Exchange rate forecasting is a challenging task. Numerous factors influence the value of a currency, making accurate prediction a complex problem. The retail community’s discussion on how to forecast a currency’s exchange rate often revolves around questionable and/or unproven methods conducted by people who may not be familiar with the scientific method. Today, we will attempt to remedy this situation by reviewing a piece of solid research. The paper “Forecasting Exchange Rates of Major Currencies with Long-Maturity Interest Rates” by Zsolt Darvas and Zoltan Schepp delves into this intricate subject, offering intriguing insights. This article aims to unpack the paper’s findings and their implications for investors, economists, and anyone interested in the world of foreign exchange.

The Role of Long-Maturity Interest Rates

Historically, many studies have attempted to outperform the random walk process, which assumes that future exchange rates are unpredictable based on past data. Despite these efforts, most models based on economic fundamentals have either failed or their initial successes have been later disproven.

However, more recent research has shown promising results. Some theory-based models, like those using macroeconomic fundamentals or long-term interest rates, have been successful in short-term and long-term forecasting.

For instance, the monetary model has helped predict exchange rates over one to five years. Other studies focus on empirical methods, using a mix of data-driven approaches without necessarily relying on a solid theoretical foundation.

This research introduces a new model that combines elements from previous theoretical models with a new error-correction framework. The authors argue that long-term forward exchange rates can provide a more accurate estimate of future currency values. Additionally, it remains robust across different periods, currencies, and forecast horizons, showing significant improvement over prior models.

The research suggests that long-term exchange rate forecasting is possible using a well-designed model, though challenges remain, particularly in the predictability of emerging market currencies. This research contributes to ongoing debates on the best ways to predict exchange rates and highlights areas for further investigation.

As mentioned, exchange rate forecasting models traditionally focus on short-term interest rates. However, this research suggests that long-maturity interest rates hold significant predictive power for major currency pairs. This is particularly true when we are talking about interest rates of longer maturities, for instance, ten years or longer.

This approach stems from the uncovered interest rate parity (UIP) condition. It postulates that the expected change in the exchange rate should equal the interest rate differential between two countries. The UIP often fails to hold in the short run. Darvas argues that it is more likely to be valid over longer horizons. This makes long-maturity interest rates a relevant factor in exchange rate forecasting.

How Does The Model Predict the Exchange Rates?

Zsolt Darvas and Zoltan Schepp’s forecasting model combines error correction principles and long-maturity forward exchange rates. The model is based on the idea that exchange rates adjust toward a fundamental equilibrium value over time. However, instead of estimating this equilibrium directly, they use long-maturity forward rates as a proxy to forecast exchange rates.

The model starts with an error correction approach, where the change in an exchange rate depends on the difference between the current exchange rate and the estimated equilibrium rate. Essentially, if the current rate is far from the equilibrium, the exchange rate will move in a way that reduces this gap.

The authors use long-maturity forward rates, since directly estimating the equilibrium rate can be tricky. These are market-based forecasts of where the exchange rate is expected to go in the long run. The model assumes that the difference between the equilibrium and actual exchange rates is closely related to the long-term forward rate.

To avoid statistical issues when forecasting exchange rates over long horizons, the model uses an iterative approach. It makes one-period-ahead forecasts (for example, predicting next month’s exchange rate) and then uses this to generate longer-term forecasts. By repeatedly applying this process, the model can predict future exchange rates over multiple periods, such as months or years.

In short, their model combines the predictive power of long-term forward rates with error correction techniques, allowing for more accurate results when forecasting exchange rates over both short- and long-term periods.

Empirical Evidence

The paper employs a comprehensive dataset of monthly observations of exchange and interest rates for major currencies. The currencies considered are the USD, EUR, JPY, GBP, CHF, CAD, and AUD. Furthermore, the data covers the period from 1999 to 2019, offering a substantial sample for analysis.

