Key Takeaways: This article explains the federal budget deficit and public debt definition, how they are interrelated, and why they matter. The federal budget deficit refers to when government spending exceeds revenue, while public debt is the accumulation of these deficits over time. Both impact the economy, financial markets, and currency values. We explore how deficits arise, how debt is managed, and what it all means for economic stability and investor confidence. Updated 2025.

What Is the Federal Budget Deficit and Why Should We Care?

A budget deficit arises when the federal government’s expenses exceed its revenues within a given fiscal period, necessitating borrowing to bridge the gap and ultimately inflating the national debt. Governments often run deficits to finance various activities, such as infrastructure projects, social programs, or stimulating the economy during economic downturns.

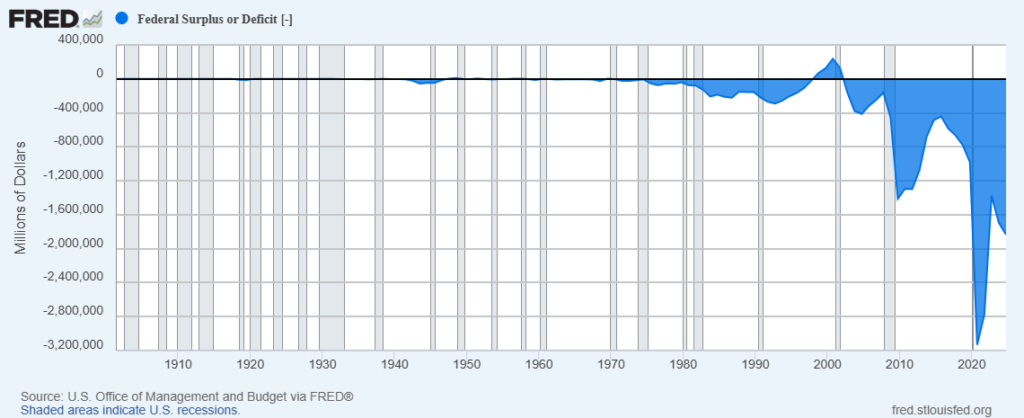

For example, in the fiscal year 2024, the United States faced a deficit of roughly $1.8 trillion, partly fueled by mounting interest payments and increased outlays for older Americans. This upward trend persisted into the first five months of fiscal year 2025, spanning October 2024 through February 2025, as the deficit reached $1.147 trillion, compared to $828 billion over the same interval a year earlier.

Looking ahead, the Congressional Budget Office estimates that existing laws and policies will result in a cumulative $20 trillion in federal deficits from 2025 to 2034, while debt held by the public is projected to climb to 116 percent of GDP.

What Is the Public Debt Definition and How Does It Reflect a Nation’s Financial Health?

Understanding the public debt definition is key to grasping how a nation finances its spending. National debt—often referred to as public or sovereign debt—is simply the total money a government owes to its creditors. This amount grows when government expenditures outpace revenues, resulting in budget deficits that must be financed through borrowing.

Governments usually borrow by issuing debt instruments like bonds and securities, which are purchased by both domestic and international investors. In the United States, the national debt is split into two primary categories. The first is Debt Held by the Public, which includes Treasury securities owned by individuals, corporations, foreign governments, and other non-governmental entities. The second category is Intragovernmental Holdings—non-marketable Treasury securities kept in accounts for federal programs such as the Social Security Trust Fund.

As of October 2024, the U.S. national debt reached roughly $35.8 trillion. Economists often compare this figure to the country’s gross domestic product (GDP) to assess debt sustainability. The reason for that is a high debt-to-GDP ratio could signal potential challenges in meeting future obligations and maintaining economic stability. Persistent increases in national debt may lead to higher interest payments, reduced public investment, and less flexibility in policy-making. As a result, the careful management of public debt is crucial for long-term economic health.

