If you’re new to forex trading, you’ve likely heard terms like bid, ask, and spread—but what do they really mean, and why should you care? In this article, we’ll break down the structure of forex quotes, explain the difference between base and quote currencies, and demystify direct vs. indirect quotes. Most importantly, we’ll explore the concept of the spread—the subtle but powerful force that directly impacts your trading costs and profitability.

What Are Currency Exchange Quotes and How Do We Read Them?

Before we discuss the concept of spread in forex, we need to introduce a couple of other things that complete the picture. In the context of the forex market, a quote refers to the representation of the exchange rate between two currencies. It indicates the price at which one currency can be exchanged for another currency.

Base And Price Currencies

The base currency, also referred to as the transaction currency or primary currency. It’s the currency against which the exchange rate is quoted. Essentially, when you’re looking at a currency pair, the base currency is the one you’re buying or selling. For instance, in the EUR/USD pair, the euro (EUR) is the base currency, while the U.S. dollar (USD) is the quoted or price currency. So, the base currency is the one you’re aiming to exchange or trade in order to acquire the quoted currency.

Let Us Learn The Difference Between Direct and Indirect Quotes

There are direct quotes and indirect quotes:

- A direct quote is when the domestic currency is the base currency and the foreign currency is the quote currency. It represents the amount of the quote currency needed to purchase one unit of the base currency.

- On the other hand, an indirect quote is when the foreign currency is the base currency and the domestic currency is the quote currency. It represents the amount of the quote currency obtained by selling one unit of the base currency.

The choice between direct and indirect quotes depends on the convention used in a particular country or region or where you are. It’s important to understand these conventions when trading or dealing with foreign exchange rates.

For example, if you’re in the US, it’s a direct quote because the euro is a foreign currency. But if you’re in Europe, it’s an indirect quote because your home currency’s price is expressed in a foreign currency.

Or let us look at a different example. When you are shopping at your local supermarket, the prices are expressed in your home currency. You can easily calculate how much you pay for everyday items. However, when you travel abroad, it takes a moment to convert local prices in your head. Can you relate? The concept behind exchange rate quotes is similar. Now, let us consider someone from Australia.

Both the US dollar and the euro are foreign currencies for them. To avoid confusion, the professional forex market follows conventions for making and requesting quotes. But remember, there’s no consistent use of direct and indirect quoting conventions across the entire forex market.

What Are The Most Common Forex Market Conventions For Denoting Currencies?

The exhibit below shows conventions for major currencies. It displays the actual ratio of the price currency per unit of the base currency and the market terms used for each currency pair.

| Currency Pair | Convention | Trader's Slang |

|---|---|---|

| EUR/USD | Euro against US dollar | Eurodollar or Fiber |

| EUR/JPY | Euro against the Japanese yen | Yuppy or Euppy |

| EUR/GBP | Euro against the British pound | Eurosterling or Chunnel |

| EUR/CAD | Euro against the Canadian dollar | Euroloonie or Eurocad |

| EUR/CHF | Euro against the Swiss franc | Euroswissy or Chunnel |

| USD/JPY | US dollar against the Japanese yen | Dollar-yen or Gopher |

| USD/CHF | US dollar against the Swiss franc | Dollar-swissy or Swissy |

| USD/CAD | US dollar against the Canadian dollar | Loonie or Funds |

| AUD/USD | Australian dollar against US dollar | Aussie |

| GBP/USD | British pound against US dollar | Cable |

| NZD/USD | New Zealand dollar against US dollar | Kiwi |

| CAD/JPY | Canadian dollar against the Japanese yen | Loonie-yen or Cadjpy |

| GBP/JPY | British pound against the Japanese yen | Guppy or Beast |

Let’s Go Over Some Key Points About This Table

First, pay attention to the four currency pairs highlighted in bold:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

These pairs are commonly known as major pairs or simply “majors.” They are currently the most actively traded pairs in the market. Some argue that USD/CAD, AUD/USD, and NZD/USD should also be considered majors.

