News trading in the forex market is a strategic approach that capitalizes on the volatility caused by significant news events and economic data releases. This method assumes that key occurrences such as changes in central bank interest rates, employment statistics, GDP figures, and geopolitical developments can drive swift and substantial shifts in currency values. Traders use this tactic by predicting the market’s reaction to upcoming news or by responding to the actual outcomes, demanding quick interpretation skills and a deep understanding of market dynamics.

What Is News Trading in the Forex Market?

News trading is a short-term strategy that focuses on trading when significant economic events and news come out, which can impact currency rates. It differs from trading based on fundamental analysis involving long-term planning or trend analysis. It’s more about making trades within several minutes after the news release.

The most exciting pieces of data for news trading in Forex market, in our opinion, are the following three:

- CPI

- USD – Non-Farm Employment Change

- Interest rates

Trading Consumer Price Index (CPI)

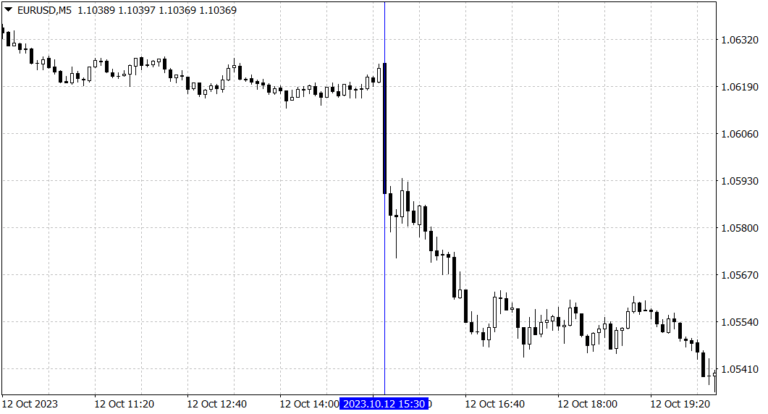

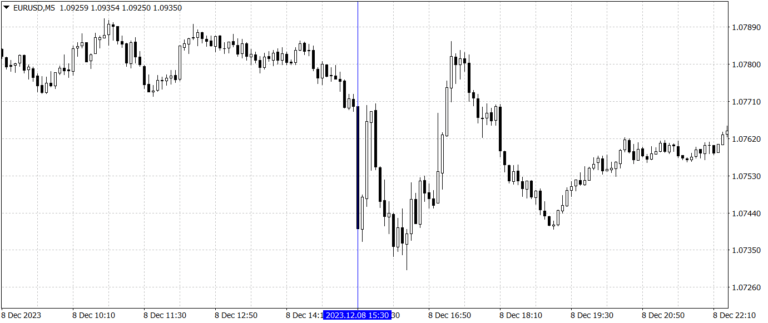

The CPI data represents the Consumer Price Index, a measure of inflation. Publishing CPI data from leading countries with significant economies (for example, CPI data from European countries and the USA) presents an excellent trading opportunity. Using the CPI publication from any European country or the USA can introduce you to volatility. Scalping trades can be made in either direction. Below is the EURUSD currency pair chart, where a vertical line indicates the moment CPI data came out.

October 12, 2023, EURUSD

The pair’s price fell after the following CPI data block release:

CPI USD – The US inflation data came out better than the forecast.

The US inflation data was better than forecast, which, “by the book,” is interpreted as strengthening the American economy, leading to a short-term drop in the EURUSD pair by more than a thousand points. Let’s translate this example into money:

Suppose you missed the data publication and opened a SELL order after the data release at 15:31, at a price of 1.0588 (refer to the picture above).

Your deposit is 1000 dollars, and fearing significant risks, you opened an order of 0.05 of a standard lot volume. Later, you closed the order at 19:00 (server time) at a price of 1.0541, your profit would be:

Profit = (OpenPrice – ClosePrice) x Lots x OrderVolume

Profit = (1.0588 – 1.0541) x 100,000 x 0.05 = $23.5 or a return of one trade at 2.35%

Of course, you could have gone for a larger volume in the example, like 0.05, but a standard lot would have yielded $470 from this order. But the more significant the order, the higher the risks. It’s possible to lose it all. However, by taking more minor risks, you can achieve good results.

In this specific example, 0.05 lots translate to 5000. In your trades, you were operating with an amount five times larger than your deposit. Generally, that’s enough to keep your nerves at ease.

Non-Farm Employment Change

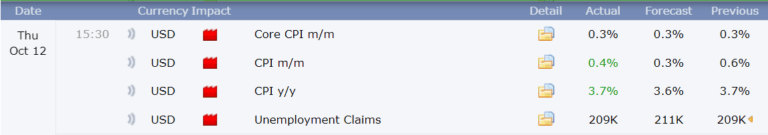

USD – Non-Farm Employment Change refers to changes in employment in the US non-farm sector. It’s the most volatile trading moment, usually released on the first Friday of every month.

EURUSDM5_03112023_ADP Non-Farm Employment Change

Here’s where things get interesting with price behavior – after data releases, there’s often a strong movement, followed by a market reversal in about five to ten minutes, leading to an even greater move in the opposite direction.