Federal Budget Deficit Vs. Public Debt

Now that we have a handle on what the federal budget deficit is and a working definition of public debt, we can contrast these things. A budget deficit occurs when a government’s expenditures exceed its revenues within a given fiscal year. This results in a shortfall that must be covered by borrowing. This annual gap between what the government earns, mainly through taxes, and what it spends, highlights the immediate challenges in managing public finances.

In contrast, the national debt represents the cumulative total of all past budget deficits, minus any surpluses. It is the aggregate amount the government owes to its creditors at any point in time. Essentially, while the budget deficit is a yearly measure of financial imbalance, the national debt reflects the long-term impact of these deficits over time.

Although a budget deficit highlights short-term fiscal challenges, its persistent occurrence contributes to a growing national debt. And this is what can influence economic stability and shape future policy decisions.

How Do Governments Manage Deficits?

Now, let’s take a closer look at some factors contributing to deficits. Economic fluctuations play a significant role as economies go through cycles of expansion and contraction. Government revenues tend to decrease during economic downturns or recessions due to lower economic activity. At the same time, governments often increase their spending on social programs and stimulus measures to support the economy. These factors can lead to deficits during challenging economic periods.

Structural factors within government budgets also contribute to ongoing deficits. Programs like social security or healthcare, designed to provide long-term support to specific population segments, can lead to increased costs over time. While governments may aim for balanced budgets or surpluses, achieving and maintaining them is challenging due to these factors. Governments must strike a balance between addressing immediate needs, promoting economic growth, and managing the long-term sustainability of their finances.

Additionally, political considerations also influence federal budget deficits. Governments face pressure to fulfill promises and provide public services requiring substantial spending. Balancing these demands while maintaining a balanced budget can be challenging. Politicians may prioritize short-term goals or implement policies that require deficit spending to gain political popularity.

Understanding How Debt and Deficits Shape Economic Stability

Now, let’s focus on the impact of debts and deficits on an economy. If an economy experiences real growth, tax revenues increase, enhancing the ability to service a growing real debt. However, if the real growth lags behind the real interest rate on the debt, the debt ratio worsens. This is because the debt burden, determined by the real interest rate multiplied by the debt, grows faster than the economy. So, an important consideration for governments and their creditors is whether additional spending generates sufficiently higher tax revenues to cover the interest on the debt used to finance the extra spending.

Furthermore, within a national economy, the real value of the outstanding debt may decrease if the overall price level rises, causing inflation. This results in a rise in nominal GDP, even if real GDP remains relatively stable. The debt-to-GDP ratio may not increase significantly. If the general price level falls, leading to deflation, the ratio may remain elevated for an extended period.

Additionally, rapid increases in net interest payments and a loss of investor confidence in a government’s ability to honor its debts can escalate financing costs and create an unstable situation. In conclusion, having a firm grasp of deficits and the national debt is crucial for comprehending a country’s fiscal situation. By grasping these concepts and their implications, we can gain insights into economic stability, sustainability, and the factors that shape fiscal policy.

Should We Be Concerned About the Size of the National Debt (Relative to GDP)?

