We continue to report from the frontlines of the Forex industry. Today, we are going to focus on something most retail traders don’t fully understand: the data feed of a Forex broker. Many retail traders, especially novices, have only a vague understanding of what it is and what it represents. This is understandable—we get it, you’re busy with important tasks like looking for the next guru or following advice from someone on TikTok.

In today’s article, we will try to remedy this situation by taking a deep dive into this topic. We will explain what the data feed is, what information it contains, and why traders should understand it. Now, get yourself a nice cup of coffee, because we are about to begin.

What is Data Feed in Forex Trading?

In the context of forex trading, a data feed refers to the continuous and real-time supply of market data that traders use to make informed decisions. The most crucial element of a data feed is the price feed, which provides live bid/ask prices for currency pairs and allows traders to see the real-time cost of buying or selling.

A data feed also delivers updates on various other market data, including, but not limited to:

- The amount of a currency pair being traded (volume)

- Information on the current buy and sell orders at different price levels (order book depth)

- Some historical data might be included, but it may be limited, and traders might need separate subscriptions for extensive analysis.

Forex brokers source data feeds from exchanges, liquidity providers, and financial news services. They are delivered in a format easily integrated into trading platforms, algorithms, and analysis tools.

The term “data feed” is often used in Forex trading, but retail traders often misunderstand its meaning. For instance, a trader might express dissatisfaction to their broker about the execution price. Let us say when he/she checks the XAUUSD (gold) price on their broker’s trading terminal, they see the following price of 17,000.000*, but when they check the price for that exact instrument on other platforms (e.g., Google Finance, Yahoo Finance, Investing.com, etc.), they see a different price of 19,000.000*. This discrepancy is due to the different data feeds used by the broker and the platforms we mentioned above.

*Purely hypothetical example.

As a result, the trader accuses the broker of fraud. However, the trader is wrong in this situation. The reason is simple: they don’t understand where the broker’s price of 19,000 came from. The reason is straightforward – it’s the data feed the broker receives.

It’s important to remember that FOREX is an over-the-counter (OTC) market. This means that we can’t directly compare prices from different platforms with the prices you see in your broker’s trading terminal. The reason is simple: they come from different sources (liquidity providers). Forex brokers (technically, they are dealers) receive their prices in the form of a data feed. To put it in perspective, imagine going to KFC and expecting to buy a burger at the same price as at McDonald’s. The same goes for the situation described above – the product is the same, but the quotes come from different sources.

For small Forex brokers, the sources of prices can be prime brokers or banks. Consequently, they receive the data feed formed by the clients of that prime broker or bank.

Order Book

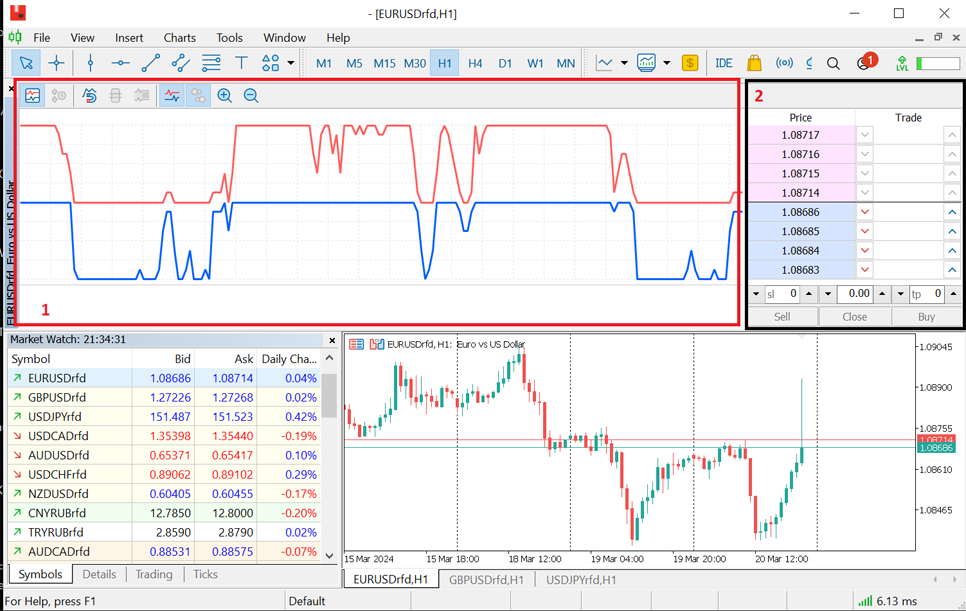

Imagine numerous traders, all with trading terminals, placing their orders. These orders create two lists: buy orders and sell orders—the former form the terminal’s Ask prices, and the latter form the Bid prices. This list of prices is called the “order book.” In the MetaTrader5 trading terminal, it looks like this:

The chart at the top of the screenshot, is a “tick chart.” The trading terminal generates it from the best BID/ASK prices. To the right of this chart, you can see a window marked with two columns “Price and “Trade””. It shows the list of prices highlighted in pink and blue. This is the “order book.”

