Before diving into the intricacies of technical analysis, it’s essential to acknowledge that the topic is quite controversial. Does technical analysis work? It depends on whom you ask. If you ask someone in the retail trading community, the consensus is yes. However, given the poor track record among retail traders, perhaps this belief isn’t entirely accurate. There are two primary schools of thought: those who strongly believe in its predictive power and those who dismiss it as a waste of time. So, how should we approach it? Should we embrace it or dismiss it altogether? Not necessarily. To approach this topic with an open mind, it’s crucial to position technical analysis properly and understand its underlying assumptions. That’s what we will do in this article.

The Premise of Technical Analysis

At its core, technical analysis assumes that past market behavior can help predict future price movements. This belief stems from the idea that market trends and cycles are repeatable and observable. But does technical analysis work consistently?

The concept is simple: if certain conditions in the market, such as specific candlestick patterns, precede price movements in the past, they are likely to do so again in the future. For example, if we observe the particular shape of a candlestick pattern believed to precede an up-move, we can position ourselves accordingly for a trade.

However, while we can observe these patterns, the actual process driving these changes often remains hidden. In this sense, technical analysis operates like a black box—something is happening, even though we can’t directly see it.

Can We Observe Trends and Cycles but not Predict Them?

The first assumption we can make is that trends and cycles exist. We can observe price trends over time, and we know business cycles occur—there are periods of expansion, slowdowns, and contractions. This is not up for debate; history shows us these patterns.

However, while the existence of trends and cycles is clear, predicting when they will shift is far less certain. Just as we cannot know exactly when a business cycle will transition from expansion to contraction, we cannot always predict when a market trend will reverse. This is where the controversy of technical analysis begins to take shape: its predictive power.

The Controversy of Prediction

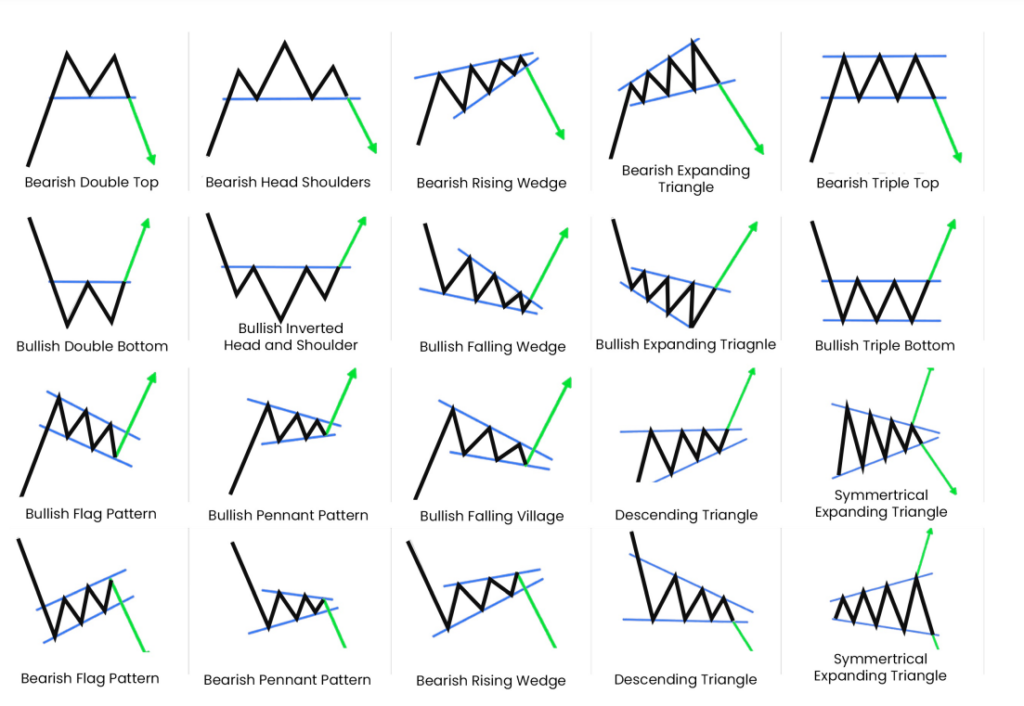

The second part of technical analysis, and by far the most controversial, lies in its claim to predict market turning points. Proponents believe that there is some objective knowledge that allows us to foresee when trends will change. Does technical analysis work to predict these shifts? They have developed numerous methods to make these predictions. From chart patterns to indicators, technical analysts use various tools to predict when prices will move up, down, or sideways.

DISCLAIMER: The image above is provided for demonstration purposes only. It does not constitute an investment advice.

Yet, the field is filled with uncertainty. Despite the many books, courses, and videos that claim to teach the secrets of technical analysis, the results are often inconsistent. No universally accepted method consistently predicts market behavior with absolute accuracy. The more methods that emerge, the less clarity we seem to gain.

