Our economy is a vast, complicated machine that requires constant fine-tuning. Central banks, with their monetary policy, and the government with their fiscal policy, are at the heart of it. Whether the government is on a spending spree to stimulate a sluggish economy or press the brake pedal to prevent the economy from overheating, it is always a balancing act critical for maintaining economic stability. Automatic stabilizers, or in-built economic controls, play a vital role in this process. They help cushion drops during economic downturns and cool the economic climate down in times of rapid growth.

Fiscal Stance and Automatic Stabilizers

Before we dive into the heart of our topic, let’s take a moment to set the stage. When we talk about a country’s “fiscal stance,” we’re referring to how the government manages its money. More precisely, we mean spending and taxation. If the government spends more than it brings in through taxes, this is generally called an “expansionary stance.” Governments often take this approach when the economy is struggling and they want to jumpstart growth. This might mean increasing spending on things like infrastructure projects or cutting taxes so people have more cash in their pockets.

On the other hand, if the economy is growing too quickly and inflation is creeping up, the government might try to slow things down. This is known as a “contractionary stance.” In this case, the government might reduce its spending or increase taxes. The goal here is to cool down economic activity and rein in inflation.

What Are Automatic Stabilizers and Where Do They Come Into Play?

Automatic stabilizers are features built into a government’s fiscal system that respond naturally to changes in the economy. There is no need to pass any extra laws or take special actions. Think of them as the economy’s autopilot. When times get tough, they automatically help cushion the impact. Or on the contrary, when the economy is soaring, they subtly tap the brakes to keep it from overheating.

How Do They Work in Practice?

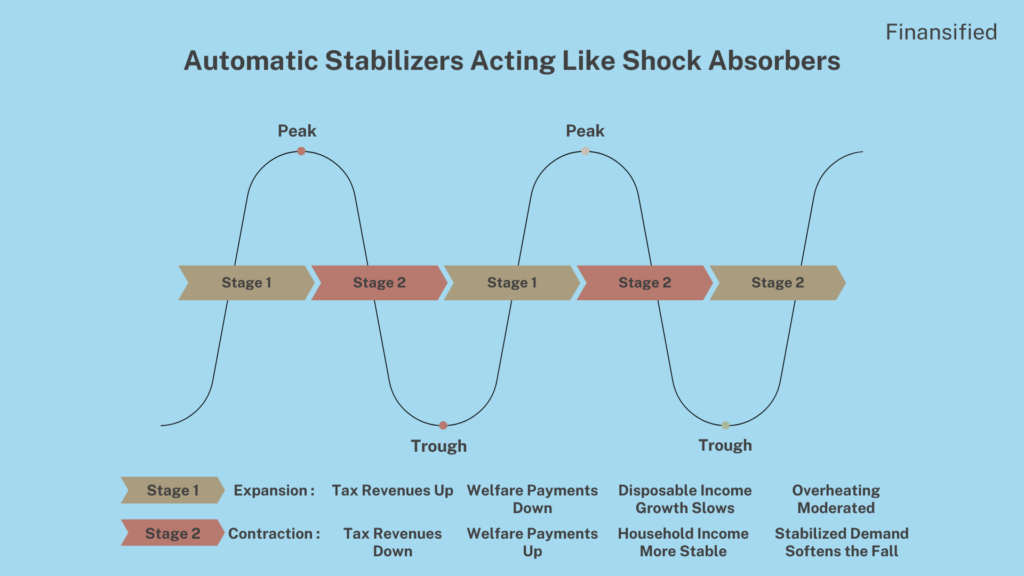

When the economy slows down and people’s incomes fall, tax revenues naturally drop. At the same time, government spending on programs like unemployment benefits or welfare increases because more people qualify for help. This leads to an expansionary effect. By putting more money into people’s hands when they need it most, automatic stabilizers help support overall demand and encourage the economy to recover.

On the other hand, when the economy picks up and incomes rise, tax revenues grow, and government spending on support programs decreases as fewer people need assistance. Well, at least in theory. Real world economics is not a precise science. And we should always remember that. This results in a contractionary effect, pulling money out of circulation and preventing the economy from overheating. In other words, automatic stabilizers guide the government’s fiscal stance. They help maintain a smoother ride through the ups and downs of the business cycle.

How Can We Use Automatic Stabilizers?

These stabilizers aren’t just helpful for policymakers—they can also be useful for anyone trying to understand broader economic trends. By tracking shifts in tax revenues, social spending, and central bank policies, we can get a sense of where the economy is heading. These insights can offer clues about future movements. If stabilizers start signaling that the economy is slowing, investors may adjust their strategies accordingly. Conversely, if automatic stabilizers indicate growth and rising incomes, markets may respond by pricing in stronger corporate earnings and higher asset values.

