The ability to calculate volatility and estimate future price levels has led to the creation of derivatives. Derivatives are financial contracts that derive value from another asset, the underlying. The foreign exchange (FX) market is one of the largest and most liquid financial markets globally. At its core, it facilitates the exchange of one currency for another. But beyond this primary function lies a sophisticated world of foreign exchange derivatives or simply forex derivatives. As a forex-centric platform, we primarily focus on forex derivatives, such as futures, forwards, options, swaps, etc. Multiple contracts with different expiration dates can be created for the same underlying currency. This allows market participants to manage risk and speculate on future price movements across various timeframes. The Chicago Mercantile Exchange (CME) is a major marketplace for trading currency futures.

Understanding Forex Derivatives: Types, Uses, and Benefits

Foreign exchange market derivatives can come in various forms, with different levels of complexity and risk. Let’s explore the most common types of FX derivatives.

Forward Contracts

A forward contract is an agreement between two parties to exchange one currency for another at a predetermined rate on a future date. Unlike standardized futures contracts traded on exchanges, forwards are customized and traded over-the-counter (OTC).

According to the Bank for International Settlements (BIS) 2022 Triennial Survey, the average daily turnover in FX forwards reached $799 billion, accounting for approximately 11% of the total global FX market turnover.

A company with future cash flows in foreign currency might use a forex derivative like a forward contract to lock in an exchange rate today, ensuring they’re protected from adverse currency fluctuations when the actual exchange occurs.

Futures Contracts

Futures are similar to forwards but with a key difference: they are standardized contracts traded on regulated exchanges, such as the Chicago Mercantile Exchange (CME). These contracts specify a set date, amount, and exchange rate.

Futures are popular among traders who wish to speculate on currency price movements or hedge against potential currency risks. Because futures are traded on exchanges, they are more transparent and liquid than forward contracts. They also fall under the category of forex derivatives.

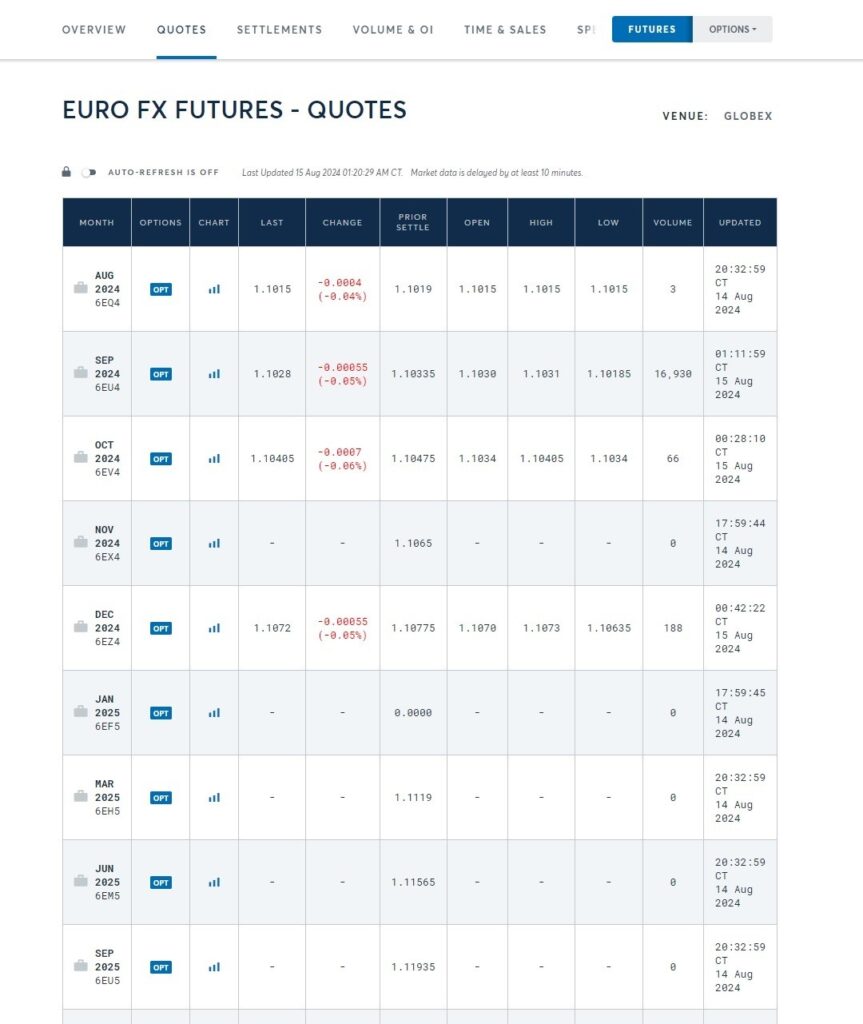

The CME “dashboard” of currency futures for the EURO looks like this:

Options

Options give the holder the right—but not the obligation—to buy or sell a currency at a predetermined exchange rate before or on a specific date. There are two main types of options. Unlike a futures contract, an option is a right, not an obligation.

