We continue to report from the trenches on the frontlines of forex trading. Today, we dive into passive trading, focusing on “copy trading.” It is a hands-off approach that allows you to engage in the forex market by mirroring the trades of experienced traders. This strategy offers a pathway for those with limited time or knowledge to participate actively and serves as a learning tool by observing seasoned traders’ decisions in action. However, while copy trading offers potential gains, it’s crucial to approach cautiously as risks loom if the chosen traders don’t perform as expected. Implementing risk management strategies, such as starting with a demo account, can help mitigate these risks.

How Does Copy Trading Work?

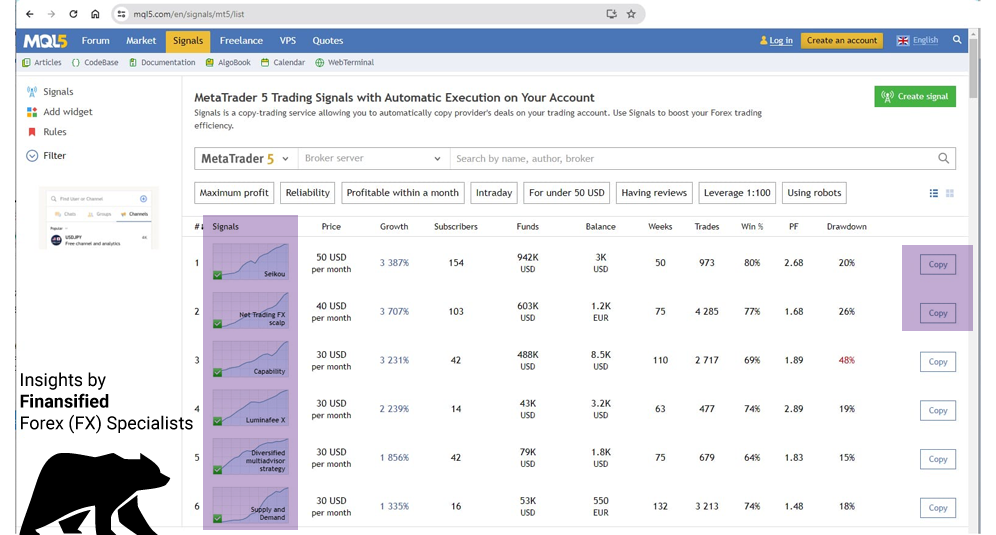

If you’re hesitant or nervous about trading Forex yourself, here’s another option: passive trading by copying trades. With this approach, trades are automatically opened or closed on your account based on signals. Simply pick someone to follow. You can check out the strategy list and their details right here. But remember, choosing the right strategy is crucial. Dig into any signal provider’s background and statistics before subscribing. Understanding these details can save you a lot of grief later. And why not try them out on a demo account first? That way, you’re not putting your hard-earned money on the line right away.

The signal providers’ list

Copy-Trading Service by MetaQuotes

Signals from MetaQuotes is a copy-trading service by MetaQuotes Software Corp., the developer of popular platforms for trading on financial markets, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The main idea behind MetaQuotes Signals is to offer traders the ability to copy the trades of other traders. This social trading platform allows traders to subscribe to signals from experienced and successful traders. The system will mirror all their transactions on the subscribers’ accounts.

How Do You Choice a Signal Provider?

When choosing signals, it’s crucial to consider various charts like growth, drawdown, and trading statistics:

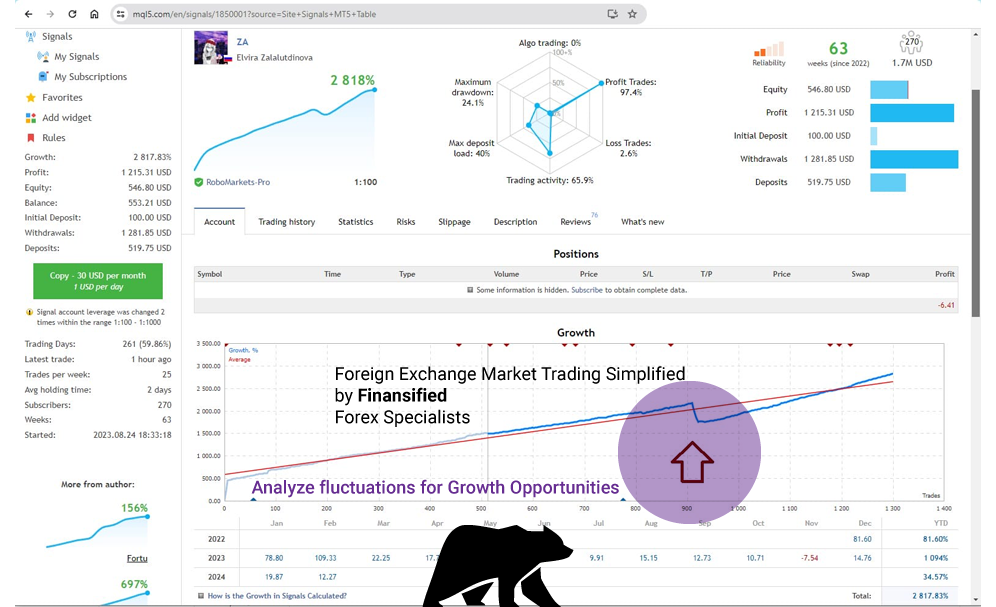

For example, here is the account of one of the trading leaders named ZA.

Let’s delve into the account of one of our trading leaders, ZA. This account has been active for just over two years, starting from December 2022, and all transactions are with real money. Over this period, the account has generated an impressive return of 2,818%. Currently, 270 investors have subscribed to this signal provider, indicating its popularity and reliability. These statistics clearly show the forex signal provider’s performance and can guide your decision-making process.

The chart’s slope indicates that the profit is generated from many transactions that yield small profits. Additionally, the chart shows a section with a significant drawdown. The transaction history shows that trading is conducted on a single currency pair, GBPUSD, with a constant volume of 0.01 lots. Trades generated an average profit of 50 pips, bringing approximately 50 cents per order to the account.

However, one intriguing detail stands out if you take a closer look at the performance chart. One should be very cautious when copying trades of this signal provider. For example, in the screenshot above, there is a section that we’ve highlighted with an arrow. What do you think caused such a drawdown of nearly $400? The explanation is quite simple. In all probability, this account trades using a grid system, which we discussed in our previous publications. If a trade runs (short or long) and the market starts moving in the opposite direction, the signal provider opens additional trades at certain intervals. Such a drop in growth indicates that the trader or trading robot hit a losing streak. In this case, they opened numerous orders, which all started to incur significant losses at one point. Eventually, all orders were closed at once, marring our previously beautiful growth chart.

This forex signals provider is not the only one who uses grid or Martingale strategies to manage accounts. It’s a traditional and easy trading method, similar to gambling in a casino where you keep placing your bet on the same color, increasing your stake each time in hopes of eventually winning.

However, we want to caution you against copying traders of signal providers like that. Grids or Martingale strategies often result in significant losses.

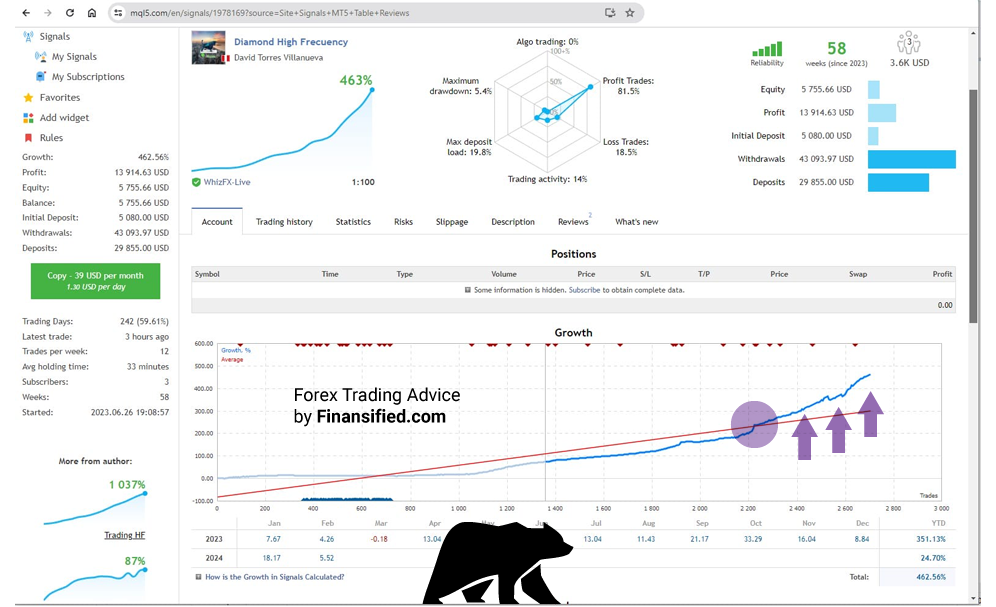

You might argue, if not Martingale or grid systems, what kind of signal provider should you look for? Well, consider this signal – Diamond High Frequency! Among the many good ones, it’s worth looking for ones like it. Why? Let us explain:

The Diamond High Frequency signal, managed by David Torres Villanueva from Peru, stands out…

The account has been trading for fourteen months, focusing on gold. The account’s profit has been increasing gradually. There are losses, but overall, this is normal. There are no solely profitable periods. The important thing is that the profit is growing. And over the year, the account has not been wiped out. If you look at the statistics, you’ll see that volumes increase gradually. The drawdown over the entire period is no more than 5.5 percent. The total return over 14 months amounted to 453 percent.

There are no signs of grid or Martingale strategies. The mere absence of Martingale in trading is a huge plus. This is a fairly good signal provider. The signals have a monthly subscription fee of $39, but the account’s profitability balances this out. It is also worth noting the good trading statistics. This copy-trading service offers many such good signal providers. You just need to find them. There are many convenient filters that you can use to examine the stats of different signal providers.

Using this copy trading platform is pretty simple. Just open and fund a broker account, set up your trading platform, and link it to the manager you’ve picked. Your trading platform must stay on, and your computer must be connected to the internet. A VPS can handle this easily, ensuring you’re always ready to trade. Once set up, the system handles everything. Your trades will automatically mirror your manager’s moves, adjusting the size of your transactions based on the funds available in your account compared to your manager’s. It’s pretty slick for hands-off trading, but picking the right signal provider is crucial. And even with this automated system, you’ll want to keep an eye on your account to know exactly what’s going on.

In our next article, we’ll dive deeper into how to pick the right signals and understand the stats behind them.

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Harness the vast ocean of knowledge and experience of Foreign Exchange Market industry veterans “Finansified”. Follow us for exclusive and professional insights, be in the know with the latest Crypto and Forex industry advice and developments.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.