- Eugene Steiner

- Post Updated: April 20, 2025

Working across different forex brokers has given us unique insights into the retail trading world. Beyond merely observing, we’ve directly engaged with many of you via our support team. A clear pattern emerged through these conversations. There is significant confusion about the structure of the foreign exchange market (Forex for short), the key players, and the role of traders and retail forex brokers in the grand scheme. Misconceptions abound in retail foreign exchange trading. They have become so ingrained that they’re widely shared and believed within Forex forums, Reddit subs, and Facebook groups. These myths have created a peculiar echo chamber. For this reason, they believe in conspiracy theories, listen to “gurus” who “hacked” the market, and search for “legit” brokers or strategies instead of focusing on real education. In today’s article, we’re setting out to debunk some of these common myths, shedding light on the realities of forex trading.

Introduction

Contrary to the belief common among retail traders, institutional traders don’t trade markets like retail traders do. Yes, they engage in speculative transactions just like retail traders do, but that’s the only commonality. To understand how different institutions trade and why, it is important to understand the structure of the foreign exchange market. And this is what we are going to do today.

The foreign exchange (FX) market sets the prices for global currencies, making it crucial for buying and selling goods, services, and financial assets across borders. Professional market participants also see currencies as a unique asset class in itself. This market attracts a diverse crowd, from big banks to regular people worldwide, all participating in shaping currency values.

The forex market is decentralized, which means there is no single clearing center. Trading happens everywhere, all at once. This is essential for understanding the structure of the forex market. Consequently, there cannot be any algorithms governing the market or so-called “smart money” hunting retail traders. More on that later. Keep reading.

The forex market consists of two main levels: the interbank market, where the largest banks trade currencies among themselves, and the retail or client market, which includes transactions through brokers accessible to smaller banks, businesses, and individual traders.

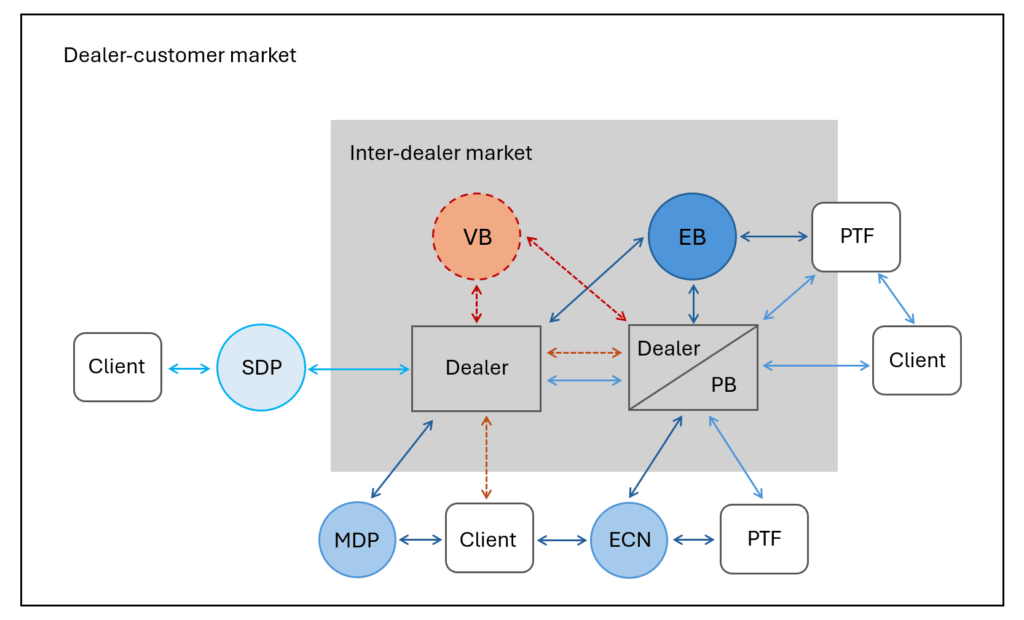

Source: BIS Working Papers No 1094, “The foreign exchange market,” by Alain Chaboud, Dagfinn Rime, and Vladyslav Sushko.

Note: The figure builds on King, Osler, and Rime (2012); EB = electronic broker; MDP = multi-dealer platform; ECN = electronic communication network; PB = prime broker; PTF = principal trading firm; SDP = single-dealer platform; VB = voice broker.