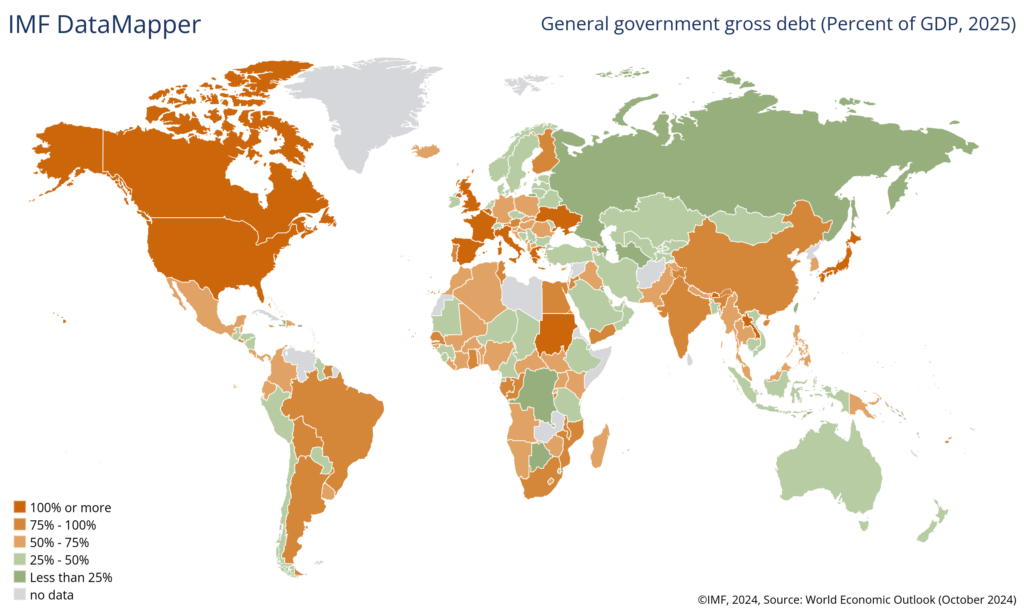

It’s natural to wonder whether the size of a country’s national debt relative to its GDP should be a cause for concern. While some government debt is perfectly normal—and even necessary—too much debt can certainly pose risks. Let’s look at why this matters.

First, there’s debt sustainability. When debt grows faster than the economy, it can become tough to manage. Countries might struggle to meet their interest payments, increasing the risk of default or forcing them into severe spending cuts and austerity measures.

Next up is economic stability. Large debts can disrupt an economy by driving up borrowing costs, crowding out private investment, and leaving fewer resources for productive government spending. High debt levels can also lead to higher interest rates, inflation, and a loss of investor confidence.

Another important factor is fiscal flexibility. A high debt-to-GDP ratio can restrict a government’s ability to respond effectively during economic downturns or emergencies. This limitation means policymakers might not have enough flexibility to support the economy when it’s needed most.

Inter-generational equity is also a crucial consideration. Excessive debt today often means future generations will face the music. In practical terms, we are talking about higher taxes or reduced public services, potentially affecting their standard of living.

However, it’s worth noting that what we consider a manageable debt level can differ significantly between countries. Factors such as economic strength, institutional stability, and fiscal discipline all play essential roles. Countries with higher debt ratios might still maintain economic stability. How? Well, if they have solid economic fundamentals, credible policies, and strong investor confidence.

Overall, while we can expect some level of national debt, in fact, it is often beneficial. However, excessive debt levels relative to GDP should prompt careful monitoring and prudent financial management.

How Debt and Deficits Affect a Country’s Currency?

First, there’s inflation. When government spending exceeds its income, it often covers the shortfall by issuing debt. If this debt becomes too large, the government might resort to printing more money to manage repayments. Printing more money increases the amount of currency in circulation, reducing each unit’s purchasing power, which we experience as inflation.

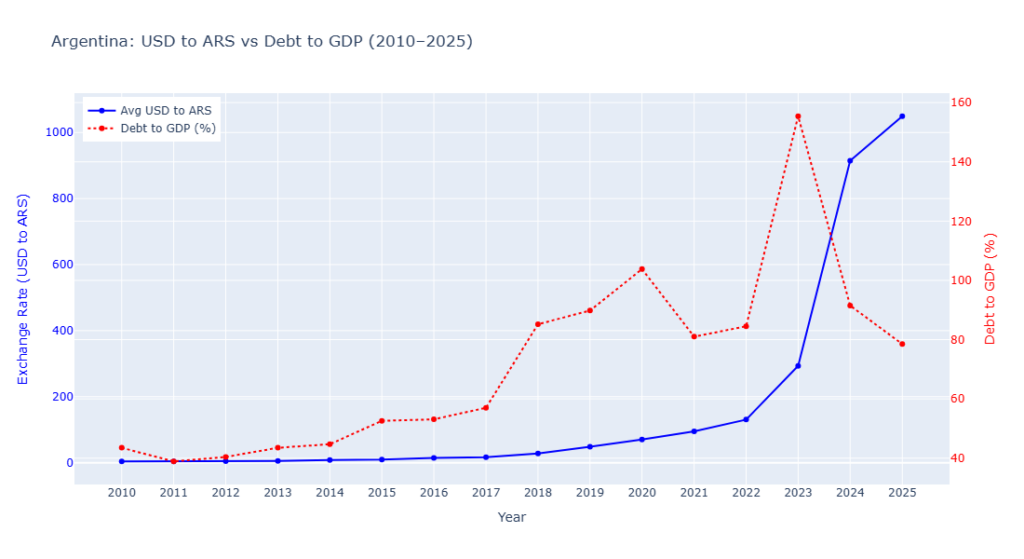

In the past few years, the Argentine government has heavily relied on its central bank to finance budget deficits by printing money. Combined with economic mismanagement and a lack of investor confidence, this has led to skyrocketing inflation, surpassing 200% in 2023. Prices have soared, wages have struggled to keep up. As a result the Argentine peso has lost significant value against the U.S. dollar. We conducted a small research and plotted the value of the ARS in relation to the dent to GDP ratio.

Interest Rates: Balancing Debt Attraction and Currency Stability

Next, interest rates play a significant role. Governments may offer higher interest rates to make their debt attractive to investors. These higher rates can attract foreign investment, boosting the currency’s value in the short term. However, if debt levels become excessively high, it can trigger inflation, eventually lowering the currency’s value again.

Thirdly, investor confidence is crucial. If investors start doubting a country’s ability to repay its debts, they may sell off that country’s currency holdings. This sell-off can cause the currency’s value to decline. Additionally, a currency’s exchange rate often mirrors global perceptions of a country’s economic health. Countries burdened by significant debt are typically seen as higher-risk, further weakening their currency.

Another important factor is the government’s capacity to stimulate the economy. High debt levels can restrict government spending during economic downturns. This restriction can prolong economic struggles and weaken the currency further.

Trade Deficits and Their Influence on Currency Valuation

Finally, trade deficits also impact currency value. A persistent trade deficit means a country imports more than it exports, exerting downward pressure on its currency.

While national debt and deficits undeniably influence a country’s currency, their exact effects depend on a broader range of economic conditions. Therefore, it’s important to always look at the full economic context.

Frequently Asked Questions

What is the difference between a federal budget deficit and public debt?

The federal budget deficit refers to the annual shortfall when government spending exceeds revenue. Public debt is the total amount the government owes from accumulating past deficits.

How does the national debt affect everyday citizens?

High national debt can lead to inflation, higher taxes, reduced government services, and slower economic growth, all of which affect consumers and businesses alike.

Can a country operate indefinitely with a budget deficit?

Running a deficit isn’t necessarily harmful short-term, especially during recessions. However, long-term structural deficits without growth or fiscal reform may lead to unsustainable debt burdens.

Conclusion

Understanding the federal budget deficit and public debt definition is essential for anyone interested in economics, investing, or public policy. These two concepts reflect not only a government’s current financial situation but also its long-term sustainability and policy flexibility. While some level of debt and deficit is normal—and sometimes necessary—persistent imbalances can affect inflation, interest rates, and currency stability. Monitoring these metrics within the broader economic context allows policymakers, investors, and the public to make more informed decisions.

SOURCES OF INFORMATION USED IN THIS ARTICLE:

- The International Monetary Fund (IMF) is a global organization of 191 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty worldwide.

- “Fiscal Data” is a website, fiscaldata.treasury.gov, created by the Bureau of the Fiscal Service within the U.S. Department of the Treasury, that provides accessible, easy-to-use federal financial data and resources to inform the public and promote transparency.

- FRED is an online database consisting of hundreds of thousands of economic data time series from scores of national, international, public, and private sources.

- The Peter G. Peterson Foundation is a foundation established by Peter G. Peterson and dedicated to addressing America’s long-term fiscal challenges to ensure a better economic future.