As forex market enthusiasts, we are deeply interested in all factors influencing currency behaviors. Fiscal and monetary policies are paramount, profoundly impacting the foreign exchange market. Understanding these policies—what they are, how they differ, and their interaction—is crucial for all market participants. This knowledge is particularly vital for forex traders who rely on fundamental analysis, as it helps them anticipate and respond to market movements. For instance, a country’s decision to alter interest rates (a monetary policy action) can lead to significant currency fluctuations, providing trading opportunities.

The Difference Between Fiscal and Monetary Policy

To grasp the differences between fiscal and monetary policies, it’s crucial first to understand their definitions, functions, various types, and interactions. Fiscal policy, managed by the government, involves adjusting spending levels and tax rates to influence the economy. Types include expansionary, which stimulates growth through increased spending or lower taxes, and contractionary, which aims to cool an overheated economy through cuts in spending or higher taxes. Monetary policy, controlled by the central bank, manipulates interest rates and money supply to stabilize inflation and control economic growth. Both policies are interrelated and often used simultaneously to achieve economic stability. Let us first deal with types.

Types of Monetary and Fiscal Policies Are There?

Expansionary Monetary Policy is crucial during recessions. This policy involves lowering interest rates, which makes money cheaper. As a result, spending and consumption increase. This stimulus leads to increased economic activity and, consequently, a boost in economic output.

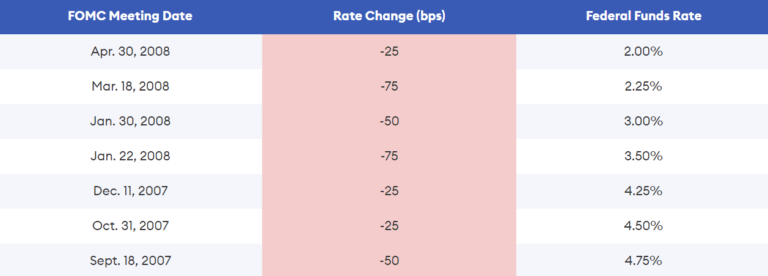

An example of expansionary monetary policy is the decision by the Federal Reserve (the central bank of the United States) to lower the federal funds rate during the 2008 financial crisis. By reducing this key interest rate from 4.75% in mid-2007 to a range of 0-0.25% by the end of 2008, the Federal Reserve aimed to make borrowing cheaper for banks. This, in turn, was intended to encourage banks to lend more readily to businesses and consumers, thereby stimulating investment and consumption and helping to counteract the severe downturn in economic activity triggered by the crisis.

In contrast, central banks tend to use Contractionary Monetary Policy during economic booms. Under this policy, they increase interest rates. This is particularly useful when growth threatens to tip into uncontrollable inflation. This increase makes borrowing more expensive, slows spending, and ultimately decreases economic output.

In November 2017, the Bank of England raised its base interest rate from 0.25% to 0.5%. This was the first rate increase in over a decade, implemented in response to rising inflation levels, which had exceeded the Bank’s target of 2%. By increasing the interest rate, the Bank of England aimed to curb excessive spending and borrowing, thus slowing inflation. This move was intended to stabilize the economy by making borrowing more expensive, which typically reduces consumer spending and investment, leading to slower economic growth and reduced inflationary pressures.

Governments, specifically the treasury or finance department, use Fiscal policy to influence the economy through taxation and expenditure. Expansionary Fiscal Policy is often employed during a recession. Here, the government acts by increasing its spending or decreasing taxes. The aim is to stimulate the economy. A typical move might be to embark on public works projects, creating jobs and stimulating economic activity.

A notable example of expansionary fiscal policy in recent years is Japan’s 2020 stimulus packages. Facing the economic downturn caused by the COVID-19 pandemic, the Japanese government unveiled several large-scale fiscal stimulus packages totaling over $2 trillion. These measures included direct cash payments to citizens, subsidies for businesses affected by the virus, increased healthcare spending, and support for local economies impacted by decreased tourism. This massive fiscal injection was aimed at mitigating the economic fallout of the pandemic, encouraging spending, and supporting the most at-risk economic sectors.

However, a different approach is needed during rapid economic expansion. This is when Contractionary Fiscal Policy comes into play. The government decreases its spending or increases taxes to cool the economy down. This action helps reduce inflation and prevent the formation of economic bubbles.

In 2008, Greece faced a severe fiscal crisis, with its budget deficit reaching 15% of GDP. The government responded with harsh contractionary measures, including higher taxes and reduced public spending. These measures significantly decreased consumer spending power and helped bring down inflation rates.

How Do Monetary and Fiscal Policies Work in Tandem?

In the real world, monetary and fiscal policies often work together. They guide economies toward their economic goals. Each policy plays its part, independently and/or in tandem, to create a balanced economic performance.

Despite their benefits, these policies are not without controversy. They often stir political and economic debates regarding their effectiveness and potential side effects. No policy is a magic bullet, but smart monetary and fiscal policy use is crucial. Why?