If there were truly a way to predict market movements with certainty, one or a few methods would have risen to prominence by now. In any scientific field, when a method proves effective, it is replicated and becomes widely accepted. However, in technical analysis, replication remains elusive. Traders using different methods often arrive at different conclusions, leading to a sense that something fundamental is missing.

The Replication Problem

Replication is the foundation of scientific inquiry. If a method works, it should be consistently repeatable by different people in different situations. In technical analysis, however, this is rarely the case. Many technical indicators and chart patterns lead to different outcomes for different traders. This inconsistency suggests the methods used in technical analysis may not uncover an objective truth.

Consider the analogy of a cheesecake recipe. If you follow the recipe correctly, you should get a cheesecake. Yet, in technical analysis, many traders following the same “recipe” end up with different results—some might get a muffin, while others might burn their trades entirely. The discrepancy clearly indicates that no surefire method guarantees success in technical analysis.

The Role of Probability in Technical Analysis

One important distinction is that technical analysis is probabilistic, not deterministic. While patterns and trends exist, they do not offer certainties, only probabilities. For example, a specific chart pattern may increase the likelihood of a price moving in one direction, but it does not guarantee it. Many traders struggle with this reliance on probabilities—they expect technical analysis to provide exact predictions when, in reality, it can only suggest likely outcomes.

Understanding that technical analysis is probabilistic is crucial for managing expectations. Traders often get caught up in the idea that they’ve found a “secret” or “holy grail” of trading, only to be disappointed when their predictions don’t pan out. This leads to frustration and disillusionment with the practice as a whole. So, in summary, does technical analysis work as a foolproof method? The evidence suggests it does not.

The Faith-Based Nature of Technical Analysis

Once we recognize the probabilistic nature of technical analysis, it becomes clear that much of the debate about whether technical analysis works is faith-based. Traders believe in specific patterns, indicators, and methods because they have worked for them, read about them in books, or seen them taught in courses. This belief drives their behavior in the market, sometimes creating self-fulfilling prophecies that contribute to the perception that technical analysis works.

For example, if enough traders believe that a specific support or resistance level will hold, their collective actions (buying or selling) can cause the price to react at that level, even if there is no underlying fundamental reason. This is known as herding behavior—a phenomenon studied in behavioral finance. In essence, traders act based on what they think other traders will do, creating market movements and reinforcing the belief that it works.

The belief-driven nature of technical analysis means that, even though the methods themselves may not be objectively valid, they still have an impact because so many people believe in them. This makes it difficult to answer definitively whether technical analysis works—it often does, but largely because traders make decisions based on the collective psychology surrounding it.

The Limits of Technical Analysis

Given the ongoing debate about whether it works, why do so many traders continue to rely on technical analysis? Part of the answer lies in its appeal to human psychology. The idea that we can uncover hidden patterns in the market and use them to our advantage is enticing. It offers a sense of control in an otherwise unpredictable environment.

However, relying solely on technical analysis without considering fundamental and economic data is risky. Various factors influence markets, including interest rates, corporate earnings, geopolitical events, and economic indicators. Technical analysis can be a useful tool when combined with these other forms of analysis. Using it in isolation is unlikely to lead to consistent long-term success.

Traders relying exclusively on chart patterns and indicators often frustrate themselves by the market’s unpredictability. In the short to intermediate term, the market can behave in ways that technical analysis cannot account for, leading to losses. This is why it’s essential to question whether technical analysis works and use it as one part of a broader trading strategy rather than as a standalone solution.

The ICT Perspective: Another Layer of Complexity

The emergence of concepts like fair value gaps and liquidity sweeps, taught by proponents of the Inner Circle Trader (ICT) methodology, adds another layer of complexity to the debate around technical analysis. ICT followers believe the market is controlled by an algorithm that dictates price movements. They have developed detailed explanations for how this algorithm operates.

While the ICT methodology offers a highly detailed view of market behavior, it falls into the same trap as traditional technical analysis. It attempts to explain something that cannot be fully known or predicted. Despite the complexity and depth of the explanations provided by ICT followers, their predictions often suffer from the same lack of replication as traditional technical analysis methods.

Where Do We Go From Here, and What Conclusions Can We Make?

In the end, technical analysis remains a controversial and divisive topic. On one hand, it offers valuable insights into market trends and cycles, which are observable and undeniable. On the other hand, its predictive power is highly questionable, and traders who rely too heavily on it often find themselves chasing false promises.

The key takeaway for traders is approaching technical analysis with a healthy dose of skepticism. While it can provide helpful information, it should not be the only basis for trading decisions. Instead, it should be used in conjunction with other forms of analysis, such as fundamental analysis and economic data.

Ultimately, technical analysis doesn’t aim to uncover some hidden truth about the markets. It is one of the misconceptions about it. Its primary objective is understanding how other traders react to specific patterns and indicators. By recognizing the belief-driven nature of technical analysis, traders can use it to gauge market sentiment and behavior rather than as a crystal ball for predicting the future.