And that’s what the CME dashboard for options looks like:

With futures, you have two choices – buy or sell. But with options, things get a lot more interesting. There are two options for each side of the trade:

Call Option. This contract gives the buyer the right (but not the obligation) to buy a certain amount of currency at a fixed exchange rate from the seller on a specific future date.

Put Option. This contract gives the buyer the right (but not the obligation) to sell a certain amount of currency at a fixed exchange rate to the seller on a specific future date.

Options are another important type of foreign exchange derivative, offering market participants flexibility and risk management capabilities. Pay attention to the phrases “right to buy” and “right to sell.” You pay a small fee—the option premium—for this right, but you can choose not to exercise it if it’s not beneficial. The second party in the trade, the seller, is only obligated to either sell to you or buy from you in the future at the price agreed upon now.

Let us illustrate this in a simplified way:

- Spot Trading: The current exchange rate for EUR/USD is 1.0100, and you can trade at this price right now. This is spot trading, a regular buy or sell at current prices.

- Futures Trading: Someone forecasts the exchange rate will rise to 1.0500 and offers you a deal at 1.0300. This is futures trading – trading at prices for future periods.

- Options Trading: The price may rise to 1.0500, or it may fall to 1.0000. You can pay a $50 premium now for the right to buy in the future at 1.0000 or a $100 premium now for the right to sell at 1.0500, regardless of the market prices. This is trading, not the underlying asset itself, but the possibility to perform specific actions with it in the future or decline them – these are options.

As we said before, when you buy an option, you purchase the right, not the obligation, and it is entirely up to you whether or not to exercise the option. However, if you can buy an option, you can also sell it. If you are selling, you forgo your right to exercise the option in return for a fixed payment (the premium).

So, there are two sides to the trade and two possible directions for the trade. 2 x 2 = 4, giving us four types of options trades:

- Buy a Call

- Buy a Put

- Sell a Call

- Sell a Put

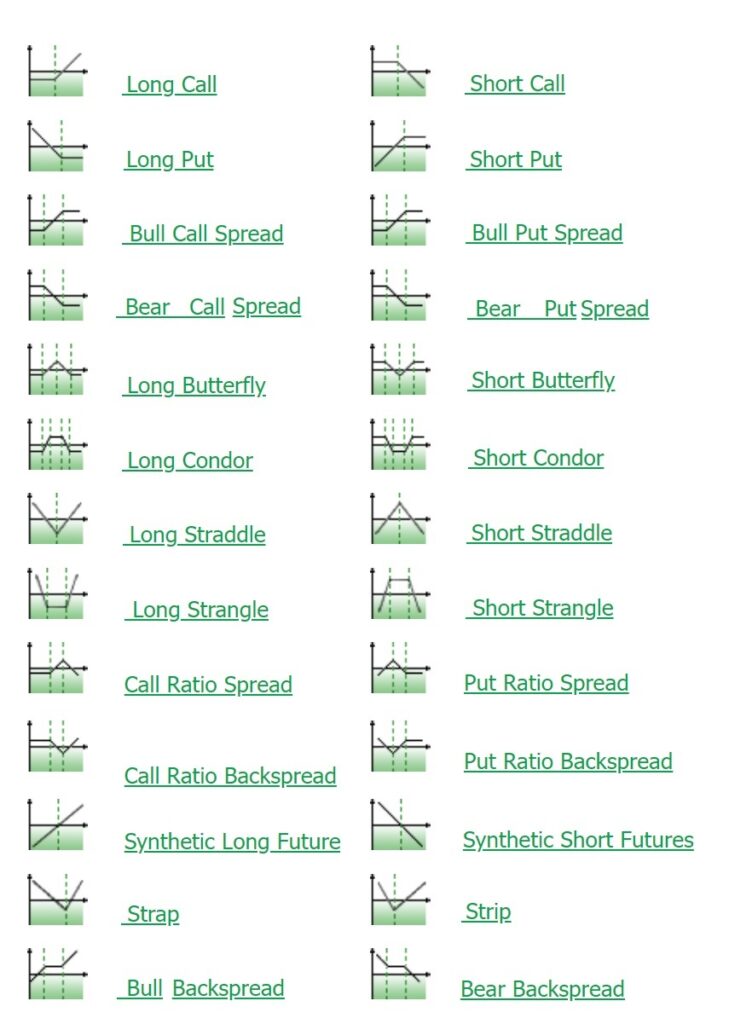

In the realm of forex derivatives, options stand out as remarkably versatile instruments. Each of the four basic option types (call and put, buy and sell) presents its own set of advantages and disadvantages, depending on future currency price movements. By strategically combining multiple options, traders can unlock many strategies developed and refined over time:

Visualizing these strategies often involves a graph where the horizontal axis represents the price change of the underlying currency pair, while the vertical axis shows potential profit or loss. This visual aid helps traders grasp the potential outcomes of their chosen strategies. Many combinations offer limited losses and the enticing possibility of unlimited profits.