Monetary policy’s impact on overall demand can change based on fiscal policy. The same applies to fiscal policy under various monetary conditions. It’s vital for those making policies to understand this interaction. They need to see how budget changes affect total demand under different monetary settings.

How Are Fiscal and Monetary Policies Similar?

Exploring the similarities between fiscal and monetary policy can provide a clearer understanding of how these two fundamental economic tools operate. Both policies aim to achieve economic stability and growth, but they do so through different mechanisms.

Firstly, fiscal and monetary policies are designed to influence a country’s economic activity and maintain stability. They help manage economic fluctuations by stimulating the economy during downturns or cooling it down during periods of excessive growth. This common goal ensures that both policies are central to a government’s strategy for economic management.

Secondly, both policy types affect aggregate demand, the total demand for goods and services within a country. Fiscal policy impacts aggregate demand directly through government spending and taxation decisions. For example, increasing government spending or decreasing taxes can boost demand by increasing consumers’ spending power. On the other hand, monetary policy influences aggregate demand indirectly through changes in interest rates and the money supply. Lowering interest rates can encourage borrowing and investing, thereby increasing demand.

Additionally, both policies play crucial roles in controlling inflation and unemployment, which are often the primary focus of economic policy. By adjusting spending, taxes, interest rates, and the money supply, governments and central banks can influence price levels and employment rates, striving to keep both within the desired ranges.

Lastly, the effectiveness of fiscal and monetary policies is significantly increases when governments and central banks coordinate their actions. This coordination ensures that the actions of a country’s central bank (managing monetary policy) and its government (managing fiscal policy) are aligned, thus avoiding contradictory actions that could undermine economic stability.

How Does Fiscal Policy Differ From Monetary Policy?

Now that we know the types, their interaction, and their similarities, we can finally explain the differences between monetary and fiscal policies.

Fiscal and monetary policies are two fundamental tools in the arsenal of governments and central banks. Each one differs by methods of control, tools, and focus. The government directly manages fiscal policy, which makes public spending and taxation decisions to influence economic activity and output directly. This approach targets aggregate demand, aiming to stimulate the economy through increased government expenditure or cool it down by raising taxes.

In contrast, monetary policy is the central bank’s domain, which adjusts the nation’s money supply and interest rates to impact economic conditions indirectly. The tools at its disposal—interest rate adjustments, reserve requirements, and open market operations—are designed to regulate the banking system, control inflation, and adjust the cost of borrowing money. This policy is crucial for influencing economic conditions indirectly through financial channels.

Moreover, monetary policy is known for its speed and flexibility. Unlike fiscal policy, which often involves lengthy legislative processes and can be slow to implement, monetary policy can be adjusted more swiftly. Central banks can quickly change policies in response to economic indicators, making it a dynamic tool for managing economic stability. This flexibility is critical in rapidly changing economic landscapes, allowing central banks to act promptly to mitigate financial crises or inflation spikes.

How Does it All Impact the Foreign Exchange Market?

The impact of fiscal and monetary policies on the foreign exchange market can be significant, as these policies influence economic variables that affect currency values.

Monetary Policy

Forex traders closely watch monetary policy, especially regarding interest rate decisions by central banks. Higher interest rates provide higher returns on investments denominated in that currency and tend to attract foreign capital, leading to an appreciation of the currency. Conversely, lower interest rates can result in a depreciation of the currency.

Expansionary monetary policy, which increases the money supply, can lead to currency depreciation, as more currency in circulation can reduce its value. On the other hand, a contractionary monetary policy, which tightens the money supply, might boost a currency’s value.

Fiscal Policy

Large-scale government spending can stimulate economic growth, potentially strengthening the currency if it leads to a robust economic outlook. However, if such spending leads to high deficits or increasing debt levels without sustainable growth, it could worry investors, leading to currency depreciation.

Changes in tax policy can also affect the forex market. For example, lower taxes might increase disposable income and boost consumer spending, potentially strengthening the currency in the short term. However, similar to spending, if tax cuts lead to larger government deficits, the long-term effect might be negative for the currency.

Other Considerations

Fiscal and monetary policies can alter investor sentiment and market perceptions. For instance, a country adopting rigorous and credible fiscal measures to manage its finances effectively might strengthen its currency due to increased investor confidence. Conversely, erratic fiscal or monetary policy changes might lead to uncertainty and result in currency volatility.

Economic forecasts based on changes in these policies can also influence forex markets. For example, if a fiscal stimulus is expected to lead to higher inflation, traders might anticipate central bank actions to counter this by raising interest rates, which could affect currency movements.

In essence, fiscal and monetary policies shape economic fundamentals critical to currency valuations in the forex market. Traders closely monitor policy shifts, as these can indicate potential movements in currency pairs, guiding trading strategies and investment decisions.

We understand that there is much to learn about Forex trading and investing. As you can see, effective coordination between monetary and fiscal policies can drastically affect economic cycles, stabilize or increase currecy rates, and promote growth. Avoid the trial and error, learn from experience.

Follow Finansified.com How-to Find Best Foreign Exchange Market Brokers

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.