First, let’s determine what fundamental analysis is, and what it isn’t, in the context of the foreign exchange market. Fundamental analysis focuses on the bigger picture. Since the health and structure of an economy determine the value of its respective currency, fundamental analysis examines the health of the economy by analyzing various metrics, such as GDP growth, employment, inflation, and monetary policies. All these are slow-moving factors, so fundamental analysis has limited applicability in shorter-term day trading. Why bother, then? Fundamental analysis is more about forming medium-to-long-term expectations—outlooks—by discerning trends. And trends are something we can work with as traders and investors. As the adage goes, the trend is your friend. So let us learn where and how to find them.

What Do We Mean When We Say Fundamental Analysis in the Forex Market?

Many textbooks mention two types of fundamental analysis for stocks, bonds, and alternative investment vehicles: bottom-up and top-down analysis.

A top-down fundamental analysis of these markets involves analyzing the broader global and macroeconomic environment first before narrowing it down to specific regions, countries, and issuers (private companies, governments). It focuses on the big picture, starting from global trends and working down to more specific factors that affect the instrument of interest. Then, we drill down even further into financial statements and analyze the issuer.

A bottom-up fundamental analysis starts with the specific details of individual issuers and then expands outward to consider how those details fit into the broader macroeconomic context. This method contrasts with top-down analysis, which starts with global factors.

So, how do we apply this knowledge to the foreign exchange market? It’s all about adjusting our approach. Since currencies are issued by central banks of different countries and not by companies, we can’t analyze ‘financial statements’ as we do for corporate issuers. But don’t worry. Central banks and governments publish the next best thing: key economic metrics, such as GDP growth, inflation, and trade balances, which we can analyze in a way that mimics bottom-up analysis. This is where your understanding of the concepts comes into play, empowering you to apply these methods in the real world of forex trading.

While a strict bottom-up approach isn’t feasible in the forex market, we can combine top-down and country-specific (bottom-up) analysis elements. This integrated approach, which we’ll guide you through, starts by looking at global and macroeconomic trends, interest rates, monetary policies, and geopolitical events (top-down analysis). Then, we analyze country-specific economic data like employment, inflation, and trade balances (similar to bottom-up analysis for individual countries). This way, you’re not just learning about forex analysis but gaining a comprehensive understanding of the factors that influence currency values. Since the forex market is literally all about money, perhaps it makes sense to learn what money is and its role. We have a comprehensive article on this topic.

The Goal of Fundamental Analysis

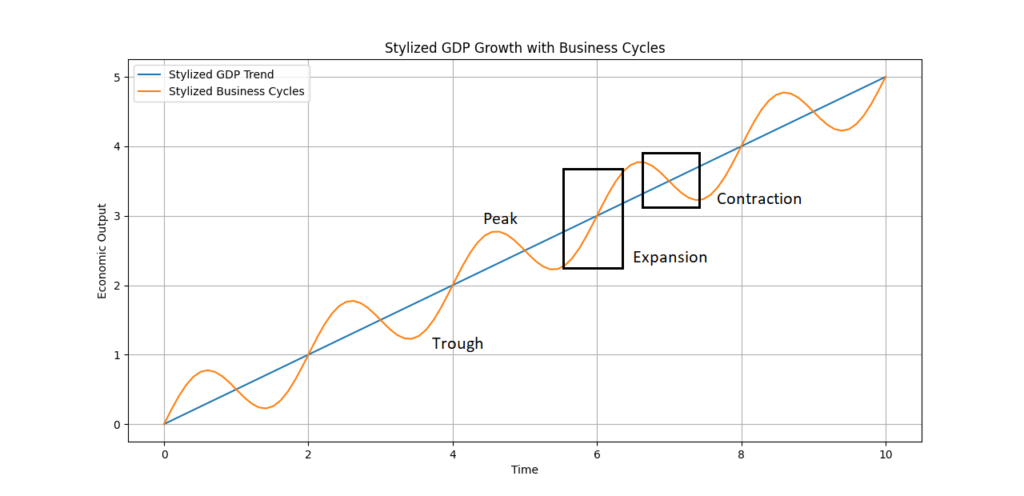

The goal of fundamental analysis, as we see it, is to form medium-to-long-term expectations about an asset, in our case, currencies. We analyze the economy to determine the long-term trend. Hopefully, it is growing. That long-term trend is built into an oscillating business cycle (expansion, top, contraction, trough), as shown on the image below.

