Hey everyone! Finansified is back with more proven Forex tips and insights. Today, we’re diving into the world of MetaTrader 4 and showing you how to use “pending orders” to your advantage, especially during those crazy rollover times when the market gets a bit wild. We’ll break down some smart strategies to help you automate your trades and potentially make some sweet profits. So, simply grab a cup of coffee, and let’s learn about using pending orders in Forex to boost your trading game.

Advanced Forex Strategies Using Pending Orders

Let’s continue exploring trading during the night and morning (GMT+1). These times can offer unique profit opportunities that few traders know about. The strategies we are about to review are MetaTrader-centric and use pending orders, so let’s do a quick refresher on what these beasts are, their main types, and how they work.

MetaTrader 4 (MT4) is a popular trading platform for forex and other financial market traders. It offers various pending orders that allow traders to automate their trades. Here are the main types of pending orders available in MetaTrader 4:

- Buy Limit orders allow you to buy at a price lower than the current market price. Traders use them when they believe the market will go down to a certain level and then bounce back up.

- Sell Limit orders allow traders to sell at a price higher than the current market price. They use these orders when they believe the price will rise to a certain level and then fall.

- Buy Stop is an order to buy at a price higher than the current market price. Traders use these orders when they believe the price will continue to rise after reaching a certain level.

- Sell Stop orders allow you to sell at a price lower than the current market price. They are used when you believe the price will continue to fall after reaching a certain level.

These pending orders help traders execute trades based on their market analysis and trading strategies without constantly monitoring the market.

Going Against The General Market Direction

The strategy we are about to review is a variety of “Channel Trading strategies” that leverage pending orders in Forex. First, we identify established price channels on the chart. These channels help you recognize predictable* patterns where prices tend to bounce between support and resistance lines. We place buy limit orders, a type of pending order, at the channel’s support line, anticipating potential rebounds as the price hits this lower boundary.

Conversely, we place limit orders, another form of a pending order, at the channel’s resistance line. Here, we expect the price to pull back when the price reaches this upper boundary. This strategy leverages the natural oscillation within the channel to optimize entry and exit points for profitable trades while utilizing the power of pending orders in Forex.

* It should be understood that we use the term “predictability” very loosely in this context. The predictability of currency pair price movements is quite limited.

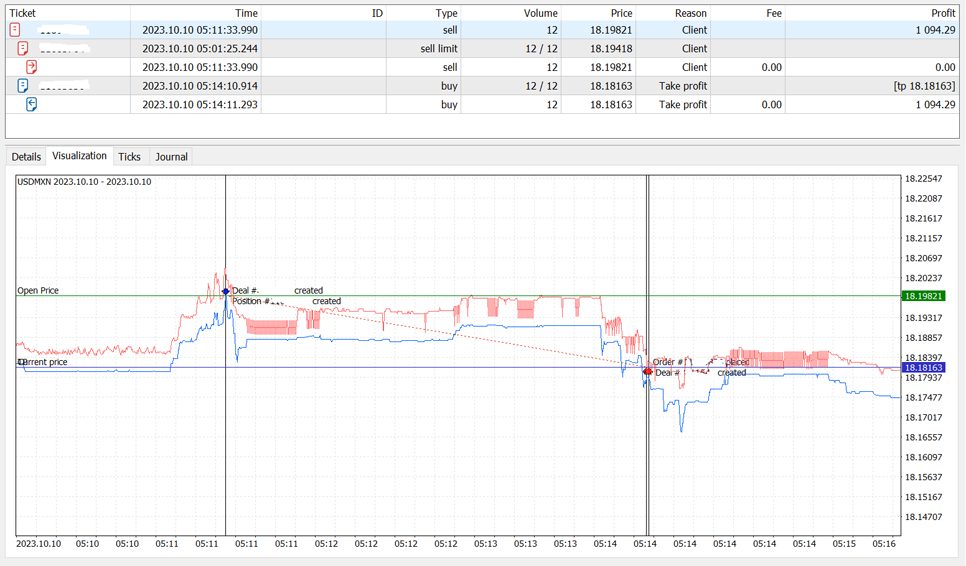

In the morning for Europeans and at night for Mexicans, the Mexican Peso (USDMXN) spread widens, and volatility decreases. During this time, the pair can trade within a narrow range. We can place a sell order at the upper boundary of the range and a buy order at the lower boundary. We use pending orders that we place within the spread. You can see an illustration of this situation in the diagram below.