Second, when both currencies are mentioned in the naming convention, the base currency always comes first. For example, the code for “Euro–Yen” is “EUR/JPY.” It’s worth noting that the codes may appear in different formats, such as EURJPY, EUR–JPY, or EUR: JPY, but they all represent the same currency pair.

Third, there is a general hierarchy for quoting conventions. The base currency for quotes involving the EUR is the EUR, like EUR/USD. Then, for quotes involving the GBP (but not the EUR), the base currency is the GBP, such as GBP/USD. Lastly, for quotes involving the USD (but not the GBP or EUR), the base currency is the USD, like USD/CAD. However, there are exceptions for the AUD and NZD, as they serve as the base currency when quoted against the USD, as in AUD/USD and NZD/USD.

How Does The Two-Sided Price (Bid/Ask) Work?

We are getting closer to the main topic of our article: the spread in the forex market. In professional foreign exchange markets, there is another important concept to consider when it comes to exchange rate quotes, and that is the two-sided price.

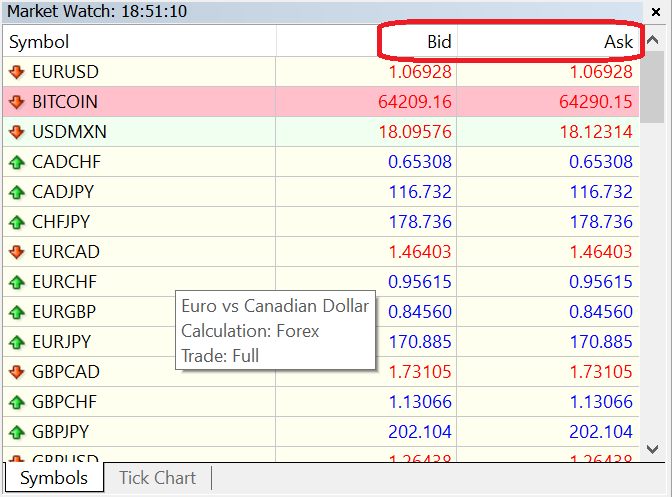

When clients request an exchange rate quote from a dealer, broker, or bank, they will receive both a “bid” price (the price at which they can buy the currency) and an “offer” or “ask” price (the price at which they can sell the currency).

A Common Mistake: The MetaTrader Example

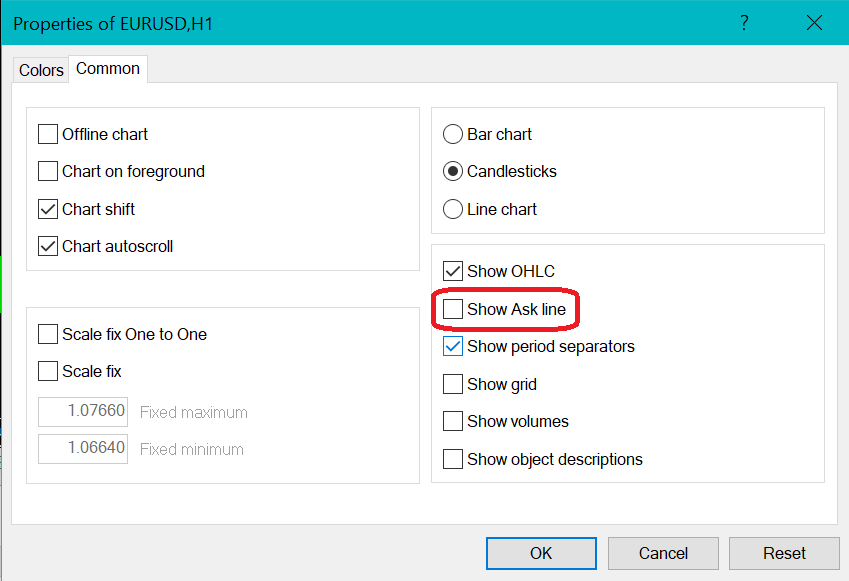

PRO TIP: While analyzing trade disputes we have learnt that the concept of the two-sided price often causes confusion among novice retail traders. This confusion becomes even more apparent when trying to close short orders on platforms like MetaTrader.

