Monetary policy refers to the actions taken by a central bank to control the money supply and interest rates in an economy. A central bank implements this policy using several tools that help manage critical factors like inflation, economic growth, and financial stability. These decisions are based on economic indicators such as inflation rates, GDP growth, and employment levels. Remember, monetary policy is just one part of the overall economic strategy. Our goal is to explain how monetary policy works, the different types of policies, and the tools involved. So, grab a cup of coffee and let’s get started.

Monetary Policy Defined

A simple definition of monetary policy is the actions undertaken by a central bank, such as the Federal Reserve in the United States, to influence the availability and cost of money and credit. These actions promote national economic goals involving the management of interest rates and control of the money supply to achieve objectives like controlling inflation, managing employment levels, and stabilizing the currency.

Now that we have defined monetary policy let us focus on the actions undertaken by a central bank and their types. In other words, we will break down how monetary policy works.

Different Types

A central bank may employ two main types of monetary policy, depending on the economic situation.

If the economy is sluggish, they may roll out Expansionary Monetary Policy. This aims to stimulate the economy by increasing the money supply and lowering interest rates, making borrowing cheaper. The idea behind this is quite simple and logical. Low-interest rates make credit more affordable. Consumers and businesses use this cheap money to increase consumption and economic investment. In practice, this may only sometimes work as central banks intend.

On the other end of the spectrum is Contractionary Monetary Policy. If the party of consumption and investment becomes too wild and is on the verge of spinning out of control, a central bank may step in and employ emergency breaks because Contractionary Policy is essentially a break. It aims to curb inflation and stabilize the economy by decreasing the money supply or increasing interest rates, making borrowing more expensive.

The central bank employs various tools to implement these policies, including adjusting the interest rates, buying or selling government bonds, and changing the amount of money banks must keep in reserve. That’s the gist of how monetary policy works.

How does the central bank implement monetary policy?

Central banks usually have several tools in their toolbox of things they can whip out to sway the economy one way or the other.

Traditional Tools

Conventional tools of monetary policy are:

- Open market operations

- Reserve requirements

- Official Interest Rate (the name may vary from one central bank to another).

Let us take a more detailed look at each one of them.

Open Market Operations

A central bank can increase or decrease the money in the economy. It can do it by buying or selling government bonds to commercial banks. When the central bank buys government bonds from commercial banks, it increases the banks’ reserves. Bank reserves are the money they have on their hands. It can encourage the banks to lend more money to individuals and companies. It can lead to more money circulating in the economy*. Suppose the central bank sells government bonds to commercial banks. In that case, it reduces their reserves, making it harder for them to lend money and decreasing the amount of money in the economy. The central bank can use these operations to target a specific level of reserves or interest rates for the banks.

*Please refer to “Paper Money and the Money Creation Process” to explore the “money multiplier” mechanism.

In 2023, the Federal Reserve continued its policy of reducing the size of its balance sheet, a part of its open market operations. Throughout the year, the Fed focused on decreasing its Treasury and agency mortgage-backed securities (MBS) holdings. Specifically, the holdings of Treasuries declined from $5.5 trillion to $4.8 trillion, driven mainly by redemptions of Treasury coupon and bill securities. Meanwhile, the agency MBS holdings decreased from $2.6 trillion to $2.4 trillion. The overall reduction in these securities significantly decreased the Fed’s total assets (New York Fed).

Reserve Requirements

Another monetary policy tool central banks can use to impact the supply of money is reserve requirements.

In a fractional-reserve banking system, banks must keep a certain portion of their depositors’ money in reserve, either holding it as cash in their vaults or depositing it with the central bank. This reserve requirement ensures that banks have enough funds available to meet a reasonable amount of customer withdrawals.

This means that central banks can require banks to keep more money in reserve instead of lending it out. The more money banks must save in reserve, the less they can lend out; therefore, the less money the economy creates. However, this policy is only sometimes used in developed economies because it can be disruptive for banks.

If a central bank suddenly raises reserve requirements, banks might have to stop lending until they have enough reserves, which could slow economic growth.