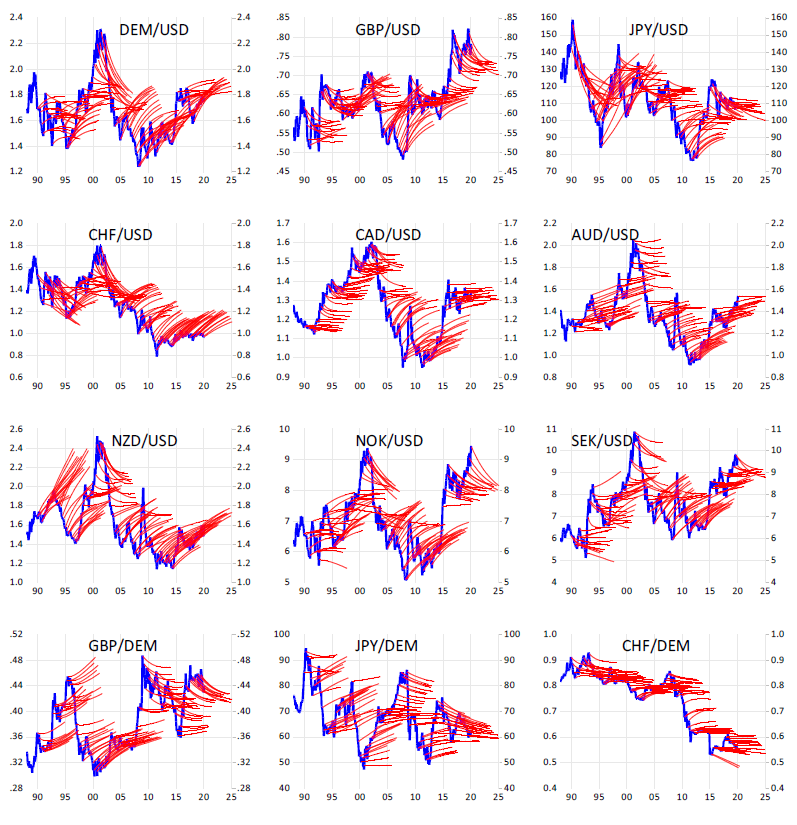

Note: The panels show actual exchange rate movements (blue line in 1988-2020) and out-of-sample forecasts for five years ahead (light red lines), starting at each date from the actual exchange rate. The latest forecast was made in February 2020 for the period from March 2020 to February 2025. For better readability, forecasts for March, June, September, and December of each year are shown, plus the forecast for February 2020. Although data was used in logarithmic form for estimation and forecasting, panels of this figure show data in their natural units (the price of one US dollar in terms of the other currencies in the first nine panels and the price of one German mark in terms of the other currencies on the last three panels).

Subsequently, the authors employ a vector autoregression (VAR) model1 to assess the predictive power of long-term interest rates. This model allows for an examination of the dynamic relationship between exchange and interest rates. Ultimately, the results reveal that long-maturity interest rate differentials are statistically significant2 predictors of exchange rate changes for most major currency pairs. Furthermore, the paper compares the forecasting performance of models using long-term interest rates with those using short-term interest rates.

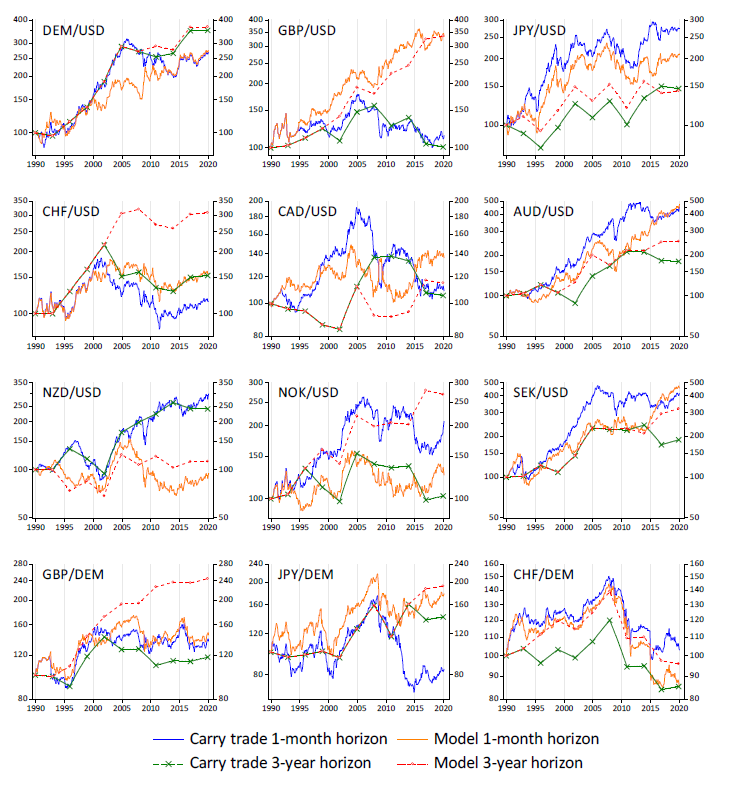

Note: The values show the cumulative excess return to investment strategies based on the model (equation 18, as per original paper) and the carry trade (equation 17, as per original paper) for an initial 100 investment in December 1989, for monthly reinvestments based on monthly forecasts and three-year reinvestments based non-overlapping 3-year forecasts. For the model, the trading strategy based on combined forecasts is used, whereby three forecasts are combined with equal weights from the three models using alternative maturity theoretical forward rates, 3-year, 5-year, or 10-year (except for New Zealand and Sweden, for which the 2-year maturity rate is used instead of the 3-year maturity rate).

