The textbook definition of fiscal policy is the government’s use of spending and taxation to influence the economy. Essentially, fiscal policy involves strategically using government revenue, mainly taxes and expenditures (or spending), to accomplish several key objectives. The primary goals of fiscal policy are to promote economic growth, maintain price stability (low inflation), and create more jobs. How does this connect to exchange rates? The link is that when the government takes action to achieve its fiscal policy goals, it indirectly influences the value of its currency. Governments have a variety of tools at their disposal to implement fiscal policy, and that’s what we’ll explore further. In today’s article, we will examine the types and effects of fiscal policy on an economy and, by extension, on exchange rates.

What is Fiscal Policy?

We have already hinted at this in the intro, but now we will expand on it for further clarity. The government can influence the economy through either taxation or spending. These are the primary fiscal policy tools.

The word “fiscal” traces its roots back to the Latin word “fiscus,” which originally meant “basket” or “money basket.” The “fiscus” was the emperor’s private treasury in ancient Rome, where taxes and other revenues were collected and stored. Over time, the term evolved to encompass all matters related to public finances and taxation.

Taxation

Taxes generally account for the bulk of the U.S. Treasury’s cash inflows. Other revenue sources, such as fees, fines, and asset sales, typically account for a smaller portion of the total inflows.

Spending

Not all spending is the same. There are several types of spending, and each works differently.

Capital Expenditure

Capital expenditure refers to the government spending money to build, upgrade, and maintain physical assets (infrastructure). These assets are typically long-term and expected to generate future economic benefits.

Examples of capital expenditure:

-

Building roads, bridges, or other infrastructure

-

Constructing schools or hospitals

-

Investing in public transportation systems

-

Developing renewable energy projects

When a government invests in these types of projects, it immediately impacts the economy by creating jobs. Workers receive wages, which they then spend, stimulating economic demand. In the long run, these projects can also positively affect the overall economy. How? Improved infrastructure facilitates better economic functioning. For example, better railroads and highways enhance the transportation of goods and services and improve workforce mobility within the country.

A prime example of capital expenditure are the infrastructure projects during the Great Depression in the US undertaken as part of President Franklin D. Roosevelt’s New Deal programs.

It is important to note that the effectiveness of capital expenditure can vary depending on the specific projects and how they are managed (e.g., ghost cities in China, overbuilt infrastructure).

The government uses these tools in tandem or separately in certain situations, and they are often combined with monetary policy (which is conducted by the central bank).

Government expenditure

Government consumption expenditure, also known as government final consumption expenditure, refers to the spending by a government on goods and services that directly satisfy the individual or collective needs of the community.

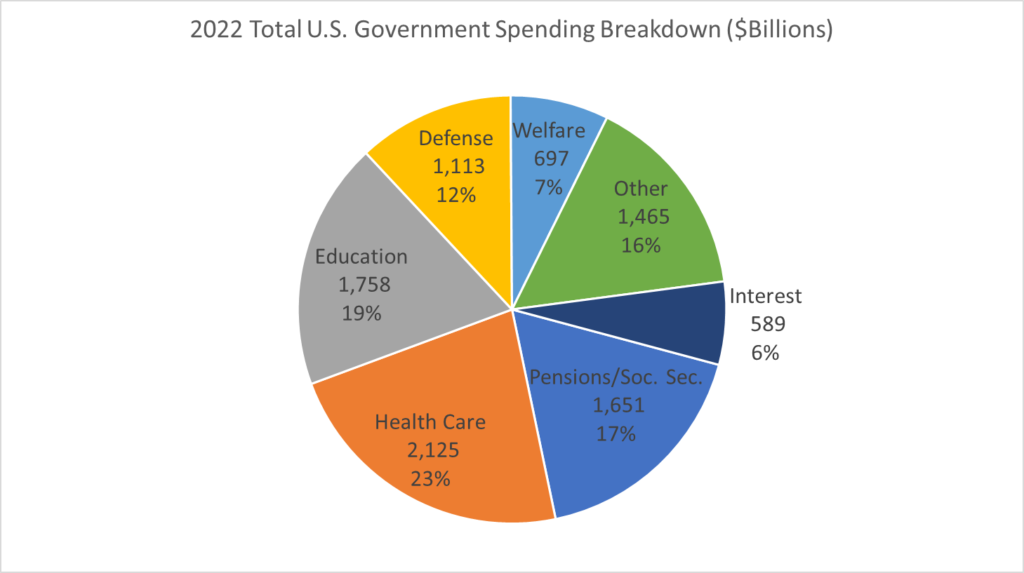

These goods and services are “consumed” in the sense that they are used to provide public services and do not result in the creation of fixed assets. Defense, health, and education are examples of Government Consumption Expenditures.

Transfer Payments

Transfer payments are payments made by the government to individuals or households for which the government receives no goods or services in return (e.g., welfare programs). They are essentially a redistribution of income and wealth within the economy to achieve various social and economic objectives.

What types of fiscal policy are there?

There are two primary types of fiscal policy: expansionary and contractionary. Governments often use an expansionary fiscal policy when the economy is slowing down or in a downturn. This policy aims to kickstart the economy and increase demand for goods and services. How do they do this? The government can cut taxes, which means people have more money to spend. Alternatively, the government can spend more, directly putting money into the economy.

Growing the Economy

Expansionary policy is a type of fiscal policy designed to stimulate economic growth. For example, if the government cuts taxes, families can buy more things, which increases demand. This also helps businesses hire more people, which helps lower unemployment. Alternatively, if the government spends more money on things like building infrastructure or providing public services, this can also create jobs and get the economy going.

Cooling Down an Economy

On the other hand, when the economy is growing too fast and getting too hot, governments typically use another type of fiscal policy, a contractionary fiscal policy. This strategy aims to slow down the economy by raising taxes or cutting government spending.