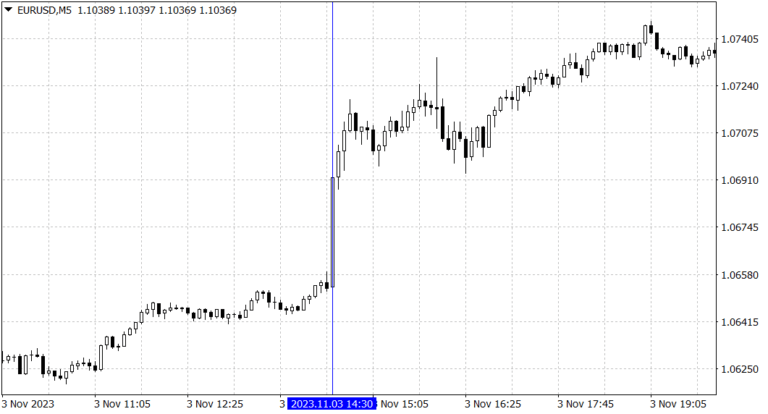

Calendar_08122023_ADP Non-Farm Employment Change

EURUSDM5_08122023_ADP Non-Farm Employment Change

This return effect to the pre-release price level of the pair happens quite frequently. That’s why news trading in forex is short-term and shouldn’t be lumped together with Fundamental Analysis, which targets long-term movements.

This effect is something to keep in mind.

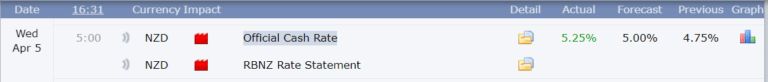

Central Bank interest rate changes

Central Bank interest rate changes. Of particular interest are the USA, European countries, Australia, and New Zealand, which are essentially what’s considered the “developed Western world.”

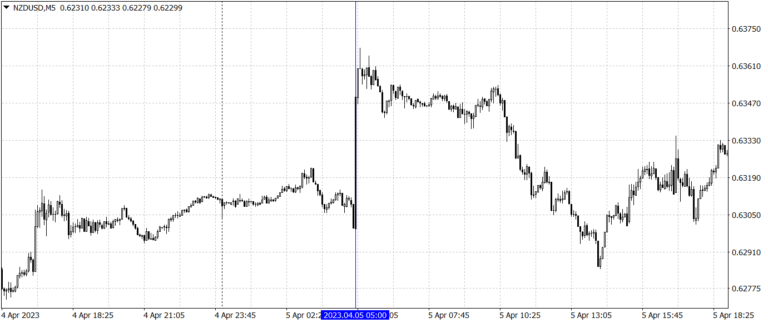

Interest rate changes impact the entire economy. They’re raised to curb inflation, but this makes loans for production and mortgages more expensive, slowing things down. Then, rates are lowered to stimulate production. Interest rate changes cause very significant price movements in currency pairs. Here’s an example from New Zealand:

April 5, 2023, the NZD interest rate changed from 5% to 5,25%

And this is how the currency market reacted – an instantaneous surge in the price of the NZD.

NZDUSDM5_Official Cash Rate_05042023

If you want to try your hand and luck in trading during the news releases, here are the upcoming data releases:

Let’s take the CPI release for the USA on January 11, 2024, as an example for EURUSD. The data from the States has often been negative lately, so there’s a good chance the following scenario may unfold. After a worse-than-expected data release, we might see a quick rise in the price of EUR/USD. However, EURUSD prices might drop again soon after, considering Europe’s troubling indicators, like the farmers’ strike in Germany. This allows you to capitalize on the rise after the data release and the subsequent fall. To the critics, this is just a hypothesis, one of many scenarios; everything depends on the actual values published and how they differ from the forecasts. Or, the scenario might completely flip if the data from the States turns out better than expected.

You can follow how the situation unfolds here:

Remember, news trading in forex can be challenging. For instance, we wouldn’t recommend placing pending orders, as they tend to execute with significant slippage. The execution price can differ significantly from the stated price, often for the worse. This is standard practice, not a broker’s deceit, so filing complaints is pointless.

Remember, the impact of data releases is short-lived, which presents certain difficulties for traders. The exchange rates of currency pairs change before, during, and after the release, and only sometimes, as the textbooks suggest. For example, an interest rate hike, theoretically good for the currency experiencing the increase, should immediately boost its price and continue to rise. However, a storm often happens after the release. The currency spikes and then plummets, sometimes falling below its pre-release position, knocking out any stop losses. But, it’s also true that this substantial volatility can offer a chance for quick, easy earnings. And maybe a few gray hairs, too.

Other data types cause currency pairs to jump, like the FOMC (Federal Open Market Committee Meeting Minutes) or speeches by some FOMC members. The FOMC meetings are pivotal events that determine the monetary policy of the United States, including interest rate changes, quantitative easing policies, and economic outlooks. These decisions can significantly impact the value of the U.S. dollar (USD) and, consequently, currency pairs involving the USD. But determining exactly what will happen at the FOMC requires time. With the three data types mentioned earlier, market volatility usually increases manifold. For news trading in forex amidst these kinds of volatile news releases, the strategy involves rapid responses and quick button presses to keep up with sudden currency movements.

In our previous article we reviewed scalping, pipsing and HFT. Next we’ll look at trading support and resistance levels in Forex and learn about horizontal support and sloping support resistance levels.

Join in. It’s fascinating and thrilling.

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Take your Forex Trading and Crypto Exchange business to the next level. Reach out to Finansified for expert assistance in registration and licensing of Forex Brokerage Firm or Crypto Exchanges in all jurisdictions worldwide. Stay updated with our blog for cutting-edge Foreign Exchange Market strategies and industry news. Subscribe

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.