Interbank Market or Interdealer Market

The interbank market is a key part of the foreign exchange market structure. Think of it as the behind-the-scenes marketplace where the big currency deals happen. Mostly, it’s banks trading with each other. Unlike the stock market, there’s no central spot or official exchange for these trades; it’s all over the place and not really governed by any strict rules.

The interbank market is a big part of the forex trading market. It is the biggest trading scene on the planet. This part of the market really sets the pace for everything else in currency trading. It handles huge volumes, and the major players know about currencies, and everything there is to know. Plus, if you’re trading in the interbank market, you’re likely getting some sweet deals on transaction fees because of the massive amounts of money changing hands.

This market plays a big role in keeping the forex market liquid and efficient. It helps financial institutions balance their currency holdings, reduce risks, and ensure they have the currency they need for their operations. Even though most people don’t see this part of the foreign exchange market structure, it’s essential for the smooth running and stability of global currency trading.

The difference between the interdealer and interbank markets can be subtle because the terms are sometimes interchangeable. However, the distinction generally lies in the participants and the purpose of the trades. While all interdealer trading is part of the broader interbank market, not all are in the interdealer market.

Dealer to Customer

The dealer-to-customer segment of the forex market structure is where banks directly trade currencies with their clients. These clients can include corporations, hedge funds, and individual investors. Unlike the interbank market, the bank-to-client market focuses on providing currency trading services to end users.

Trading Environment

At this point, we should clarify that the distinction between various segments in the forex market structure is not as clear-cut now as it may seem at first glance. They are not operating in isolation from one another. On the contrary, they constantly interact. But how do they do that? That’s where trading venues come into play.

In the early 2000s, new online trading technologies emerged that changed how customers and dealers (banks) interacted. One major development was the creation of multi-dealer platforms (MDPs). These platforms allowed customers to ask for price quotes from several dealers at once. This innovation made it easier for customers to compare options and fostered competition among dealers.

In response to this, some banks developed their own trading platforms, known as single-dealer platforms (SDPs), which allowed for direct electronic trading. Over time, these platforms largely replaced older methods like phone or telex for direct trades between two parties.

This period also saw two major changes in the forex market structure. Firstly, there was a growth in trading venues that offered different ways to execute trades, such as streaming prices directly or placing orders in an electronic book—similar to methods used in the dealer-to-dealer market. We call these venues electronic communications networks, or ECNs.

Secondly, principal trading firms (PTFs), companies that trade on their own money, began to challenge banks in the core areas of the market. They started providing and consuming liquidity (basically, making it easier to buy and sell) in central trading systems, known as central limit order books (CLOBs), and later, they also began offering prices directly to customers through ECNs. This allowed these firms to gain a significant presence in parts of the forex market traditionally dominated by banks. Interestingly, these trading firms often rely on services provided by the banks they compete with, through arrangements known as prime brokerage.

Role Of Trading Venues In The Forex Market Structure

Trading venues are marketplaces where all the transactions happen. They are crucial elements in the structure of the foreign exchange market, as they provide a place and rules for fair trading. It’s important to remember that no single venue hosts all FX trading. The rates at which trades are made on different marketplaces can differ dramatically from one venue to another, highlighting the fragmented nature of the FX market. Each trading venue offers its own pricing, liquidity, and volume, making the FX market not a singular entity but a network of interconnected markets.

So, when you hear someone mention the “FX Market,” think of it not as a single marketplace but as a broad network of places where trading occurs. It’s a fascinating web of interactions continuously evolving with technology and market demands.

Not only do market participants differ in size, but execution venues also vary. The size of an execution venue is typically represented by the trading volume it handles. Larger and wealthier participants may have access to a wider range of execution venues. However, most trading venues have specific access requirements based on regulatory status and market role, not merely financial size.

Some financial institutions own their own execution venues, known as single-dealer platforms (SDPs), such as Cortex by BNP Paribas, Neo by UBS, and Velocity by Citi. These platforms serve a broad client base, including large institutional clients.

Moreover, in the interdealer/interbank market, dealers trade with each other in large quantities through interdealer platforms (IDPs), such as EBS Market and Refinitiv Matching, where trading is often anonymous. This segment in the foreign exchange market structure is crucial for large-scale transactions between financial institutions.

Historically, these large execution venues were predominantly the domain of the largest financial institutions. However, access has broadened over time, allowing medium-sized players to participate through arrangements like prime brokerage. In prime brokerage, players can trade under the umbrella of larger institutions, which might charge them a fee based on trading volume.