USDMXN 2023.10.10

Let’s figure out what we see in the screenshot above. As we can see, at a certain point, the Mexican Peso rose. The trading robot placed a Sell Limit order within the spread. Remember, a Sell Limit is an order to sell at a price better than the current one. We need to remember that the Bid price triggers this order. In the screenshot, this is represented by the blue line, and it needs to reach the order price level to trigger it.

As you can see, the order eventually opened, and the price decreased. As we mentioned earlier, the price of the Mexican Peso often fluctuates within a narrow range during low volatility. We place the Take Profit level (closing the order with profit) fairly close, for example, at the spread distance, which, as mentioned in the previous article, can expand significantly during the rollover period.

The Second Strategy Is Based On The Rollover Period

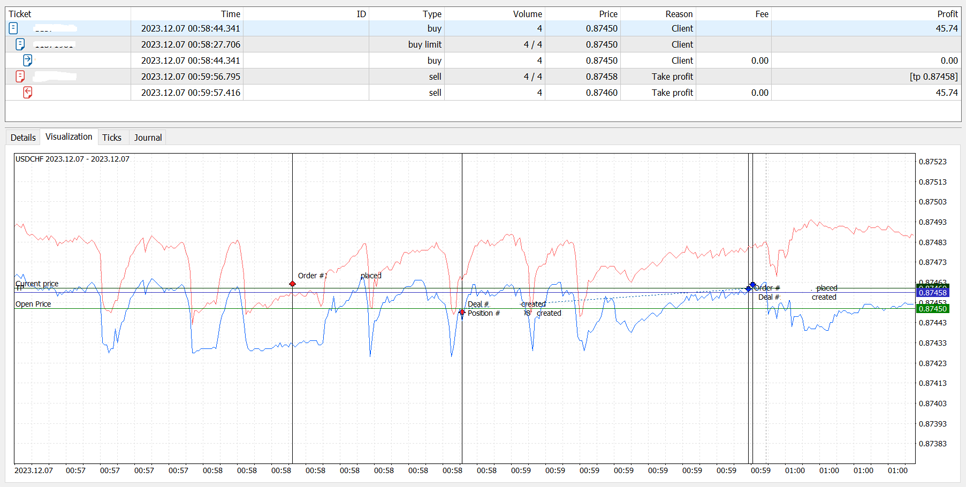

We will also need to use the tick chart to implement this strategy because potential trading opportunities, which can be exploited using pending orders in Forex, are only visible on the tick charts. During the rollover procedure, brokers may switch between price streams from multiple liquidity providers (LPs). These switches occur because of scripts that “turn off” streams with excessively wide spreads and “turn on” streams with more acceptable spreads for different instruments. Since the spread can expand and contract multiple times, these switches can also happen many times. Graphically, this appears as the formation of a “mountain ridge” on the chart, as you can see in the image below:

USDCHF 2023.12.07

On the right side of the screenshot above, you’ll find a timestamp of 01:00. After this moment, the price stream switching stopped, and you can see how wide the spread became—the distance between the blue and red lines. Such significant spread expansions are detrimental to traders because they trigger stop-loss orders. Then, the broker switches to price streams with narrower spreads, providing potential opportunities for traders to utilize pending orders in Forex.

This is precisely why many retail traders, without understanding these nuances, conclude that brokers are “hunting” their stop-loss orders. We’ve seen these discussions on various platforms and even tried to participate in them many times. However, usually, no one wanted to listen. It’s easier for many to believe that the broker is to blame for everything rather than trying to understand the situation. Thus, the cycle of ignorance became self-sustaining. But that’s a story for another time.

For this particular broker, the scripts for switching between streams from different liquidity providers stopped working at 1:00 AM server time.

The trading algorithm in this situation will be the same as in the previous example. We will trade using pending orders placed within the spread. However, in this case, the currency pair can be any, not just the Mexican Peso. The choice of pair can be left to the trading robot.

As you can see, the trades closed with a profit in both scenarios we discussed.

It’s also worth noting that the described strategies comply with all trading rules, and the broker does not have the right to annul the profit earned on such trades. If they attempt to do so, this decision can be challenged with the regulatory authority overseeing your broker.

We strongly encourage you to learn about rollover strategies in our previous article.

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Finansified is your go-to resource for Foreign Exchange Market industry education, we provide in-depth insights, easy to understand educational content, and proven strategies to help you thrive in the FX markets. Subscribe to our newsletter for exclusive access to expert advice and market updates.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.