By default, MetaTrader4 only displays the bid price on their charts. Therefore, when traders go short, the platform uses the bid price displayed on the chart. However, when it comes to closing their positions, they need to use the offer price. This price is not displayed by default. To display the offer price on MetaTrader4 charts, traders can adjust the settings by ticking a specific box. Unfortunately, many traders wonder why their stop-loss orders or take-profit orders don’t get triggered, and their first instinct is often to blame their broker or dealer.

Why Understanding Bid and Ask Matters?

So, understanding the concept of the two-sided price is crucial in foreign exchange trading to ensure accurate order placement and avoid potential misunderstandings. When a financial institution provides a two-sided price quote, it shows the price we would pay to buy the base currency or the price we would receive for selling it.

In simple terms:

- The bid price is the number of units of the price currency you would receive for one unit of the base currency (when selling).

- The ask price is the number of units of the price currency you must pay to obtain one unit of the base currency (when buying).

The two-sided price quote tells us the exchange rate for buying or selling the base currency in terms of the price currency. This understanding is crucial when interpreting exchange rate quotes in the financial market.

Real-Life Example: Currency Exchange at an Airport

EXAMPLE: Let’s demonstrate these mechanics with a real-world example. So, imagine you’re a German tourist visiting Japan. Upon arrival, you head to the airport kiosk to exchange some of your euros (EUR) for Japanese yen (JPY). Then, when it’s time to return to Germany, you sell your remaining JPY and buy back EUR.

Now, if you’ve ever gone through this process before, you may have noticed something interesting. These airport kiosks typically display two prices (just like the trading platform of your favourite broker) for each currency they deal with a lower price known as the bid and a higher price known as the ask. So, when you exchanged your EUR for JPY, you transacted at the lower bid price. And when you exchanged JPY for EUR, you had to use the higher ask price.

Essentially, this airport exchange kiosk serves as a simplified version of a bank, dealer, or broker, although it lacks all the additional features.

What is Spread in the Forex Market?

We’ve established that the base currency’s price is displayed in terms of the price currency, with the bid consistently lower than the offer. In addition, financial institutions such as banks, or brokers buy the base currency at a low price and sell it at a higher price to generate profits. That’s all there is to it. It is the difference between the bid and offer/ask. However, despite this simplicity, many people struggle with the concept. We’ve worked with hundreds of beginner traders and consistently see confusion around spreads.

Why Spreads Matter for Traders?

The spread is an important concept in the forex market because it directly affects the profitability of trades. When the spread is narrow, it means that the difference between the bid and ask prices is small, resulting in lower transaction costs for traders. This is favorable as it allows traders to enter and exit positions with minimal impact on their profits.

On the other hand, a wide spread indicates a larger difference between the bid and ask prices, leading to higher transaction costs. This can reduce potential profits and make it more challenging for traders to achieve their desired outcomes. Therefore, understanding and considering the spread is crucial when analyzing trading opportunities and managing risk in the forex market.

Spread In Forex As An Indicator of Market Liquidity

Additionally, the spread can also reflect market liquidity. Highly liquid currency pairs tend to have narrower spreads, while less liquid pairs may have wider spreads. As a result, monitoring and being aware of the spread can help traders assess market conditions and make informed trading decisions.

How Technology Has Influenced Forex Spreads?

