The foreign exchange market (FX), measured by daily turnover, is where different market participants trade currencies against each other. According to recent estimates, the global foreign exchange market reached a daily turnover of 7.5 trillion dollars in April 2022.

Furthermore, this volume is about ten to fifteen times larger than the daily turnover in global bond markets and approximately fifty times larger than the worldwide turnover in equities.

Moreover, the FX market operates 24 hours a day, five days a week, making it a truly global market. It connects market players from all time zones through electronic communication networks. For instance, these networks bring together prominent players such as multinational corporations and hedge funds, as well as small retail traders. Additionally, the foreign exchange market plays a vital role in facilitating international trade and linking all major financial markets. These factors, among others, attract the attention of key market participants and make the foreign exchange market a subject of various studies.

What Is the Role of the Forex Market in International Investment?

The economies of different countries have been becoming more and more interconnected. Consequently, we can view them as one enormous, live organism. In other words, to a greater degree, the global economy determines the production and flow of goods and services rather than constituent economies. As a result, the foreign exchange market reflects all these factors.

Moreover, as we mentioned earlier, foreign exchange markets not only help international trade but also foster global investment. As a byproduct of international trade, they encourage investors to seek additional growth opportunities abroad. A compelling example is the steady growth of foreign direct investment, which started in the 90s. In 2015 it reached a remarkable USD2.6 trillion.

“Foreign direct investment (FDI) refers to the investment made by individuals, companies, or entities from one country into businesses or assets located in another country. It involves acquiring ownership or control over tangible and intangible assets.

Moreover, FDI can take two forms:

Greenfield Investments: This occurs when companies establish new businesses or facilities in a foreign country.

Mergers and Acquisitions: In this case, investors acquire existing foreign companies or their assets.”

This undeniable evidence demonstrates that investors who previously focused exclusively on their home countries are now expanding their horizons. Consequently, the foreign exchange rate has become an indispensable metric for evaluating portfolio performance. Why? Well, when we invest abroad, the value of foreign assets is expressed in their respective home currencies. However, our primary interest lies in assessing how our investment performs in terms of our domestic currency.

Additionally, due to the globalization of the world economy, large companies like Apple can successfully market and sell their products on a global scale. In fact, their international sales often account for a substantial portion of their total sales.

In summary, the integration of economies and the interdependence of the global economy have made the foreign exchange market a vital reflection of these dynamics. It not only helps international trade but also drives global investment and serves as a crucial measure for portfolio performance. Moreover, the globalization of the world economy has enabled multinational companies to expand their reach and achieve significant international sales.

On the other hand, it is important to consider the impact of foreign investors on domestic asset prices, such as real estate, bonds, and shares. Their demand directly influences these markets, highlighting the interconnectedness of global finance. Moreover, the developments in the foreign exchange markets are a result of these complex interactions.

Therefore, it becomes crucial to have a comprehensive understanding of how today’s foreign exchange markets operate. In the following article, we will provide a concise introduction to the foreign exchange market. This will include fundamental concepts, and key terminology, and even touch upon basic economic principles.

Furthermore, it is worth noting that conventions used in foreign exchange markets can vary significantly across the globe. Market professionals quote exchange rates in terms of domestic currency units per unit of foreign currency, or vice versa. The notation used to represent exchange rates may also differ widely. In some cases, different sources may even use the same notation to convey different meanings. Hence, it is essential to pay close attention to the conventions and not solely rely on rote memorization.

To summarize, understanding the impact of foreign investors on domestic asset prices and comprehending the dynamics of foreign exchange markets is vital for navigating the global financial landscape.

What Are the Foreign Exchange Market Conventions?

To gain a thorough understanding of the FX market, it is crucial to familiarize oneself with some basic conventions that shape its operations. One such convention is the utilization of standardized three-letter codes. The International Organization for Standardization (ISO) came up with these codes back in the day and today everybody uses them.

ISO 4217 is an international standard that provides codes for representing currencies used around the world.

