remain largely unknown—but within, they’re treated like celebrities.

Red Flags to Watch Out For

Fake gurus rarely discuss the realities of trading, such as risk management or losses. Instead, they focus solely on the benefits, portraying trading as a guaranteed path to wealth. When pressed for details about their strategies or processes, they tend to:

- Offer vague, evasive answers.

- Become defensive or hostile.

Additionally, they exploit social media platforms like YouTube, Instagram, Telegram, and WhatsApp to reach a wider audience. Their comment sections are often flooded with fake testimonials, where supposed “students” claim the guru’s guidance turned them into millionaires overnight. These comments are typically created by bots, not genuine users.

Fake gurus are among the most dangerous forex scammers because they prey on the hopes of inexperienced traders. They promise wealth, but deliver empty advice and misleading narratives. If someone claims to have a “secret formula” for success in trading, it’s a major red flag.

Trading Courses: A Common Trap

Trading courses is by far one of the most popular forex scams. While there are legitimate courses that provide valuable knowledge—sometimes even free—there are also countless scams designed to exploit unsuspecting traders.

Spotting the Scams

Scam trading courses often lure you in with bold claims and flashy marketing. They emphasize “exclusivity,” suggesting they possess secret strategies or knowledge that no one else has—and they’re willing to share it with you for a fee.

Where the Scam Happens

If you fall for the hype and purchase one of these courses, the scam can occur in at least several ways:

- The Course Fee

The initial scam lies in the fee you pay. These courses often provide little to no value, offering generic or outdated material that doesn’t help you become a better trader. If this is the only loss, consider yourself lucky. - Introducing Brokers (IBs)

Many scam course providers act as Introducing Brokers, partnering with specific forex brokers to earn commissions for every client they refer. As part of the course, they may suggest opening a trading account with their “recommended” broker to practice what you’ve learned. This seemingly helpful nudge is designed to generate additional profits for them. - Operating Their Own Brokerage

In some cases, these scammers may run their own brokerage, allowing them to profit from both the course fees and the trades you execute. By directing you to their platform, they can take advantage of your trading activity, whether through high spreads, hidden fees, or other mechanisms.

How to Protect Yourself

To avoid falling victim to these scams, carefully research any trading course before investing your time or money. Look for reviews from reputable sources, check whether the material is grounded in solid trading principles, and be wary of anyone claiming to have “secrets” to success. Legitimate courses focus on educating traders about fundamental concepts, risk management, and strategies without overselling unrealistic outcomes or pressuring you into specific broker relationships.

We must admit that not all trading courses are scams. Many are designed to take advantage of beginners by over-promising and under-delivering. Always exercise caution and remember that no single course or “secret” strategy can guarantee success in the forex market. Success requires continuous learning, practice, and an honest understanding of the risks involved.

Conclusion

In our article, we covered the main types of forex trading scams. To be fair, not all EA developers, money managers, or trading classes should be automatically labeled as scams, and there are legitimate ones out there. So, you have to exercise caution. Is this an all-inclusive and exhaustive list? Surely not. These are just the most common ones. There are different sub-species and cross-breeds of these four. They all, however, share some common features.

Almost all of them:

- Promise unrealistic returns on your investment over a relatively short period.

- Try to avoid the subject of risks.

- Try to be as vague as possible about their trading strategy or risk management.

If you see an investment offer associated with one of the above that sounds too good to be true, it most likely is.

“The only free cheese is in the mousetrap.”