The key to success in options trading lies in accurately predicting the currency pair’s future price direction and volatility. Correct predictions can lead to unlimited profits, while incorrect ones result in losses limited to the option premium. However, there’s a catch. Option premiums are calculated with built-in risk premiums, meaning even a seemingly profitable strategy might yield less profit than the options’ cost.

This complexity and many possible scenarios make options challenging to understand, even for seasoned professionals. Consequently, they are primarily used as insurance against adverse price movements rather than for high-frequency trading.

Despite their complexity, analyzing option prices can offer valuable insights into how market makers perceive the future movement of currency pairs. This information can be invaluable for traders seeking an edge in the forex market.

Options are powerful but complex forex derivatives. While they might not suit everyone, they remain essential for managing risk and gaining insights into market sentiment. Understanding the intricacies of options trading can open up opportunities for those willing to put in the effort.

Swaps

Currency swaps are agreements in which two parties exchange currencies on a set date and then reverse the exchange later, often at different rates. They involve exchanging principal and interest in one currency for principal and interest in another. The FX swap, a type of forex derivative, allows for the exchange of currencies on one date, followed by a reverse exchange on a future date.

According to the Bank for International Settlements (BIS) 2022 Triennial Survey, the average daily turnover in FX swaps reached $3.8 trillion. This represented a substantial increase from the $3 trillion recorded in the 2019 survey and accounted for 51% of the total global FX market turnover. This dominance of FX swaps within the FX market underscores their critical role in facilitating international trade and investment by enabling market participants to manage currency and interest rate risks efficiently.

Multinational corporations and financial institutions widely use swaps to manage cash flow mismatches or hedge long-term foreign exchange risks.

Non-Deliverable Forwards (NDFs)

NDFs are another type of forex derivative. They are forward contracts in which the physical delivery of currencies is not required. Instead, the settlement is in cash based on the difference between the contracted forward rate and the prevailing spot rate on the settlement date.

According to the Bank for International Settlements (BIS) Triennial Survey of 2022, the average daily trading volume of NDFs reached $266 billion. NDFs are particularly prevalent in emerging markets, providing a means to manage currency risk where fully convertible or freely tradable currencies are not available. Major NDF markets include the Chinese yuan, Indian rupee, South Korean won, New Taiwan dollar, and Brazilian real.

NDFs are indispensable for dealing in currencies of markets with capital controls, where there are restrictions on the delivery of certain currencies. They allow participants to hedge currency exposure without needing to exchange currencies physically.

The Uses and Benefits of Forex Derivatives

One of the most important uses of FX derivatives is hedging. Businesses and investors engaged in international transactions are exposed to the risk of fluctuating exchange rates. For example, a company exporting goods to another country may worry about the value of its foreign earnings declining due to currency depreciation. The company can lock in exchange rates by using forward contracts or options, protecting its revenues from adverse currency movements.

Speculation

FX derivatives also provide opportunities for speculation. Traders can use their predictions about future currency movements by buying or selling derivatives to profit from exchange rate fluctuations. For example, investors might purchase a call option if they expect a currency to appreciate. A call option enables them to buy the currency at a lower rate in the future and potentially profit from the price difference.

Arbitrage Opportunities

Some sophisticated traders use FX derivatives for arbitrage—profiting from discrepancies in currency prices between different markets. By simultaneously buying and selling in different markets, traders aim to lock in risk-free profits.

Risk Management for Financial Institutions

Banks and financial institutions are the major participants in the FX market. They use derivatives to manage foreign currency exposure and minimize the risks associated with currency mismatches on their balance sheets. For example, a bank might use currency swaps to manage its long-term exposure to foreign currencies.

Risks of Using Forex Derivatives

While FX derivatives offer flexibility and protection against exchange rate volatility, they also carry inherent risks, including market risk. Movements in the underlying currency directly influence the value of a derivative. Sudden or unexpected changes in exchange rates can lead to significant losses. Another type of risk is counterparty risk, the risk that the other party in a derivative contract may default on their obligations. Last but not least, some derivative instruments may not be as easily traded or liquid, especially during market stress.

Forex Derivatives: What did we learn?

Foreign exchange market derivatives are versatile and powerful tools in the global financial landscape. They serve various purposes, from protecting companies against unfavorable currency movements to offering traders opportunities to profit from speculation and arbitrage.

However, using these derivatives effectively requires a clear understanding of both their benefits and risks. Whether you’re a business looking to hedge currency exposure or a trader seeking to capitalize on market movements, FX derivatives provide the flexibility to navigate the complex world of foreign exchange with greater confidence.

We hope the information presented was helpful to you.