Nonetheless, reserve requirements are still used in some developing countries to control lending and remain an option for central banks that do not currently use them.

The Central Bank’s Interest Rate

Last but not least, interest rates are the monetary policy tool that central banks like the most. Central banks use interest rates to control economic activity. They set an interest rate (it may have different names across different central banks, but we will use “interest rate” for our purposes here) that they will lend money to commercial banks, which is called the policy rate. This rate influences short-term and long-term interest rates, affecting the cost of borrowing for regular people and organizations.

Why Commercial Banks Increase Their Interest Rates

Commercial banks usually increase their interest rates when the central bank raises its policy rate. It can affect people’s and businesses’ borrowing costs and potentially slow economic activity. A commercial bank uses the base rate to calculate lending rates for all its customers. The rate for large corporate clients is often the base rate plus a certain percentage, while small corporate clients may have to pay a higher percentage. However, why would commercial banks raise their base rates immediately after the central bank’s refinancing rate increase?

The reason is that commercial banks do not want to lend money at a lower interest rate than what they would pay the central bank. The central bank can create a deficit of money through open market operations. This will force commercial banks to sell bonds at an agreed-upon repurchase price, known as a repurchase rate. The central bank would set the repo rate at the official refinancing rate, thus earning a profit on these transactions.

A central bank can control the amount of money in the money markets by setting a policy rate. If the policy rate increases, banks are more likely to hold onto their cash reserves. They would do this to avoid paying high penalties to the central bank if they run out of funds. As a result, banks will be less inclined to lend out money. Ultimately, this will result in a decrease in the growth of the overall money supply.

Countries use different monetary policy tools and strategies when managing their money. We’ve given you a general idea of how it works, but if you want to know more, we suggest doing some research on your own to understand better how it works in different parts of the world.

Depending on the situation in the economy central banks may employ any of these policies in isolation or all together. That’s how monetary policy usually works.

Why Should Market Participants Understand Different Policy Tools?

First, central banks’ actions really do affect the economy and financial markets. By understanding how monetary policy works, the tools central banks use for monetary policy, like adjusting interest rates or managing the money supply, market participants can better understand how these moves might impact inflation or economic growth. This insight is super helpful when deciding where to put their money.

Next, central bank decisions also play a big role in setting asset prices and overall market conditions. Monitoring these decisions helps market players stay one step ahead, adjusting their investment strategies to catch the right wave before it breaks.

Plus, when central banks conduct open market operations or tweak reserve requirements, they directly affect things like how much credit is available or borrowing costs. Knowing this can help investors and businesses plan their next moves.

Unconventional Policy or Communications by Central Banks

Also, how central banks talk about their plans and policies shapes what the market expects to happen next. By tuning into this chatter, investors can understand where things might be headed and make smarter choices.

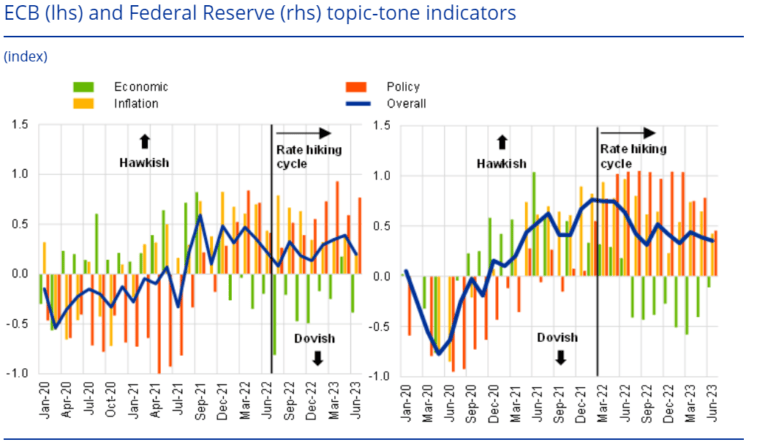

Central bank communications significantly influence market expectations and investment decisions. For instance, the Federal Reserve and the European Central Bank (ECB) adjusted their communication tones in early 2021. This signaled more restrictive monetary policies before actual rate hikes were implemented. This change in tone was a crucial indicator for markets about forthcoming monetary tightening. And it was detected through analyses of their public statements and press conferences.