The ISO 4217 standard assigns a unique three-letter code to each currency. These codes are widely used in financial systems, international banking, currency exchange, and other related fields. For example, the code “USD” represents the United States dollar, “EUR” represents the euro, and “JPY” represents the Japanese yen.

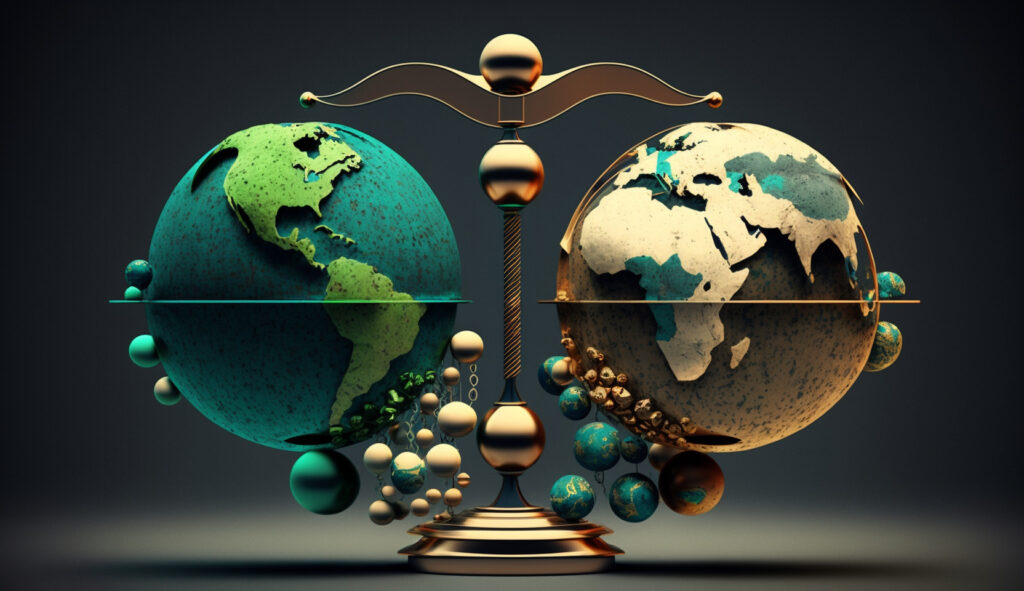

Furthermore, it is essential to differentiate between individual currencies and exchange rates when discussing the FX market. While an individual currency can be held as a singular entity, an exchange rate refers to the price of one currency in relation to another. For instance, it represents the exchange rate between the euro (EUR) and the US dollar (USD).

It’s important to note that an exchange rate always involves two currencies: the price currency and the base currency. It means the number of units of the price currency required to buy one unit of the base currency. Another way to express the exchange rate is by indicating the cost of one unit of the base currency in terms of the price currency.

Understanding the difference between individual currencies and exchange rates holds significant weight as we delve into the articles that follow. It enables us to utilize these three-letter currency codes in various ways, such as expressing exchange rates in the professional foreign exchange market (e.g., using EUR to represent the exchange rate between the euro and the US dollar).

In light of this, it is important to pay close attention to the context in which these three-letter currency codes are employed. They can serve as representations of a specific currency or an exchange rate, depending on the specific context and the intended purpose of the discussion.

To prevent any misunderstandings, it’s important to lay down a consistent convention for identifying exchange rates. In this and further articles, we will use the convention of “B/A”. It signifies the number of units of currency A needed to buy one unit of currency B. Let’s clarify this with an example: an exchange rate of EUR/USD 1.1700 means that 1 euro will buy 1.1700 US dollars. In simpler terms, 1 euro costs 1.1700 US dollars.

In this scenario, the euro serves as the base currency, while the US dollar is the price currency. If this exchange rate were to decrease, it would imply that the euro is now worth less. Alternatively, it can mean that fewer US dollars are required to buy one euro. Essentially, a decline in this exchange rate signifies that the US dollar is strengthening against the euro. Conversely, it can mean that the euro is weakening against the US dollar.

With this convention in mind, we can explain exchange rate movements and understand their meaning for currency values.