Our goal here is to use all the information we have at hand (economic indicators, central bank press releases, government decisions as a business cycle) and make an educated guess as to the current state of the business cycle. Why? Depending on that information, governments and central banks will use different tools (e.g., monetary policy), and these tools impact economies and, by extension, financial markets and financial instruments (including currencies) differently.

How to Conduct Fundamental Analysis?

Now that we have established what fundamental analysis means when applied to the forex market let’s try to conduct it. Let’s choose our currency pair. For convenience and due to data availability, we’ve chosen EUR/USD, where EUR is the base currency and USD is the quote currency. This will guide the analysis toward the regions’ economies that issue the base and quote currencies: the Eurozone for the Euro and the United States for the U.S. dollar. Yes, we are going to need two sets of analyses. It takes two to tango.

We’ll need to evaluate economic indicators such as GDP growth, inflation, employment, and central bank policies for the Eurozone and the U.S. The relative performance of these economies will help us forecast potential movements in the EUR/USD exchange rate. By understanding how each economy is performing and the monetary policy direction of the European Central Bank (ECB) and the U.S. Federal Reserve, we can gain insights into each currency’s potential strengths or weaknesses.

Why Analyzing the Domestic Economic Metrics of Each Country is an Essential Part of Fundamental Analysis?

Analyzing domestic economic fundamentals in forex starts by evaluating central banks’ interest rates and monetary policies for each country in the currency pair. Interest rates are the cost of borrowing money and are a key tool central banks use to manage economic conditions. Higher interest rates often attract foreign capital, strengthening the currency. Identify the current interest rates and determine if the central bank has a hawkish or dovish stance. Review recent central bank statements to understand their outlook on inflation, economic growth, and potential rate changes, as these factors provide insights into future currency movements.

Where do we get this information? The logical place to start would be the central banks themselves. After all, they are the bodies that determine these rates.

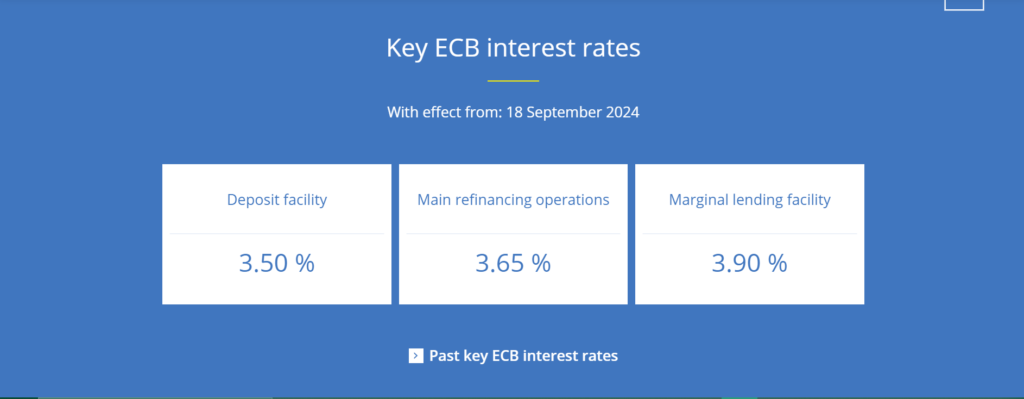

The European Central Bank is the central bank of the EUR. Its current policy rate can be found here.

On this page, you can see their past rates, which is very convenient because we can see the evolution of the interest rates over time. This gives us an idea of how the ECB responded to different economic conditions over the years. There is one more page where you can look up their interest rates in graph form, depending on your preferred presentation.

