Inflation, the steady rise in prices over time, impacts various aspects of the economy. When inflation is too high, the economy is on fire; when it’s too low, it’s in a deep freeze. Governments and central banks use different strategies to manage these extremes, like pumping money into the economy or taking money out of circulation.

Why should you and I care?

Whether you are trader, investor or Forex Broker, inflation can impact interest rates, stock prices, currency values and the overall economic environment. This means, inflation affects currency exchange rates. If you know what signs to look out for and where to check them, you may predict with a high degree of precision and with certainty when/if governments and/or central banks will step in with their policies. With that information in mind, we will examine what inflation is, how it works, what types exist, how it is measured, and how it affects the forex market. So, let us begin.

Inflation Definition for Dummies

So, you’ve probably heard the term “inflation” thrown around a bit. It’s all about prices going up over time. But it’s not just about one thing getting more expensive or prices fluctuating in the short term. No, it’s more like a steady uphill climb where everything, on average, is getting more expensive. There’s no hard and fast rule for how long prices must keep rising before it’s officially called “inflation.” However, economists generally like to see prices consistently rising for several months before they declare inflation.

Inflation comes in different “shapes” and “colors”. It can be pretty chill, with prices going up slowly and steadily. Or, it can get wild, like in cases of hyperinflation, where prices just shoot up and get out of control.

Hyperinflation is characterized by extremely rapid and uncontrolled price increases in an economy. While regular inflation involves moderate and steady price increases, hyperinflation is much more severe, with prices typically rising by more than 50% per month. This level of inflation can lead to a loss of confidence in a currency as the purchasing power of money declines rapidly, and people start to prefer holding their wealth in more stable assets. Hyperinflation is relatively rare but can be devastating to an economy, as seen in historical examples like Zimbabwe in the late 2000s or Germany in the early 1920s.

Types of Inflation

There are two main types of inflation. There is demand-pull and cost-push inflation. Understanding the difference is crucial as it offers insights into the economy and aids in investing, business strategies, wage negotiations, and monetary policies. For investors, distinguishing between demand-pull and cost-push inflation is vital. In demand-pull inflation, companies can raise prices and earn substantial profits when consumer demand increases. This scenario often presents good investment opportunities. However, during cost-push inflation, companies face shrinking profits as the costs of production rise, making it a less favorable time for investment.

How Do We Measure Inflation?

When we measure inflation, we look at how the prices of many different goods and services change over time. Think of this collection of items as a “basket.” A price index helps us understand how each item contributes to the total. It shows the weight of each item in the basket. This way, we can see how price changes for each item affect the overall cost. There are various ways to average these prices.

Let’s construct a simplified consumption basket as an example. It will only contain hamburgers and Coca-Cola. In January, we buy ten hamburgers at $5 each and seven cans of Coca-Cola at $3 each. So, our total bill in January comes to $71.

By October, prices have changed. A hamburger is now $6, and a can of Coca-Cola is $3.50. If we shop with the same list in October, our bill now comes to $84.50.

To simplify comparisons over time, we set a base level. We set the price index in January’s base period to 100. After calculating the prices for October of the same year, we find that the price index is around 119.01 ((84.50/71)*100). This means the inflation rate for October compared to January is 19.01%.

Using a fixed basket of goods to measure inflation is a method known as the Laspeyres index. It’s commonly used around the world. However, it may not always accurately reflect changes in spending habits, but that’s a different story.

The Most Common Measure of Inflation

The Consumer Price Index (CPI) is the most commonly used measure of inflation. The CPI tracks the average price change over time for a basket of goods and services households commonly purchase, such as food, housing, clothing, transportation, and medical care. Economists and policymakers use the CPI to assess price changes associated with the cost of living, making it a crucial economic indicator for understanding inflationary pressures within an economy.

Governments often use CPI adjustments to index social security benefits, wages, and other important economic parameters to keep pace with inflation. Moreover, the CPI is a key gauge for monetary policy decisions, helping central banks determine whether they need to adjust interest rates to manage inflation effectively.

Other Measures of Inflation

The Producer Price Index, or PPI, follows the CPI. This index measures the price changes of goods produced and sold by manufacturers. It provides a snapshot of trends in wholesale markets and the manufacturing sector.

Next, we have the Export and Import Price Indexes. These indexes track the price movements of goods and services traded between the U.S. and other countries. They play a crucial role in helping the government adjust trade statistics for inflation.

Another important measure is the Employment Cost Index or ECI. This index looks at changes in labor costs, offering valuable insights into employment trends and aiding in adjusting wage levels in labor contracts.

Finally, we have the Gross Domestic Product (GDP) Deflator. This index captures the prices of all goods and services included in the GDP, making it a broad measure of inflation. It stands out because it encompasses the entire GDP, not just consumer spending.

Inflation isn’t inherently bad. It only becomes a problem when there is too much or too little.

Why Is Too Much Inflation A Bad Thing?

High inflation has some nasty side effects. The most obvious one is that money loses its purchasing power. When high and unpredictable inflation creates uncertainty about future costs and prices. This uncertainty can make consumers hesitant to spend and businesses reluctant to invest or expand, leading to slower economic growth.