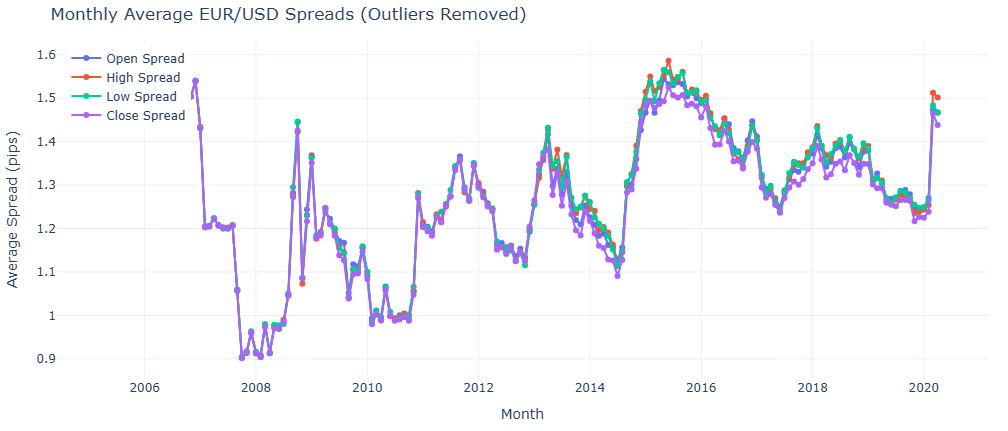

Spreads narrowed significantly during the early 2000s due to technological advancements in electronic trading, which enhanced efficiency and increased competition among market participants. However, since the 2010s, this trend has partially reversed, with spreads showing signs of widening—driven by a combination of regulatory changes, market fragmentation, and shifts in liquidity provision.

We calculated the average spread for the EUR/USD pair from 2005 to 2020 and plotted it on a graph for easy visualization. Here’s how the spread evolved over time.

Nevertheless, the most liquid currency pairs—typically those involving major economies such as the EUR/USD, USD/JPY, and GBP/USD—tend to have relatively tight spreads under normal conditions. However, even these pairs can experience temporary spread widening, especially during certain predictable or volatile periods. For example, spreads often widen around market open and market close, particularly during the 5 PM EST daily rollover and the Sunday evening open, when liquidity tends to be lower and market participants are repositioning or closing out positions.

Since the April 2024 survey period, the largest increases in volume across all instruments by currency pair occurred in USD/CAD ($26.0 billion increase) and EUR/USD ($21.8 billion increase). Year-over-year, EUR/USD saw the largest increase in transaction value for a single currency pair, with an increase of $89.3 billion across all instruments while USD/CAD average daily volumes increased by $81.8 billion across all instruments. – Survey of North American Foreign Exchange Volume.

Spreads may also widen during the release of high-impact macroeconomic data (more on that below). In addition, unexpected geopolitical or economic events—such as the Trump administration’s tariff announcements, Brexit-related developments, or the outbreak of wars or global crises—can trigger market-wide volatility, causing spreads to widen even for highly liquid currency pairs.

When Do Spreads Widen?

In forex trading, even the most liquid currency pairs like EUR/USD can experience periods of widened spreads—the difference between bid and ask prices—due to fluctuations in market liquidity. Understanding these instances is crucial for effective risk management.

During transitions between major trading sessions, such as the New York close and the Asian open, liquidity often decreases. This reduction leads to wider spreads as fewer market participants are active. Similarly, at the start of the trading week, typically late Sunday or early Monday, lower trading activity can result in thinner market conditions and expanded spreads.

The daily market rollover occurs at 5 p.m. Eastern Time, marking the end of the trading day. During this time, liquidity providers may temporarily withdraw, causing a notable widening of spreads. This period of reduced liquidity can last from a few minutes to over an hour, depending on market conditions.

Significant economic events, such as the U.S. Non-Farm Payrolls (NFP) report, Gross Domestic Product (GDP) releases, or central bank interest rate decisions, can introduce heightened market volatility. In anticipation of rapid price movements, liquidity providers often widen spreads to mitigate risk, leading to temporarily increased trading costs.

Unexpected geopolitical or financial developments—like sudden tariff announcements, military conflicts, or economic crises—can create market uncertainty. In such scenarios, traders may hesitate to place orders, reducing liquidity and causing spreads to widen significantly.

Recognizing these patterns enables traders to anticipate potential spread fluctuations, adjust their strategies accordingly, and manage risks more effectively.

Frequently Asked Questions (FAQ)

Conclusion

Understanding forex quotes and spreads is more than just learning definitions—it’s about recognizing how small pricing details can significantly impact your trading decisions. From base and quote currencies to the bid/ask spread and market liquidity, these foundational concepts help you make smarter, more informed trades. Mastering them now puts you one step ahead on your forex trading journey.

DISCLAIMER: This article is for educational purposes only and does not constitute financial advice. Trading forex involves significant risk and may not be suitable for all investors.