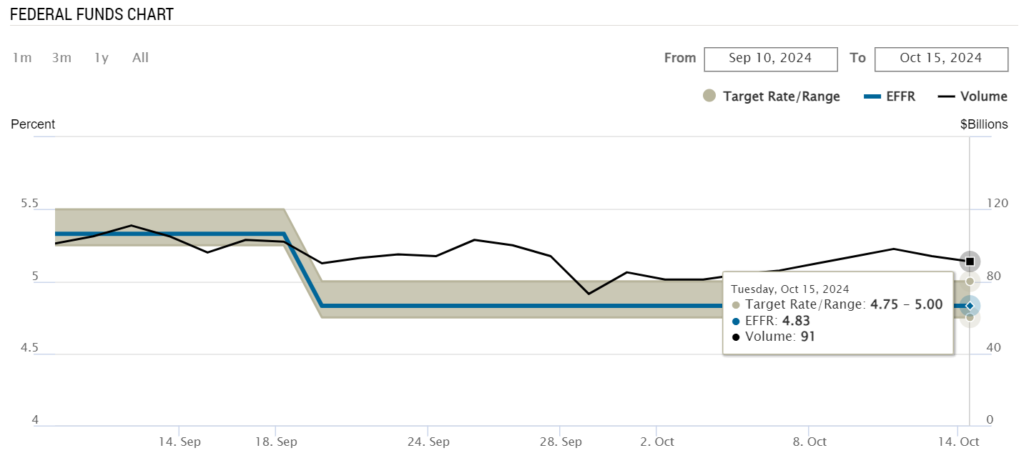

The U.S. Central Bank, the Fed, does not publish a single rate but a range for the Federal Funds Rate, as you can observe here or here. The FOMC chooses the target range for the Fed funds rate to communicate its monetary policy stance. Implementing monetary policy ensures that the effective federal funds rate (EFFR) remains in that range.

Source: NYFED. Federal Funds Rate and Effective Federal Funds Rate (EFFR) from September 10, 2024, to October 15, 2024.

Effective Federal Funds Rate (EFFR) is the interest rate banks charge each other for overnight loans. It fluctuates based on the supply and demand for reserves in the banking system but generally stays within the target range set by the Fed. The EFFR is one of the most accurate reflections of the U.S. economy’s short-term borrowing cost. It directly influences other short-term interest rates and indirectly affects long-term rates, which are also shaped by inflation expectations and economic conditions.

Why Do We Need Gross Domestic Product (GDP)?