The findings indicate that long-term interest rates outperform short-term rates in forecasting exchange rates, particularly over longer horizons. This suggests that long-term interest rates capture crucial information about the long-term economic outlook, influencing exchange rate movements.

Implications for Investors and Policymakers

The insights from this research have several implications for both investors and policymakers. Specifically, for investors, the paper underscores the importance of incorporating long-maturity interest rate differentials into their exchange rate forecasting models. By doing so, they can enhance the accuracy of their predictions and improve their investment decisions.

Similarly, for policymakers, the findings highlight the crucial role of long-term economic factors in driving exchange rate movements. Consequently, this emphasizes the need for sustainable economic growth and stability policies. Why? Because these factors ultimately influence the long-term value of a currency.

At this point, you are probably wondering how you can use this in your day trading. Well, you can’t, at least not directly. Day traders can use the study to gauge overall market sentiment towards a particular currency and forecast exchange rates. If long-maturity forward rates suggest strengthening a currency, it could indicate positive sentiment, which might influence short-term trading decisions. Although not directly addressed in the study, central bank policies can influence long-maturity forward rates. Day traders who monitor these rates and understand their relationship to policy decisions can gain an edge in forecasting exchange rates and anticipating potential market reactions. By understanding the long-term trends suggested by forward rates, day traders can better contextualize short-term market fluctuations and avoid being swayed by temporary noise.

Limitations and Future Research

While the paper provides valuable insights, it is important to acknowledge its limitations. First, the analysis focuses on major currencies. Future research could extend the study to emerging market currencies to assess whether the findings hold for a broader range of currencies. Second, the paper primarily employs a VAR model. Exploring alternative forecasting models, such as machine learning techniques, could offer additional insights. Third, the study examines the period from 1999 to 2019. Future research could analyze the impact of recent events. For instance, it would be interesting to know the effect of the COVID-19 pandemic and the Russia-Ukraine war on the ability of long-maturity interest rates to forecast a currency’s exchange rate.

Conclusion

The paper we analyzed introduces a novel exchange rate forecasting model. The model highlights how long-maturity forward exchange rates can help estimate the gap between the fundamental equilibrium exchange rate and the actual exchange rate.

Using nine USD exchange rate pairs (including EUR, GBP, JPY, CHF, etc), the model significantly outperforms the traditional random walk approach for short-term and long-term forecasts. Notably, forecast accuracy improves over time, with the model’s predictions beating the random walk by 0.8% on a 1-month horizon, 11.2% on a 1-year, and 43.0% on a 5-year for the euro/US dollar exchange rate.

Moreover, the model successfully predicts the direction of exchange rate changes and generates strong returns in trading simulations. The results are statistically significant and hold across different periods, currency pairs, and forecasting methods.

Additional Insights and Considerations

Beyond the key findings outlined above, the research reveals several additional insights and considerations regarding our ability to forecast a currency exchange rate. The paper emphasizes the role of expectations in driving exchange rate movements. Long-term interest rates can be seen as a reflection of market expectations about future economic conditions.

By incorporating these expectations into their models, investors and policymakers can better understand the factors influencing exchange rate dynamics.

Moreover, the paper acknowledges that the relationship between long-maturity interest rates and exchange rates is not static. It can vary depending on the specific economic context and the interplay of various factors. Therefore, it is essential to consider the broader economic environment when interpreting the predictive power of long-term interest rates in exchange rate forecasting.

Finally, the findings suggest that markets may not fully incorporate the information contained in long-term interest rates when pricing exchange rates. This creates potential opportunities for investors who can identify and exploit these inefficiencies, improving their ability to forecast exchange rates more accurately.

The Road Ahead

The field of exchange rate forecasting continues to evolve. As new data and analytical techniques emerge, our understanding of the factors influencing exchange rate movements will deepen. Darvas and Schepp’s research represents a significant contribution to this ongoing journey.

Building on these insights and refining our understanding of the complex dynamics that shape the foreign exchange market is essential as we move forward. Doing so allows us to navigate the challenges and opportunities more confidently and clearly.

So next time you’re curious about where exchange rates are going, remember those long-term forward rates may hold the key!

- A Vector Autoregression (VAR) model is a statistical tool used to capture the relationship between multiple variables that influence each other over time. If we had several things, like exchange rates and interest rates, and we wanted to see how changes in one of these variables might affect the others. The VAR model looks at the past values (or "lags") of all these variables to predict how they will change in the future. It helps us understand how different factors move together and how one can influence the others in a dynamic system. ↩︎

- "Statistical significance" means that the result you're seeing is likely not just due to random chance. Simply put, it suggests an actual cause-and-effect relationship between our study variables. For example, suppose we find that changes in interest rates are statistically significant predictors of changes in exchange rates. In that case, there's strong evidence that interest rates impact exchange rates and this relationship is unlikely to have happened by accident. ↩︎