If the government increases taxes, families and businesses have less money to spend, which reduces demand for goods and services. Alternatively, the government can spend less money, often on things like infrastructure, education, or defense. Spending less means fewer government contracts and public-sector jobs, which can help slow economic growth and prevent the economy from overheating.

What Are the Effects Of Fiscal Policy?

As we have learned, different types of fiscal policy are used to achieve growth or slow down the economy. Fiscal policy might seem like a magic fix for economic problems, but it is challenging to implement and can take time. The gap between the policy’s implementation and the time we see economic changes can be considerable.

Fiscal policy implementation lag refers to the delay between the recognition of an economic problem, such as a recession or inflation, and the time when fiscal policy (changes in government spending or taxation) actually begins to have an effect on the economy. This lag can be significant and is usually divided into three phases: Recognition Lag, Decision-Making Lag, Implementation Lag. These lags make fiscal policy less responsive and flexible compared to monetary policy, where central banks can often adjust interest rates or conduct open market operations with relatively little delay.

Fiscal policy decisions can also have other effects. For example, if the government spends more without getting more money in return, it could lead to bigger budget shortfalls and more public debt. On the other hand, higher taxes make people less willing to start businesses, develop new ideas, and make long-term investments.

While government spending and taxation are powerful tools on their own, their true effectiveness lies in their strategic combination. By adjusting spending and taxation rates in different sectors and at various times, governments can precisely target and influence specific areas of the economy as needed.

For example, a government might choose to increase infrastructure spending while simultaneously reducing taxes in the manufacturing sector. This combination could spur growth in manufacturing, leading to job creation and overall economic expansion. The careful blending and implementation of these spending and taxation tools form the foundation of a government’s fiscal policy.

In conclusion, government spending and taxation are essential instruments in a government’s fiscal policy toolkit. Understanding how these tools work can enhance our understanding of fiscal policy, providing greater insight into our governments’ economic decisions.

Fiscal Policy and Foreign Exchange Market

Whenever a government implements different types of fiscal policy, expansionary, contractionary fiscal policies, or a combination of both, these decisions have far-reaching and profound consequences for the entire economy in general, particularly for the value of the country’s currency. How so?

Phase One

Imagine a country deciding to boost its economy through expansionary fiscal policy. They slash taxes and launch ambitious infrastructure projects. Suddenly, there’s a surge of economic activity. Businesses are booming, and people have more money to spend. This newfound prosperity catches the eye of foreign investors, who see a chance to earn higher returns.

Phase Two

A growing and dynamic economy is attractive to foreign investors seeking higher returns. This can lead to increased foreign investment in the country, including hot money inflows seeking short-term gains from rising asset prices or interest rate differentials.

These investors need the country’s currency to invest in this thriving economy. They start buying it up, increasing demand and causing the currency to appreciate. It’s like a popularity contest, and this country’s currency is suddenly the belle of the ball.

Effects of Fiscal Policy On Foreign Exchange

However, this isn’t a fairy tale with a guaranteed happy ending. In the long run, the currency’s value depends on many factors. The currency could lose its luster if the government’s spending spree leads to rampant inflation. The central bank’s actions also play a crucial role. They might raise interest rates to combat inflation, which could attract even more foreign investment and further strengthen the currency.

Ultimately, the currency’s fate is intertwined with the economy’s health. A strong, growing economy will continue to attract investors and support a strong currency. However, the currency could crash if the boom turns into a bubble.

IMPORTANT! We must point out that fiscal policy shouldn’t be considered in isolation. It usually goes hand in hand with monetary policy involving the central bank’s actions. Monetary policy typically has a more immediate impact on currency values. In contrast, fiscal policy can have both short-term and long-term effects depending on the specifics of the policy and economic context.

This interdependence makes isolating fiscal policy’s impact on exchange rates difficult, as it is often intertwined with monetary policy actions.

Real World Examples

If we had to come up with examples, we could consider the fiscal stimulus packages in the United States and Australia following the global financial crisis in 2008. The reason we chose the US is because it is one of the biggest economies in the world and the data is widely available and Australia because, why not 🙂 we were simply curious.

Fiscal Stimulus in the US

The U.S. government enacted a significant fiscal stimulus package in response to the Great Recession.

Source: TradingView. Blue vertical line divides DXY and USD/EUR performance into before the Economic Stimulus Act of 2008 and after.

Source: TradingView. Blue vertical line divides DXY and USD/EUR performance into before the Economic Stimulus Act of 2008 and after.

Initially, the U.S. dollar depreciated due to concerns about increased government debt and fiscal deficits. However, the dollar appreciated as the economy began to recover and investor confidence returned. The stimulus package played a crucial role in boosting economic growth, which improved the country’s fiscal outlook and made the dollar more attractive to investors.

Fiscal Stimulus in Australia

During the global financial crisis, Australia implemented a fiscal stimulus package that included tax cuts and increased infrastructure spending.

Source: TradingView. Blue vertical line divides AXY and AUD/JPY performance into before the economic stimulus package was announced and after.

This policy helped Australia avoid a recession, and as a result, the Australian dollar appreciated. The currency’s strength was supported by investors seeking a haven and attracted by the country’s relatively higher interest rates.

Conclusions

For anyone looking to enhance their fundamental analysis game, it’s crucial to pay close attention to the types of fiscal policies implemented by governments of interest, as these decisions can dramatically impact both the overall economy and currency values. This requires consistent monitoring, as more than occasional news checks are needed. If you are serious about building a trading/investment plan based on fundamental analysis, you should constantly monitor the actions of governments whose currencies you intend to trade. It is essential to understand the different types of fiscal policies (expansionary/contractionary) and their interaction with monetary policy.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.