Why is Zero 0 Inflation Bad?

With zero inflation, consumers and businesses might postpone purchases and investments because they don’t anticipate prices rising in the future. This delay in spending can lead to reduced economic activity and slower growth. Inflation helps to erode the real value of debt over time, which can benefit borrowers, particularly in a growing economy. With zero inflation, the real value of debt remains unchanged, making it more burdensome for borrowers to repay their loans, potentially leading to higher default rates.

As is usually the case with everything else, too much and too little of something can be problematic. To give you a real-life example, physical exercise is generally considered good for your health, but training too much may lead to overexertion, which can cause different health issues. If you exercise too little, this can lead to hypodynamia.

Rational governments and central banks of developed countries try to keep the economy in good health, so they aim for an inflation rate of around +/-2 percent. If inflation accelerates out of control, they impose contractionary policies, and when inflation drops, they implement expansionary policies. When that happens, it sends waves across entire economies, affecting everything. This brings us to our next topic: inflation and foreign exchange markets.

Interrelation of Inflation and Foreign Exchange Markets.

Inflation, monetary policy, fiscal policy, and foreign exchange rates are closely linked. As a result, central banks and governments use monetary and fiscal tools to manage inflation, stabilize the economy, and create favorable conditions for their currencies in the global market. Changes in these areas can lead to significant movements in foreign exchange rates, impacting global trade and economies.

Expansionary and contractionary policies impact economic stability, influencing investor confidence and currency exchange rates. For example, if investors feel that a country is effectively managing its economic challenges through prudent fiscal and monetary measures, confidence in its currency might increase, leading to appreciation.

Interest rates set by central banks influence inflation and the value of a country’s currency. Higher interest rates offer higher returns on investments in that currency, making it more attractive to foreign investors. This increased demand can strengthen the currency.

Conversely, lower interest rates might depreciate the currency as it becomes less attractive than other currencies offering higher returns.

Generally, a country with lower inflation will strengthen its currency compared to countries with higher inflation. Lower inflation rates preserve the currency’s purchasing power, making it more attractive.

How traders and investors perceive the effectiveness of a government’s or central bank’s approach to managing inflation can also affect the foreign exchange markets. Speculative movements based on anticipated policy changes can lead to fluctuations in currency values.

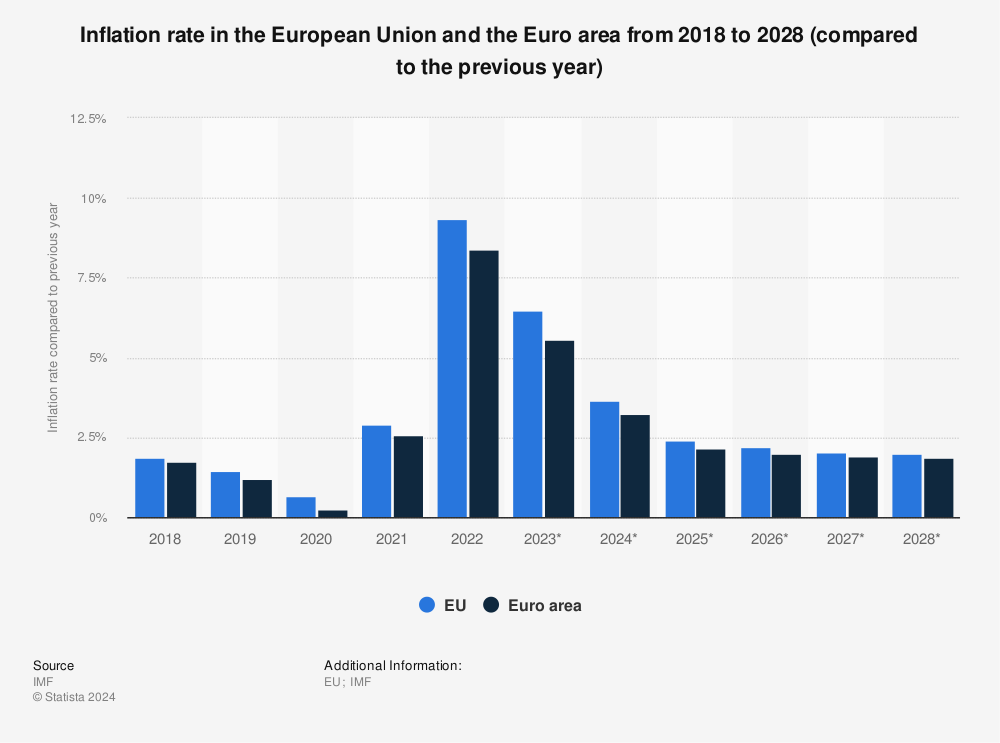

A more recent example of contractionary monetary policy to control inflation can be seen with the actions taken by the European Central Bank (ECB) starting in 2022.

Facing rising inflation rates primarily due to energy price shocks influenced by geopolitical tensions, specifically the Russia-Ukraine conflict, and post-pandemic economic recovery pressures, the ECB began adjusting its monetary policy stance in 2022 to tackle inflation, which had surged to levels significantly above its target of 2%.