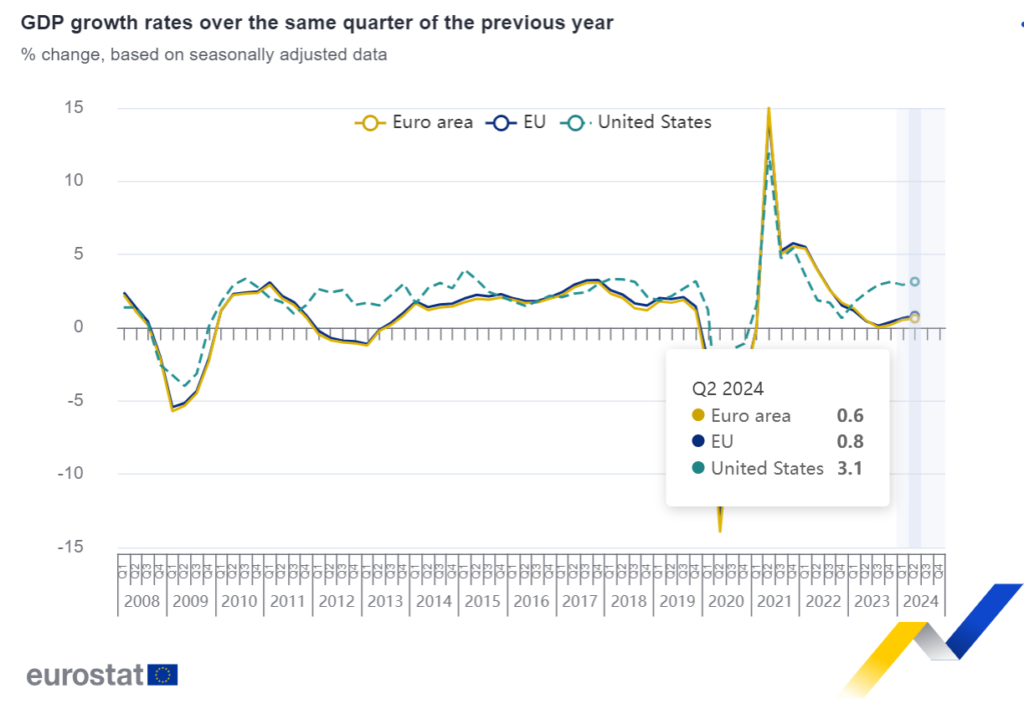

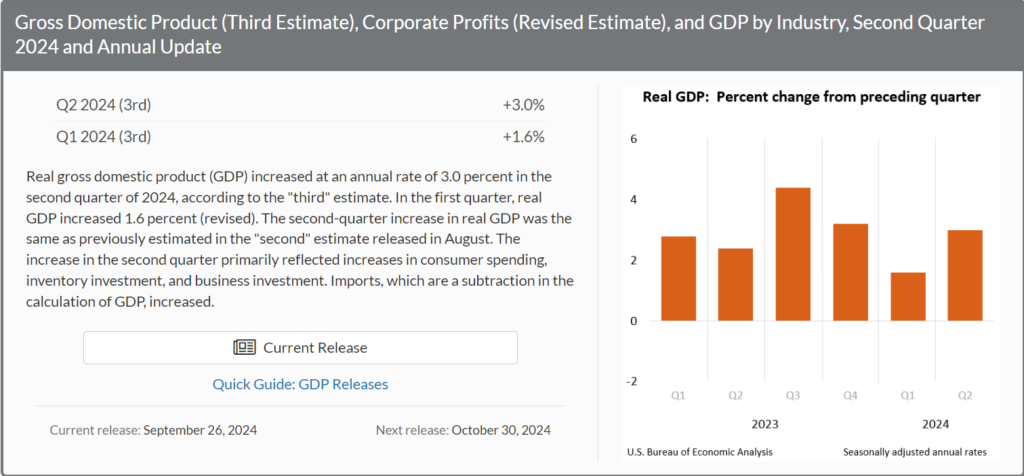

GDP growth is crucial to a country’s economic health and can strongly influence currency strength. For instance, if the U.S. experiences robust GDP growth, it often strengthens the U.S. dollar, reflecting a healthy and expanding economy. Similarly, more robust GDP growth in the EU can lead to a stronger euro. Growth forecasts for both regions offer insights into their economic outlooks for upcoming quarters. In the U.S., sectors like technology drive significant growth, while industries such as financial services or manufacturing can play a crucial role in the EU. These sector-specific drivers can disproportionately impact the strength of each currency. For this reason, analyzing trends in GDP growth is an essential part of the fundamental analysis of the forex market.

GDP stands for Gross Domestic Product, and it represents the total monetary value of all goods and services produced within a country over a specific time period, typically a year or a quarter. GDP is one of the most commonly used indicators to measure the size and health of an economy.

Where can I get the data? Every country has a body responsible for collecting statistical data. In the European Union, this is Eurostat. Here, you can see the cumulative growth rate in the EU and by member states. On this page, you can see it in graph form, along with some other interesting metrics.

In the U.S., the primary source for U.S. GDP data is the Bureau of Economic Analysis (BEA). They release quarterly and annual GDP figures and detailed breakdowns by industry sector. You can access the latest GDP figures on this page.

Why Do We Care About Inflation?