Types of Automatic Stabilizers

Automatic stabilizers take on a variety of forms, each designed to help even out the bumps in the business cycle without the need for new legislation. A prime example is a progressive tax system. In periods of economic growth, as people’s incomes rise, they naturally pay a larger share of their earnings in taxes. This reduces their disposable income. As a result, they can’t spend as much on goods and services. Eventually, this prevents the economy from overheating. Conversely, during downturns, when incomes fall, individuals and businesses pay less in taxes, leaving more money in their pockets. This helps shore up consumer spending. Other stabilizers kick in through the social safety net.

Unemployment insurance, for instance, expands automatically during recessions. Its primary function is putting money into the hands of people who have lost their jobs. As a result, consumer demand doesn’t decline as much as it could. Similarly, means-tested welfare programs—such as food assistance or subsidized healthcare—grow as more households qualify during hard times, and naturally shrink once the economy improves and fewer people need help.

Corporate profit taxes also work to even out the economic landscape: when profits surge, companies pay more in taxes, slowing down excessive growth; when profits taper off, businesses get to retain more earnings, supporting investment and employment. Taken together, these various types of automatic stabilizers help smooth fluctuations in the economy, reducing the severity of recessions and tempering the risk of runaway growth.

Case Study: How Automatic Stabilizers Softened the 2008 Financial Crisis

A real-world example of automatic stabilizers in action can be seen during the 2008 global financial crisis. As unemployment surged and consumer confidence plummeted, both the United States and Eurozone economies faced severe contractions.

In the United States, automatic stabilizers like unemployment insurance, food assistance, and progressive taxation kicked in immediately—without the need for new legislation. According to estimates from the Congressional Budget Office and the OECD, these automatic mechanisms provided fiscal support during the worst years of the crisis. This influx helped slow the decline in household income and consumer spending, buying time for discretionary stimulus policies to be enacted.

In the Eurozone, the role of automatic stabilizers was even more prominent. Countries like Germany, France, and the Netherlands had larger welfare systems and more progressive tax structures, which meant their automatic stabilizers were able to absorb a greater share of the economic shock. This significant cushion helped stabilize demand and avoid an even deeper recession, especially in countries with limited room for discretionary fiscal stimulus due to debt constraints.

Taken together, these examples show how automatic stabilizers act as economic shock absorbers, delivering timely support without political delay, and mitigating the extremes of the business cycle.

How Can We Use Knowledge About Automatic Stabilizers?

When we talk about automatic stabilizers, we’re not referring to a single policy or tool, but rather a set of built-in economic mechanisms that adjust naturally as the business cycle changes. You might be wondering how understanding these stabilizers can help you as a trader or investor. The key is to recognize that governments and central banks often respond to different phases of the business cycle in somewhat predictable ways, which can influence financial markets.

Economic Slowdowns

For example, when the economy slows down, central banks may cut interest rates, and governments might lower taxes or increase support payments to households (automatic stabilizers). These measures are designed to encourage spending and investment, ultimately aiming to lift the economy out of a slump. In turn, such actions often have a direct impact on markets: bond prices might rise as interest rates fall, and certain stocks—especially those sensitive to consumer demand—could benefit from increased spending power.

Economic Expansions

Conversely, when the economy is running hot and inflation becomes a concern, policymakers might do the opposite. Central banks could raise rates to cool things down, and governments might reduce spending. Ultimately, these measures are designed to put a damper on spending and consumption (automatic stabilizers). This can lead to a more cautious outlook for stock markets, while some investors may favor assets that perform well in high-interest-rate environments, such as certain fixed-income securities.

A real-world example occurred during the 2020–2021 period, when central banks around the world, including the U.S. Federal Reserve, slashed interest rates and supported economies through bond-buying programs. Governments also provided direct payments to individuals and businesses. Stock markets, anticipating stronger future earnings and more money in consumers’ pockets, generally reacted positively—many equity indices surged to record highs during that period.

By keeping an eye on how tax revenues, public spending, and monetary policy tools change alongside economic conditions, we can better anticipate the direction of the markets. While it’s never a guarantee of success (and unexpected twists can always occur), understanding these patterns can give you a valuable edge in navigating a complex financial landscape.

A Quick Overview of Automatic Stabilizers on an Economy and Financial Markets

| Stabilizers Do This | Financial Markets React By |

|---|---|

| Smooth out GDP volatility | Repricing earnings growth and risk premiums |

| Influence fiscal deficits | Adjusting bond yields and FX valuations |

| Support household income | Sustaining consumer stocks |

| Reduce recession depth | Dampen market drawdowns or volatility |

| Delay discretionary stimulus | Moderate expectations for fiscal packages |

How Automatic Stabilizers Influence Currency Expectations

Automatic stabilizers directly influence the business cycle, so it’s reasonable to assume they affect financial markets broadly—impacting everything from equities to bonds. But since this blog is primarily focused on the forex market, let’s take a closer look at how they shape currency expectations in several meaningful ways.