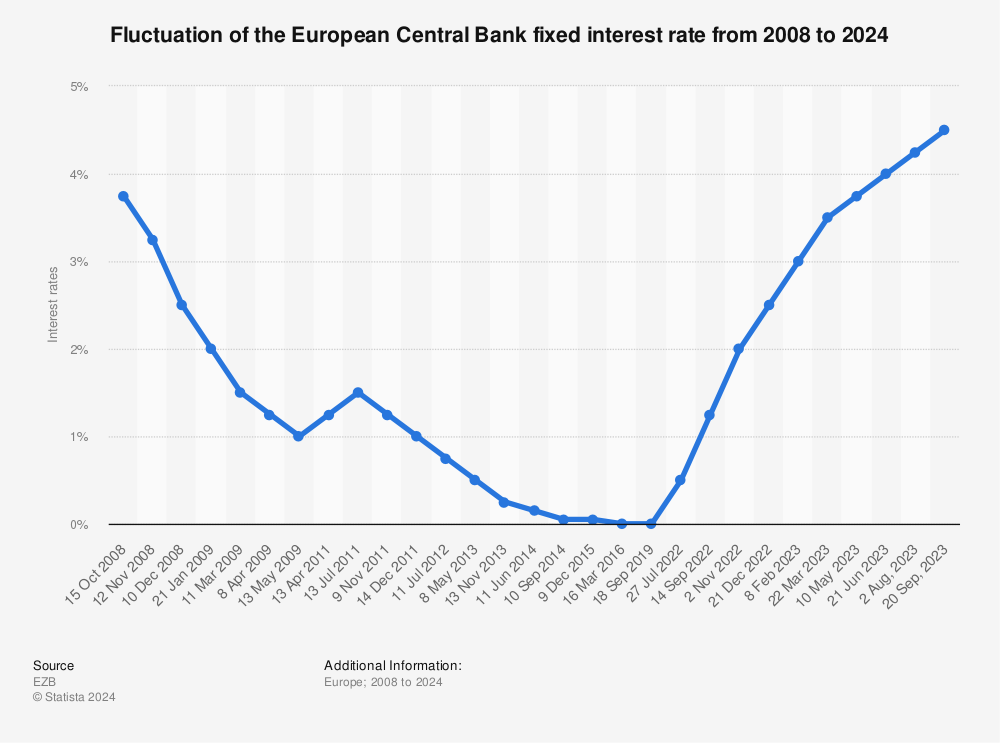

In July 2022, the ECB raised its key interest rates for the first time in 11 years, marking a significant shift from its previous expansionary policies, including negative interest rates and extensive asset purchases. The ECB continued this trend with several subsequent rate increases throughout the year.

Alongside raising rates, the ECB also scaled back its asset purchase programs, which had been an essential tool for stimulating the eurozone economy during the low-inflation years following the financial crisis and during the COVID-19 pandemic.

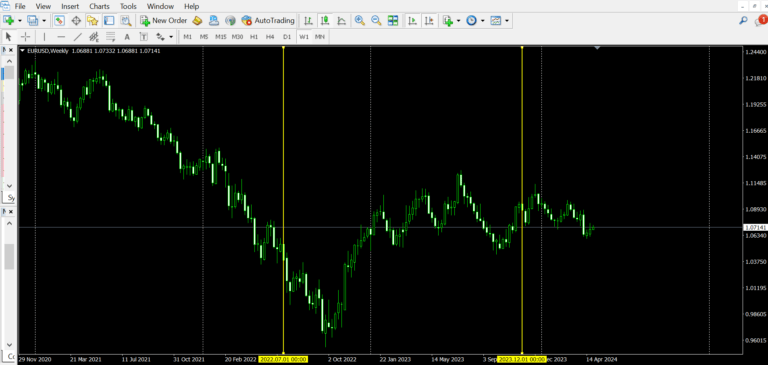

Weekly EUR/USD chart. Vertical yellow line on the left is July 2022. The ECB increased its fixed interest rate for the first time since March 2016. The yellow line vertical line on the right is the rate (4.5 percent) as of December 2023.

The main objective of these measures was to tighten monetary conditions in the eurozone to help curb inflation by reducing excessive demand and speculative investment. By raising the cost of borrowing, the ECB aimed to moderate spending and investment, thus reducing upward pressure on prices across the board.

On the chart above you can see how the EUR performed against the greenback following the rate hikes by the ECB.

By the end of 2022 and into 2023, inflation rates remained high, indicating the challenging environment in which monetary policy was operating. However, these policy adjustments were critical in signaling the ECB’s commitment to stabilizing prices and anchoring inflation expectations, crucial for maintaining long-term economic stability in the eurozone.

Main Takeaways:

- Inflation is about prices going up across the board and staying up

- Zero inflation is bad

- Too much inflation is bad

- The most common measures of inflation are CPI, PPI, ECI, and GDP Deflator

- Inflation is one of the factors affecting currency exchange rates

When looking for even more powerful financial investment insights, visit

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.