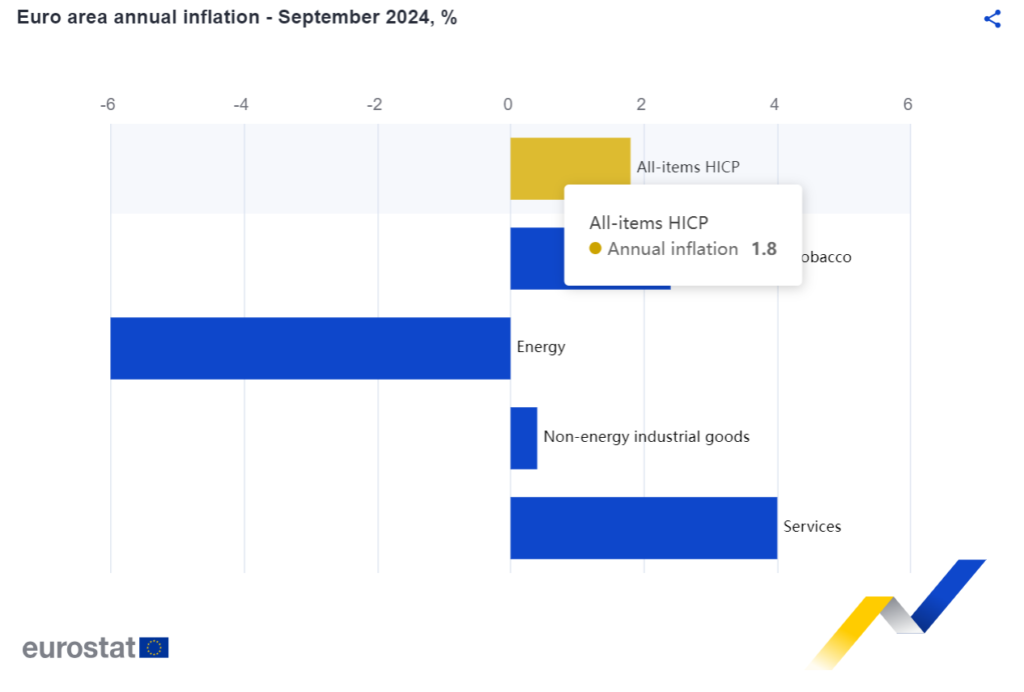

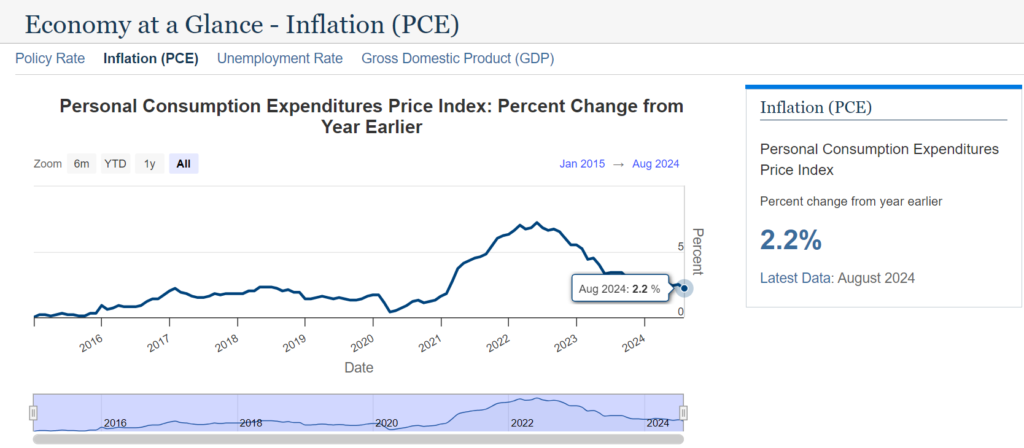

Inflation is a crucial factor influencing currency strength. It affects purchasing power and can lead central banks to adjust interest rates. The current inflation rate in each country provides insight into potential currency movements, with high inflation generally weakening a currency by eroding its value. Observing trends in inflation—whether it is increasing or decreasing—can help gauge future economic conditions. Comparing these rates to the central bank’s target offers further context. When inflation exceeds the target, it often signals potential rate hikes, which may strengthen the currency, while lower inflation can indicate possible rate cuts and a weaker currency.

Sources of data:

The same authority publishes this metric in the Eurozone as in the previous case. You can access it here or here.