First, stabilizers influence a country’s fiscal position by widening budget deficits during downturns, as welfare spending rises and tax revenues fall. In the short term, this can weigh on a currency if investors expect increased borrowing or weaker growth prospects. However, in the medium term, strong and well-designed stabilizers may actually bolster fiscal credibility. By reducing the need for abrupt discretionary stimulus, they create a more stable policy environment—something that currency markets tend to reward.

Second, stabilizers help smooth out recessions, which can improve relative growth expectations—a key factor in currency valuation. If one country’s stabilizers are more effective than another’s during a shared downturn, investors may lean toward that currency, anticipating a quicker or more resilient recovery.

Third, automatic stabilizers help moderate inflation volatility by dampening both booms and busts. This supports central bank credibility and reduces economic uncertainty—two important ingredients for currency strength. Additionally, when stabilizers are doing their job, central banks may not need to intervene as aggressively. That leads to a more predictable interest rate path, which FX markets often interpret as a positive signal.

In short, while they may not be front-page market movers, automatic stabilizers influence several of the macroeconomic fundamentals that currency traders watch most closely—growth, inflation, and policy direction.

Where Can We Find This Information?

There are several reliable sources where traders, investors, and researchers can find data and reports on tax revenues, government spending, and monetary policy decisions. Some of the most commonly used include Government Statistical Agencies.

In the United States, the U.S. Treasury Department and the Congressional Budget Office (CBO) regularly publish data and forecasts on federal revenues, spending, and deficits. In the UK, the Office for National Statistics (ONS) provides similar insights into public finances. In the European Union, the Eurostat database offers standardized information on member countries’ fiscal positions.

Central Bank Websites and Their Reports

The Federal Reserve (for the U.S.), the European Central Bank (ECB) (for the Eurozone), the Bank of England, and other central banks around the world regularly release monetary policy statements, meeting minutes, and economic projections. These sources detail interest rate decisions, quantitative easing measures, and other actions that can influence markets.

International Organizations and Economic Institutions

The International Monetary Fund (IMF) and the Organization for Economic Co-operation and Development (OECD) publish extensive data, country reports, and forecasts related to public finances and economic conditions. The World Bank and the Bank for International Settlements (BIS) also provide global economic indicators and in-depth analyses.

Official Statistical Databases

If we are talking about the US then, the Federal Reserve Economic Data (FRED) database (maintained by the St. Louis Fed) includes a wide array of economic data. This data includes government spending, tax revenue indicators, and monetary aggregates. National statistical bureaus and finance ministries maintain online databases that include historical and current fiscal metrics.

Financial News and Analytics Platforms

Reputable financial news outlets like Bloomberg, Reuters, and The Wall Street Journal often summarize and analyze newly released economic data. Analytical platforms, such as FactSet, Refinitiv, or Bloomberg Terminal, provide real-time updates and tools to chart and interpret economic indicators. By regularly reviewing these sources, traders and investors can keep a close eye on how fiscal and monetary policies evolve in response to economic conditions, potentially gaining insights into future market directions.

📌 Frequently Asked Questions About Automatic Stabilizers

Automatic stabilizers adjust fiscal flows without the need for new legislation. Discretionary fiscal policy requires deliberate government action, such as passing stimulus packages or changing tax rates in response to economic conditions.

They provide support automatically through higher welfare spending and lower taxes, helping households maintain income and demand. This reduces the depth and duration of economic downturns.

Because they affect key macro indicators like growth, inflation, and fiscal balance—factors that directly influence currency strength and central bank policy decisions.

Countries like Germany, France, and the Nordics typically have stronger stabilizers due to their more progressive tax systems and comprehensive welfare programs. The U.S. has substantial stabilizers as well, though they vary by program.

They can lead to larger budget deficits in prolonged downturns, but their stabilizing effect on the economy is generally considered a worthwhile trade-off. Most economists see them as a net positive.

Conclusion

Automatic stabilizers may not make headlines like interest rate decisions, but they play a quiet, powerful role in shaping the economy—and by extension, financial markets. From supporting household income during downturns to easing inflationary pressures during booms, these built-in fiscal tools help smooth out the economic ride. For traders and investors, understanding how stabilizers work can offer a valuable context for interpreting macro trends, anticipating policy shifts, and reading between the lines of economic data.

Did you find our article informative? Don’t forget to explore our other articles. We’d love your thoughts about this article in the comments section below.

RESOURCES USED IN THIS ARTICLE: