- Eugene Steiner

- Updated: April 21, 2025

Many people are interested in Forex trading but don’t know where to start. If you are one of those people, consider using a copy-trading service that offers trading signals. Many such platforms are available, but in this article, we will focus on one specific option from MetaQuotes, the legendary trading terminal MetaTrader 4 developer. Most retail Forex brokers offer two trading platforms, MetaTrader 4 and MetaTrader 5. However, it’s important to note that MetaQuotes has discontinued support for MT4, so in today’s article, we will only discuss signals for MT5. We will learn to read different stats on this platform and review several trading signal providers.

What are Trading Signals in Forex?

Trading signals in Forex are suggestions or indicators that provide traders with specific information on when to buy or sell a currency pair. These signals are typically generated by a combination of market analysis techniques, including technical and fundamental analysis, and are used to make informed trading decisions. MetaQuotes has a copy-trading service platform of its own. It is called “Signals.” We know it is not very original, but it is still a legit platform that allows you to copy trades of profitable traders.

How Do You Read The Stats Of Metaquotes’s Copy-trading Service?

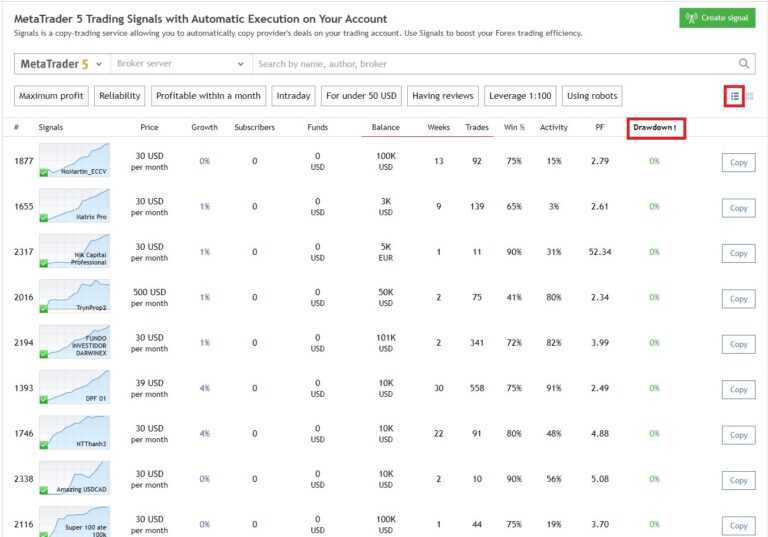

The copy-trading service by MetaQuotes has many different stats that can help us select the best signal provider. We will review them all, but first, we’ll change the main page’s view from tiles to a list. Then, we’ll apply our first filter by ‘Drawdown,’ arranging it from minimum to maximum. What to look out for?

Drawdown

A drawdown, a term commonly used in Forex trading, refers to the reduction in an investment’s value from its peak to its low. In the context of trading signals, it represents the potential loss a trader might experience. A drawdown can never be zero when someone actively trades; there’s no trading without losses. If the drawdown is zero, no losing trades were closed, which is abnormal. It’s also undesirable for this indicator to be too high. We consider values above 10-20% are unacceptable. However, you should decide based on your risk appetite and ability to bear risk.

Time Period

Next, we look at the ‘Weeks’ parameter. Ideally, the trading period should be at least six months or more than 25-26 weeks. We consider anything below these values unacceptable. With a track record of less than six months, there isn’t enough data to adequately assess the trading signal’s reliability or the signal provider’s trustworthiness.

Trade History

If the ‘Trades’ parameter shows only a small number of trades over an extended period, there is a risk that Metatrader 5 Trading Signals might disconnect the signal provider in question. If that happens, you could be left with orphaned trades that are no longer managed. Therefore, a signal provider should execute more than one trade per day. The more trades a signal provider makes, the better, as we have more statistics to understand the signal provider’s trading behavior.

Account Balance

Let’s look at the “Balance” parameter. This represents the amount of funds in the signal provider’s account, excluding open positions. Consequently, this is a crucial parameter since the signal provider trades according to their strategy, which involves calculating the trading volume. For instance, if they have a balance of $100,000 and you have $1,000, and the signal provider opens a trade of 0.1 lots, your account’s corresponding proportionate trade size should be 0.001 lots. However, such small volumes are unavailable on MetaTrader. The standard minimum in MT platforms is 0.01 lots.

Consequently, the trade might not open on your account, and the manager’s strategy might be disrupted on your account. Therefore, choose signal providers with a relatively small balance compared to your deposit. This ensures that trades on your account open correctly and that the risk on your account is proportionate to the risk on the signal provider’s account.

On a side note, many PAMM/MAM account management modules use a mechanic similar to this copy-trading service to replicate trades of a master account on sub-accounts.

Let us Select A Signals Provider

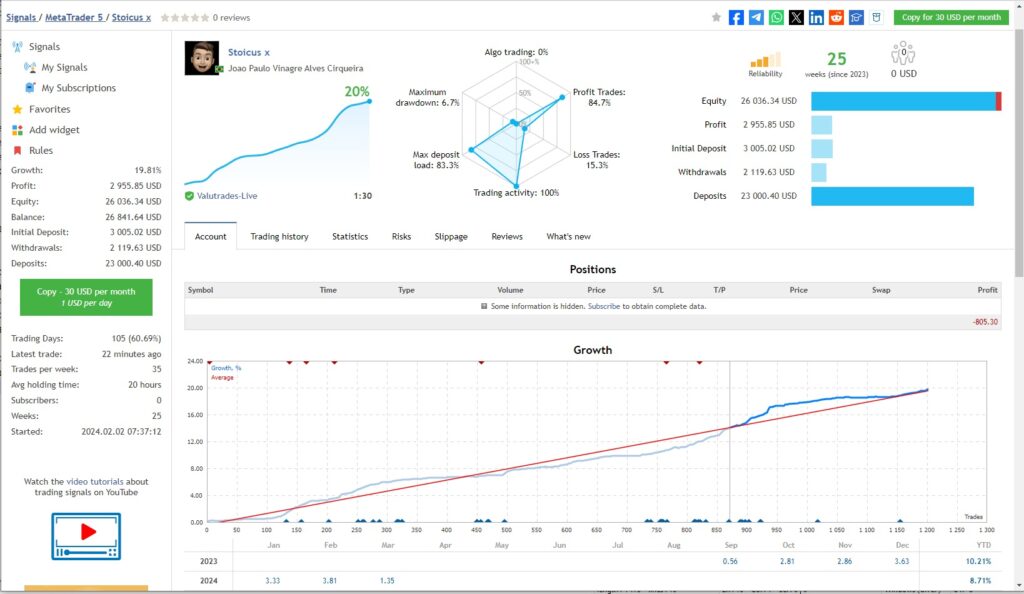

Once you have found an appropriate candidate, you can examine their trading style. So, the next step is to visit their page and review their detailed statistics. For example, let’s examine this provider’s signals, “Stoicus X.”

- Drawdown 7%

- Weeks 25

- Trades 1026

- Trades per week: 35

- Balance 27K USD

- Growth: 19.81%

- Profit: 2 955.85 USD

- Equity: 26 031.92 USD

- Balance: 26 841.64 USD

- Initial Deposit: 3 005.02 USD

- Withdrawals: 2 119.63 USD

- Deposits: 23 000.40 USD

As you can see, this copy-trading service provides a powerful suite of tools. It lets us list the signal provider we like based on their performance and evaluate them based on various metrics.

So far, we like what we see. The numbers look promising. Let’s delve a bit deeper. We’ll examine the trading history to try to understand their strategy. Let’s open the “Trading History” tab.

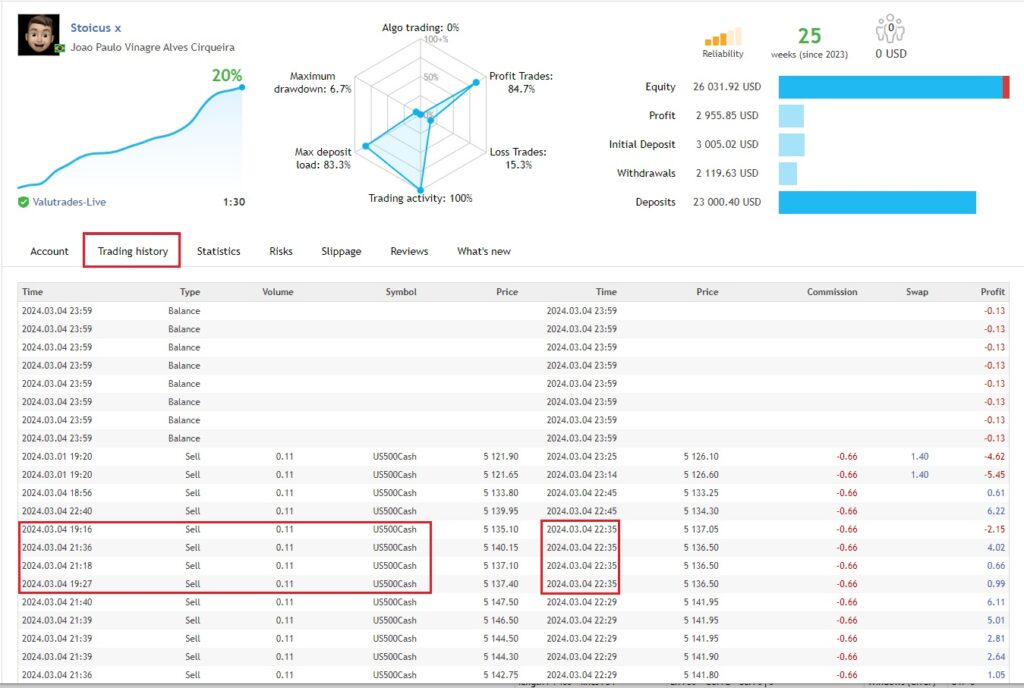

Lo and behold, here’s what we find in their trading history.

There are parts of their trading history where several trades close simultaneously, a hallmark of grid or Martingale strategies. If we examine the volume of these trades, we’ll notice it remains consistent across several of them. This suggests that the signal provider uses a grid strategy, which carries a high probability of loss. On the other hand, if the signal provider were increasing the volume of each successive trade, it would indicate a Martingale strategy, where the probability of loss is even higher. As a result, we conclude that this signal provider is too risky. We’ve discussed grids and Martingales in a previous article. Let’s look for another one.

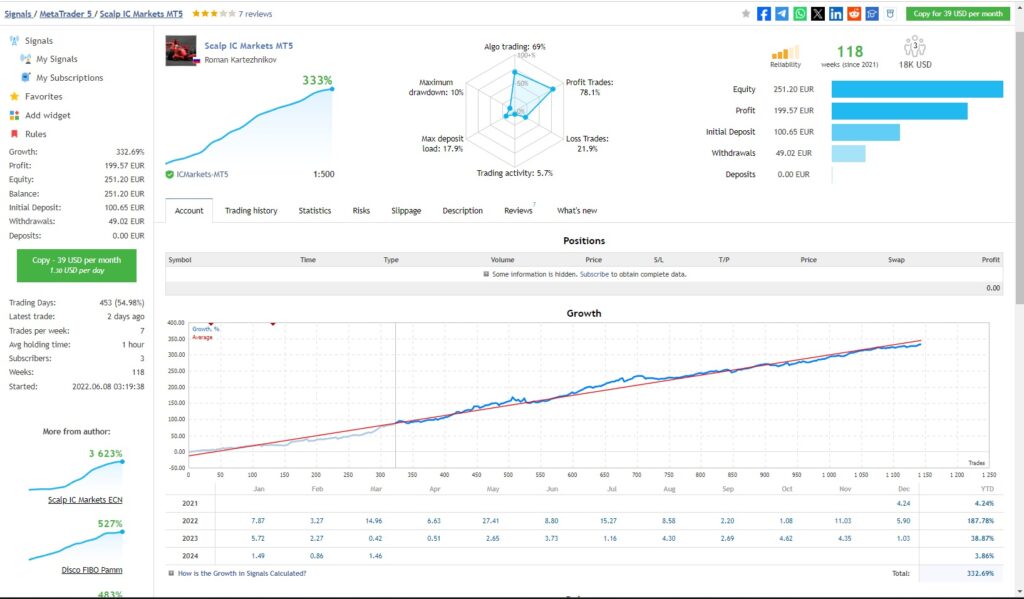

Let us take a look at this one Scalp IC Markets MT5:

- Growth: 332.69%

- Profit: 199.57 EUR

- Equity: 251.20 EUR

- Balance: 251.20 EUR

- Initial Deposit: 100.65 EUR

- Withdrawals: 49.02 EUR

- Deposits: 0.00 EUR

- Trading Days: 453 (54.98%)

- Latest trade: 2 days ago

- Trades per week: 7

- Avg holding time: 1 hour

- Subscribers: 3

- Weeks: 118

- Started: 2022.06.08 03:19:38

All in all, this signal provider looks promising. It features a relatively small balance size, the risk seems acceptable, and it has a good track record. It doesn’t appear to use grid or Martingale strategies. The subscription fee is currently $39 a month, which is quite reasonable given the potential profitability. Overall, it seems like a solid choice. The only drawback we’ve noticed is that it employs a scalping strategy, making multiple trades for very small profits. This means that if the quality of order execution on the signal provider’s account differs significantly from that of your broker, your profitability could be negatively impacted.

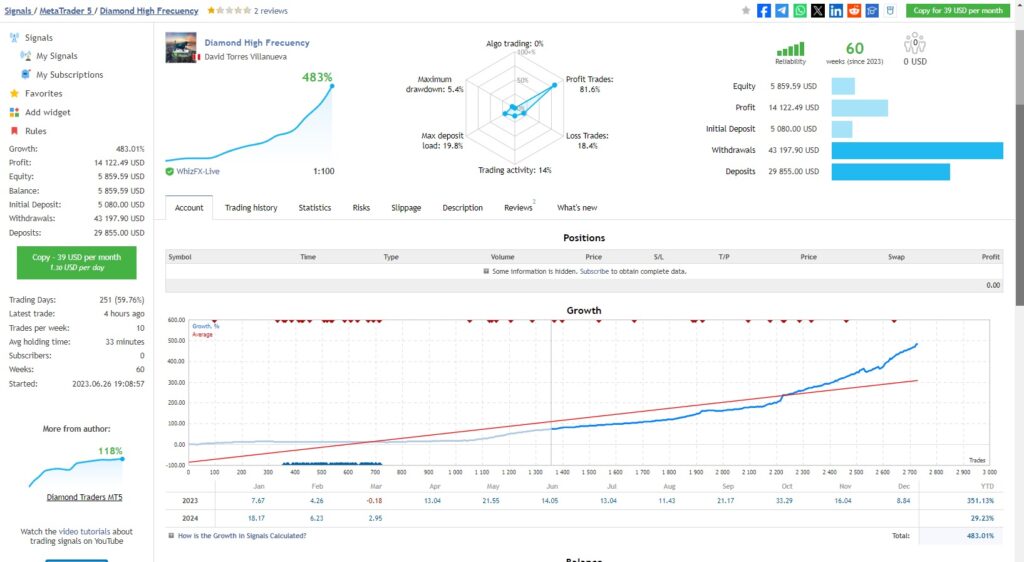

In one of our previous articles, we used this copy-trading service to analyze a signal provider from Peru named David Torres Villanueva. He employs a strategy he calls Diamond High Frequency.

This account has been trading for fourteen months, almost exclusively gold. As we can see, the account grows gradually. Sure, there are losing trades, but that’s perfectly normal. No trading period consists only of profits. However, what’s remarkable here is that the account has consistently grown, and the signal provider hasn’t blown it in over a year. Moreover, if you check the stats, you’ll notice that the volume of trades has been increasing gradually. Despite inevitable fluctuations, the drawdown for the entire period is at most 5.5%. And perhaps most impressively, the cumulative profitability of the account over 14 months is 453%, which is incredible.

Moreover, there are no signs of grids or Martingale strategies. The mere absence of Martingale in the trading is a huge plus. Overall, it is a solid signal to copy. However, one downside: the account size is around USD 30k. Practically, your account should be approximately the same size.

To sum up, this is how you can use this copy-trading service to quickly search for signals to copy.

Last time, we looked at passive forex trading. Equipped with this knowledge, you can now take advantage of data feed in forex trading.

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

As seasoned FX Market specialists, ‘Finansified’ offers comprehensive services. From sound trading advice to developing and licensing Forex brokers and Crypto Exchanges worldwide. Follow our blog for expert guidance, market updates, and strategies designed to elevate your trading game to new heights.