The “prime brokerage” arrangement involves large banks acting as ‘prime brokers’ (PBs), with medium-sized market participants as their clients. Prime brokers enable these smaller (but not too small) entities to trade almost anywhere in the forex market. Why that is the case? Smaller entities may have limited credit histories or higher risk profiles.

Over time, the distinct lines that once separated the interdealer market from other market segments have become more interconnected. The interdealer market remains a global network of trading venues used predominantly by banks and large non-bank financial institutions (NBFIs) to trade currencies among themselves, both electronically and via voice trading.

This market operates within a highly decentralized yet regulated network where banks and NBFIs negotiate bilateral currency transactions. When we refer to the ‘interdealer market’ or ‘interbank market,’ we’re talking about this network where financial institutions and other large companies negotiate currency deals.

The rates established in the interdealer market influence other market participants and smaller execution venues. Eventually, they serve as “reference” rates. Retail forex brokers typically add a markup to these rates. Then, they are fed to retail traders through retail trading platforms like MetaTrader 4. This may seem unfair, but look up the requirements for direct market access (DMA) with one of the banks. You will be “amazed,” and not in a good sense.

Retail Brokers And Their Place In The Forex Market Structure

Retail forex brokers vary significantly in size and have different market access levels. Large retail forex brokers may enter into a prime broker relationship with a bank or an even larger broker. This will allow them to trade in the name of the PB. Smaller brokers, seen as too risky by large banks, often need help securing such relationships. Instead, they might rely on ‘Prime of Prime’ (PoP) brokers. Prime of Prime brokers are medium-sized entities. They extend the capabilities of a prime broker to smaller brokers, enabling them to participate indirectly in the FX market.

Prime of Prime (PoP) brokers serve as intermediaries that enable smaller retail forex brokers to access the trading resources typically reserved for larger institutions. In other words, they are leveraging their credit relationships with prime brokers. PoPs provide these smaller brokers with the necessary liquidity and market access.

Smaller retail forex brokers often rely on relationships with larger brokers or PoPs to trade alongside the major players in the market. This is crucial because direct access to major liquidity pools and credit lines might be out of reach due to their size or capital limitations.

Prime of Prime (PoP) brokers act as an intermediary of an intermediary in the forex brokerage ecosystem. Prime of Prime brokers enhance liquidity access and credit intermediation. They act as a bridge between smaller market players and the large-scale trading infrastructures that prime brokers maintain.

As you can see, it’s already difficult enough for retail forex brokers themselves to gain access to the FX market. If other participants deem them too risky to trade with directly without some intermediary (PB or PoP), why would they want to deal with individual retail forex traders? Sorry to rain on your parade, but retail forex traders do not trade in the “market.” Your broker creates its own market for you to trade in. That’s why they are called market makers. You deal with, and ONLY with, your forex broker. When you enter an order, your broker takes the opposite side. And your order doesn’t leave the servers of your forex broker. This is true for almost ALL retail forex brokers.

Forex Market Structure – FAQ

Who are the main players in the forex market?

Major players include central banks, commercial banks, hedge funds, multinational corporations, and retail traders. Each operates on different levels of the market structure.

What is the interbank market?

The interbank market is where large banks trade currencies directly with one another. It’s the core layer of the forex market, providing most of the liquidity.

Is the forex market centralized?

No, the forex market is decentralized. There is no central exchange; instead, trading takes place over-the-counter (OTC) between participants globally.

How do retail traders access the forex market?

Retail traders access the market through online forex brokers, who aggregate prices and liquidity from larger players or liquidity providers.

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

REFERENCES

- BIS Working Papers | No 1094 | 27 April 2023 | by Alain Chaboud, Dagfinn Rime and Vladyslav Sushko

- BIS Quarterly Review | December 2022 | by Mathias Drehmann and Vladyslav Sushko

- Microstructure of Foreign Exchange Markets | February 2019 | by Martin D.D. Evans and Dagfinn Rime

- The Anatomy of the Global FX Market through the Lens of the 2013 Triennial Survey | BIS Quarterly Review | December 2013 | by Dagfinn Rime and Andreas Schrimpf

Follow Finansified for More Insights About the Forex Market

With decades of experience in the Forex market, we’re here to share the insights and strategies that have stood the test of time. Follow our website for valuable trading tips and expert analysis and advice to elevate your trading game to the next level.