Sources: ECB Governing Council press conference transcripts, Federal Open Market Committee meeting statements and press conference transcripts, and ECB staff calculations.

Notes: The overall ECB tone reflects the average across the economic, inflation and policy tone for Governing Council communications during press conferences. The overall Federal Reserve tone reflects the average across the economic, inflation, labour market (not shown) and policy tone indicators for Federal Reserve communication.

Latest observations: June 2023 meetings. (Source)

For example, when the ECB started raising interest rates in mid-2022, this was preceded by a shift to a more hawkish tone in its communications. This impacted benchmark interest rates and shaped market expectations before the policy implementation. This illustrates how central bank words can guide market sentiments and expectations. If investors had paid attention, they would have made more informed decisions based on the projected path of monetary policy.

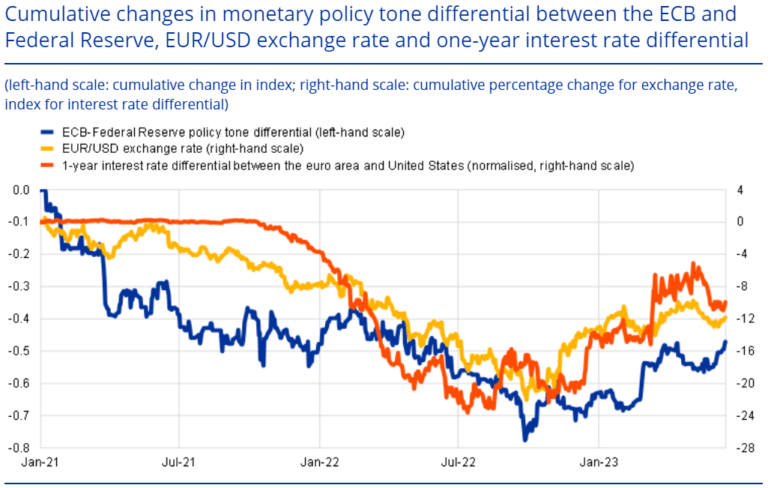

Sources: Refinitiv Datastream, Bloomberg, ECB Governing Council press conference transcripts, ECB Executive Board members’ speeches and interviews, Federal Open Market Committee meeting statements, press conference transcripts and minutes, Federal Reserve Board Governors’ speeches and congressional testimonies, and ECB staff calculations.

Notes: The policy tone differential reflects not only meeting communication but also inter-meeting speeches, interviews and testimonies before lawmakers. Due to the volatility of inter-meeting communication, the tone differential reflects a six-month moving average. The one-year interest rate differential is calculated as the difference between the one-year euro area and US OIS rates. Latest observations: 17 June 2023. (Source)

Understanding and interpreting these signals from central banks can thus provide investors and financial analysts with a critical edge in navigating the financial markets effectively. In other words it can help them to better understand how monetary policy works.

Lastly, it’s important to remember that shifts in monetary policy aren’t just local events—they ripple across the globe, affecting everything from exchange rates to where capital flows.

So, understanding how central banks use their monetary policy tools helps market participants make informed decisions.

Bottom Line

Since we are analyzing these topics through the lens of the foreign exchange market, it’s crucial to understand fundamental analysis. It isn’t about checking a Fed meeting once and forgetting about it. The key is to make it a habit to watch or read their press conferences regularly to spot changes in rhetoric before everyone else does. Up to 90% of retail traders lose money, often because they repeat the same mistakes. Don’t be part of that statistic; educate yourself. Learn how monetary policy tools work and how they affect the economy and the financial markets.

The main takeaways of todays article on how monetary policy works:

- We defined monetary policy,

- We learnt about different types of monetary policy

- We found out how central banks implement monetary policy

- We looked at traditional tools of monetary policy.