Notice that the column on the right, “Trade,” is empty. This column should display the declared volume of an order. If the terminal doesn’t display the volume, it likely means that your broker is the counterparty to your trade. In this case, the broker is acting as a market maker. Volumes are essential because, for example, let’s assume the order book looks like the one in the picture below.

Now, let us say, you put in an order to buy 80 million at the market price. Here’s where things can get tricky.

As you can see, the best price to buy is 1.08714, but at that price, you can only purchase 4 million out of the 80 million you want. If you place a market order, this will be the volume of your trade. After this, the volume and price will disappear from the order book. The next best price will be 1.08715, but this volume will also be insufficient. So, to fulfill your order, your broker will use multiple prices from the order book: 4+12+13= 29 million, meaning the remaining 51 million will come from the topmost row.

The total price of your order will be:

Order_price = (1.087144 + 1.0871512 + 1.0871613 + 1.0871751) / 80 = 1.087164

The best price in the order book was 1.08714, but your order’s price ended up being 1.08716, which means that “price slippage” has occurred.

However, it is a pretty standard situation when a larger order is executed in parts. Considering that a standard lot in FOREX is 100,000 units, the 80 million in the example equals 800 lots. That’s a very large trading volume and quite expensive. For illustration, a trader on FOREX with a leverage of 1:100 and a deposit of $5,000 has access to a volume of about 5 lots:

Lots = 5,000*100/100,000 = 5, while in the example above, it’s 800.

This is why the “Trade” column in the order book is empty. Since your trading volume is relatively small, the broker will fully execute your order immediately at one of the prices from the order book. However, there are some nuances: in most cases, you don’t need large trading volumes; that’s why brokers will use only the first few prices for execution, but these prices won’t be the best from the order book. Additionally, the counterparty to your trade will be the broker themselves.

What Are Ticks?

Order execution by an MT broker is different from what we described earlier. Here’s why: for small order volumes, the broker doesn’t need to consider the trading volume of the order book. Instead, the trading terminal receives an anonymous stream of prices. In professional lingo, we call these prices “ticks.”

In the context of data feeds, ticks refer to the smallest unit of data representing changes in the price, bid, or ask quotes of a financial instrument. A tick in data feeds represents a single update in the market data, which could be a trade price, bid price, ask price, or other relevant market information change. Ticks provide the most granular level of data, capturing each individual price movement or market update. The most crucial element of a data feed is the price feed, which provides live bid/ask prices for currency pairs and allows traders to see the real-time cost of buying or selling.

Slippage

To protect against scalpers who try to trade with orders that live less than a couple of seconds, the broker might artificially delay order execution. They can achieve this in two ways: delaying the execution time or waiting for a certain number of ticks from the liquidity provider after you place your order.

If your broker delays the execution time, just one second is usually enough to achieve their goal. If they use ticks to delay the execution, two or three ticks after receiving the order should suffice. What this means in practice is that they execute your order at the price that follows the original cost of your order, resulting in slippage.

“Execution with slippage” is nothing extraordinary. The terms and conditions that you agree to when you open an account with your broker usually have a clause covering this situation, and it is a standard practice, by the way. Complaining that the broker executed your order at a price that was different from what you saw in the trading terminal is pointless. It is a standard practice in the industry, and the regulator will almost certainly side with the broker.

Gaps

Another interesting point is the sudden price jumps by several dozen points, known as Trading Gaps. These jumps typically occur during the release of economic data, political events, or at the opening of a trading session.

Regarding gaps, your orders will also experience delays in execution. Upon receiving a price that differs from the previous one by several dozen pips, the broker’s trading server will consider it an error and wait for “confirmation” at the same level in the form of several ticks. If these ticks come in, your broker will use them to execute your order.

These subsequent ticks are what the broker will refer to as the “first prices in the market” (the wording might vary, but the idea is the same). However, the very first tick after the gap won’t trigger your order. This, too, is standard practice, and the regulator will side with the broker. It doesn’t concern you even if a single trade occurred at that price with a prime broker. The broker will execute your order once they receive several new “confirming” prices in the data feed from their Liquidity Provider. This is known as “execution with slippage at the first market prices after the gap.”

You don’t need to fight this. It’s an established practice in the retail FOREX market. Just keep this information in mind and consider it when developing your trading strategies.

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Gain the winning edge in the trading market with insights from a seasoned Forex industry veterans Finansified. Follow our blog for tried-and-true trading strategies, market trends, and expert analysis to boost your trading success.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.