The Federal Reserve primarily uses the PCE (Personal Consumption Expenditures) as its preferred measure of inflation when setting monetary policy. This is because the PCE provides a broader and more flexible understanding of price changes across the economy. The Fed’s 2% inflation target is based on the PCE. You can access the latest figures here.

Employment and Labor Market Data

Employment and labor market data are critical indicators of a country’s economic strength. A lower unemployment rate typically indicates a healthier economy, which can support a stronger currency as it reflects stable job creation and economic activity. Wage growth is another crucial factor; consumer spending increases as wages rise, driving GDP growth. This higher consumption can, in turn, boost the currency’s value by signaling economic robustness. Central banks closely monitor both unemployment levels and wage growth as they influence decisions on monetary policy, which further affects currency movements.

For EU employment and labor market data, we will again use Eurostat, broken down by country. Here, we can observe labor cost growth in the EU and Eurozone.

The US Bureau of Labor Statistics’ website displays the unemployment rate. We can observe the U.S. labor cost index here.

Trade Balance and Current Account

The trade balance and current account influence a country’s currency. Countries with trade surpluses, where exports exceed imports, tend to have stronger currencies due to higher demand for their currency in international transactions. A trade deficit, on the other hand, can weaken a currency. The current account balance provides a broader view, combining the trade balance with capital flows. A current account surplus generally supports a stronger currency by reflecting net positive money inflows. At the same time, a deficit may signal economic weaknesses, potentially leading to currency depreciation in the forex market.

The latest trade and current account balances in the Eurozone can be observed here and here.

The Role of Country-Specific Political Factors in Fundamental Analysis

Political and fiscal factors play a crucial role in currency movements. Political stability significantly impacts markets, as uncertainty often leads to currency volatility. Elections, leadership changes, or government policy shifts can profoundly affect a currency’s strength. Political risks, such as corruption, war, or domestic unrest, can further devalue a currency.

It’s easier said than done, right? But don’t worry—we are here to give you some pointers.

Incorporating political and fiscal factors into your fundamental analysis of currencies, especially in regions like the EU, can get a bit more complex compared to a single-country system like the U.S. While keeping an eye on U.S. elections and policy changes is relatively straightforward, the EU requires a more nuanced approach since it doesn’t have one central leader but rather individual leaders for each member country.

First, focus on leading EU economies like Germany, France, and Italy. These countries significantly influence the strength of the euro. For example, Germany’s economic and political stability often plays a big role in how the euro moves. Keep an eye on these countries’ elections, leadership changes, or policy shifts, as they tend to have ripple effects across the entire Eurozone.

In addition, it’s important to track EU-wide institutions like the European Central Bank (ECB) and the European Commission. These organizations drive significant policy decisions that impact the EUR, like monetary policies or fiscal agreements. Even though fiscal policies differ across EU countries, any major changes or discussions about fiscal union or budget rules can cause shifts in the currency.

Additionally, political risks like regional unrest, separatist movements, or anti-EU sentiment in countries like Italy or Spain can cause uncertainty and weaken the EUR. These political factors can create market volatility, just like Brexit. So, watch country-specific events and broader EU discussions to understand the risks thoroughly.

In 2017, Catalonia held an independence referendum, which the Spanish government declared illegal. The political unrest, including protests and clashes with the national government, created significant uncertainty for Spain and the EU. This situation led to market volatility and contributed to a temporary weakening of the euro as investors feared instability in a major EU member state.

June 1, 2018, marks the formation of Italy’s populist government led by a coalition between Lega Nord and Movimento 5 Stelle. The budget crisis escalated in October 2018 when the European Commission rejected Italy’s proposed budget, increasing tensions and market volatility (“Italexit”). This led to a spike in Italian bond yields and a temporary decline in the euro.

Finally, elections in major EU countries, shifts in coalition governments, and trade relations all shape the currency’s movements. A pro-EU government can bring stability while rising populism or nationalist movements often create volatility. By keeping track of these factors and how they play out in critical countries, you’ll have a more comprehensive view of how political and fiscal changes might affect the euro compared to other currencies.

External Factors and Global Connections

External factors and global connections have a significant impact on currency values. Especially when it comes to global risk sentiment and trade relations. During uncertain times, investors tend to flock to safe-haven currencies like the U.S. dollar (USD), Japanese yen (JPY), and Swiss franc (CHF), making them stronger. This is known as a “risk-off” environment. On the other hand, in a “risk-on” environment, where markets feel more optimistic, riskier currencies can gain strength, while safe-haven currencies might take a backseat.

Trade relations also play a crucial role. For example, trade wars like the U.S.-China conflict have caused volatility for both the USD and Chinese yuan (CNY). On the other hand, free trade agreements often help strengthen currencies as they boost trade and economic stability. When geopolitical tensions rise or tariffs are imposed, currencies can weaken due to the following economic slowdown.

Currency Pair Comparison

After evaluating each country’s economic fundamentals, the next step is directly comparing their currencies to determine which is stronger. Start by looking at interest rates. When one country has higher interest rates than the other, its currency often becomes more attractive to investors. This draws in capital and potentially strengthens that currency.

Next, compare how the two economies are performing. Stronger GDP growth, lower inflation, and better employment rates generally indicate a healthier economy, supporting a stronger currency.

Market Sentiment and Speculative Positioning

Once we’ve analyzed both currencies in the pair, we must understand how the market feels about them. Traders’ speculative positioning can offer clues about where the currency might move in the short term. Tools like the Commitment of Traders (COT) report can help gauge whether traders are “long” (betting the currency will rise) or “short” (betting it will fall).

Is there a general consensus that one currency is on the rise, or are traders more bearish, expecting it to weaken? Understanding this market sentiment can help us anticipate near-term price movements and make more informed trading decisions.

Conclusion and Outlook

To conclude the analysis, it’s helpful to summarize the currency pair’s short-term and long-term outlooks. In the short term, look at the latest data to get a sense of where the pair might be heading. Are there any immediate risks or opportunities, such as upcoming economic reports or central bank meetings, that could trigger movement?

For the long term, consider the fundamentals and how they may evolve. Will one economy outperform the other, or are there signs that central banks may shift their policies? This broader view helps paint a picture of where the currency pair could be heading over time.

Focusing on a few key areas is essential when analyzing government spending and fiscal policies. First, look at trends, particularly how government spending and revenue have changed relative to GDP and across different economic cycles. This helps you understand the broader context of fiscal policy.

Next, consider the composition of spending. Breaking down spending by categories, such as defense, social security, or healthcare, gives an insight into government priorities and where resources are being allocated. It’s also important to analyze the sources of revenue, examining different types of taxes and their contribution to overall government income.

Pay close attention to the budget balance—the difference between spending and revenue—which can result in a surplus or deficit. This balance is a crucial indicator of a government’s fiscal health. Finally, comparing U.S. government spending and taxation levels with those of other developed economies is helpful to gauge how they compare to global standards.

We provided direct data sources from the government bodies responsible for gathering, processing, and reporting information. These organizations rarely focus on “user-friendliness,” visualizations, or tools that make data easier to interpret. That’s why using alternative sources of data, which are readily available, can be helpful.

Important Considerations

Fundamental analysis isn’t just a “look it up once and forget it” approach. A single data point won’t give you the whole story—you must pay attention to how things change over time. If you’re serious about using fundamental analysis in your trading or investment decisions, monitoring and analyzing the data regularly is crucial to spot trends and potential shifts. We’ve covered a few key metrics here, but plenty more can be useful depending on your specific strategy.

Remember, fundamental data can be revised. Why? Because it’s often collected manually, meaning transcription or input errors can sneak in. When these mistakes are found, the data gets corrected. So, it’s important to remember that initial figures might not be final. You must be prepared to adjust your analysis accordingly. Nothing is set in stone.

Unlike technical analysis, which relies on interpreting price charts and patterns, fundamental analysis focuses on objective data—like economic indicators and financial reports. It’s about understanding the bigger picture of an asset’s (be it stocks, bonds, or currencies) value rather than just reading its price movements.